Q. My company offers health insurance coverage for the whole family, and fully covers the portion of the premium to cover me. But they don’t pay any of the premium to add dependents to the plan; if I want to add my kids, I have to pay the full cost of their premium. Can I buy individual policies for my children instead? Will they qualify for subsidies?

A. The ACA’s employer mandate requires businesses with 50 or more full time-equivalent employees to offer health insurance to their full-time employees and those employees’ children. But while the coverage must be considered affordable for the employees, there is no requirement that the employer funds any portion of the premiums for dependents (the average employer funds the majority of premiums even for family coverage, but they’re not required to do so and smaller businesses are less likely to cover the cost to add dependents to the plan).

In order to be in compliance with the employer mandate, the coverage that employers offer to their full-time employees for employee-only coverage can’t cost an employee more than 9.83% of the employee’s household income in 2021. Most large employers use a “safe harbor” calculation of no more than 9.83% of the employee’s wages or the federal poverty level, since employers don’t generally have access to household income data for their workers.

The family glitch

But there is no limit on the percentage of income that an employee has to pay to cover the whole family. If the coverage is deemed affordable for the employee (ie, no more than 9.83% of household income in 2021), that employee cannot get subsidies in the exchange instead of taking the employer-sponsored insurance. And as long as the employee’s dependents have access to the employer-sponsored plan, their coverage is also considered “affordable,” regardless of how much extra it costs to add them to the employer-sponsored plan. Since their coverage is considered affordable, they’re not eligible for premium subsidies (premium tax credits) in the exchange/marketplace.

Small employers (fewer than 50 full-time equivalent employees) are not required to offer coverage at all under the ACA, but if they do offer coverage and it’s considered affordable for the employee, the dependents who are eligible for coverage under the employer plan are not eligible for subsidies, regardless of how much their coverage costs through the employer-sponsored plan.

This situation is known as the family glitch, and it has put health insurance coverage out of reach for between two and six million people. Essentially, they may have no realistically affordable options, despite the fact that the employer-sponsored plan available to them is technically considered affordable. In addition to the income-based eligibility rules, premium subsidies in the exchange are only available to people who either:

- don’t have access to an employer-sponsored plan at all

- have access to an employer plan that doesn’t provide minimum value (cover at least 60% of average costs and include coverage for inpatient and physician services), or costs more than 9.83% of household income in 2021 for employee-only coverage, without regard for how much it costs to cover the whole family.

The good news for some families in this predicament is that Medicaid and Children’s Health Insurance Program (CHIP) eligibility thresholds are quite generous in some states. If your kids are eligible for Medicaid or CHIP, you may be able to enroll them even if they have access to coverage from your employer (eligibility guidelines vary by state).

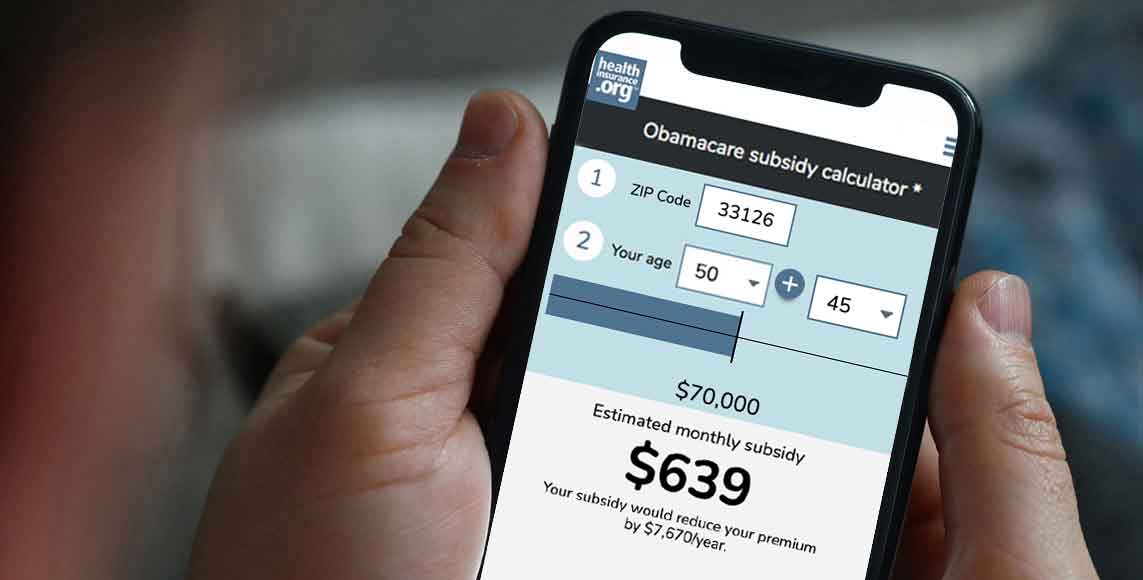

And in answer to your question, yes, you can buy an individual plan for your kids, either through the exchange or off-exchange. But since your coverage is free for you, assuming it also provides minimum value, your kids would not be eligible for exchange subsidies, regardless of how much it costs to add them to your employer-sponsored plan. That would mean that you’d have to pay full price for an individual market plan for your kids. Depending on the coverage you need and the cost of the employer-sponsored plan, that may or may not end up being a good value.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.