Q. Under the ACA, my insurance premium subsidy is dependent on adjusted gross income (AGI). But, for a self-employed person, AGI is dependent on the insurance premium, since premiums are deductible for the self-employed.

(NOTE: The following example includes the American Rescue Plan’s temporary elimination of the “subsidy cliff” for 2021 and 2022. This may or may not be extended by Congress for future years, so it’s important to understand that unless the ARP’s changes are made permanent, the subsidy cliff would reappear in 2023. This would mean that subsidy eligibility would end altogether at 400% of the poverty level, as opposed to just being reduced.)

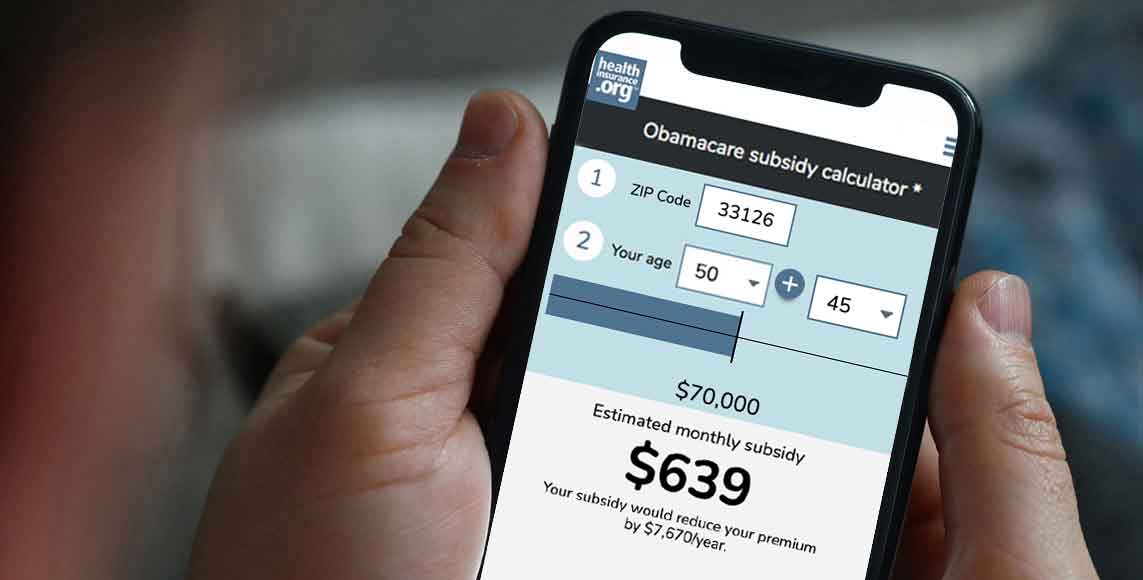

My husband and I are both 55 and have an AGI of $70,000 before accounting for health insurance. Where we live in Illinois, that results in a 2021 premium subsidy of $707 per month, and an after-subsidy premium of $498 per month for the benchmark plan. Since we’re self-employed, we can deduct that $498 per month (the amount we pay after the subsidy) using the self-employed health insurance deduction (line 16 on Schedule 1 of Form 1040). But that brings our ACA-specific MAGI down to $64,024. And that, in turn, increases our premium subsidy to $787 per month, which reduces the amount that we pay ourselves and thus reduces our deduction. The calculations thus becomes circular — how do we determine how much our premium tax credit is and how much we can actually deduct using the self-employed health insurance deduction?

A. This can be a complex situation, and our answer is intended to serve as an overview of how the subsidy calculation works; always seek help from a qualified tax professional if you have questions about your specific situation.

In July 2014, the IRS released 26 CFR 601.105, in which they acknowledged the circular relationship between self-employed health insurance premium deductions, AGI, and premium tax credits:

“… the amount of the [self-employed health insurance premium] deduction is based on the amount of the … premium tax credit, and the amount of the credit is based on the amount of the deduction – a circular relationship. Consequently, a taxpayer eligible for both a … deduction for premiums paid for qualified health plans and a … premium tax credit may have difficulty determining the amounts of those items.”

In the regulation, the IRS provides two methods that self-employed taxpayers can use to calculate their deduction and their subsidy. The iterative calculation will result in a more exact answer, but it is a little more time-consuming to compute. The alternative calculation is less exact (and appears to favor the IRS just slightly), but less time-consuming and easier to calculate. You have your choice of which one you want to use, and tax software should have the calculations built-in, which would make them both simple to use.

In a nutshell, both methods have you do the calculations repeatedly, getting ever closer to the correct answer (that’s what iteration means). But while the iterative calculation has you keep going until the difference between successive answers is less than $1, the alternative calculation lets you stop sooner.

The easiest way to understand how the two calculations work is to start on page 9 of the regulation and work through the examples the IRS has provided. When they mention the “limitation on additional tax,” they’re just referencing the caps on how much you have to pay back when you file your taxes if it turns out that your advance subsidy (the amount sent to your health insurance company each month) was overpaid because your income ended up being higher than projected. So in example 1 on page 9, the IRS uses $2,500 as the limitation on additional tax, because the family’s household income is between 300% and 400% of poverty (these limits vary by year; for the 2020 tax year, excess subsidy repayments were eliminated altogether, but they’ll return for the 2021 tax year).

In addressing the question of the circular relationship between AGI and premium subsidies for self-employed people, the examples the IRS provides cover scenarios where the filers took advance premium tax credits as well as scenarios where they did not, since you can pay your own premiums in full each month and then claim your total credit for the year when you file your taxes. The examples make the calculations relatively straightforward, although the standard advice applies: If in doubt at all, contact a tax professional for assistance.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.