EDITOR'S NOTE: Healthinsurance.org's Curbside Consult is a periodic informal dialogue with medical and health policy experts about pressing issues of the day.

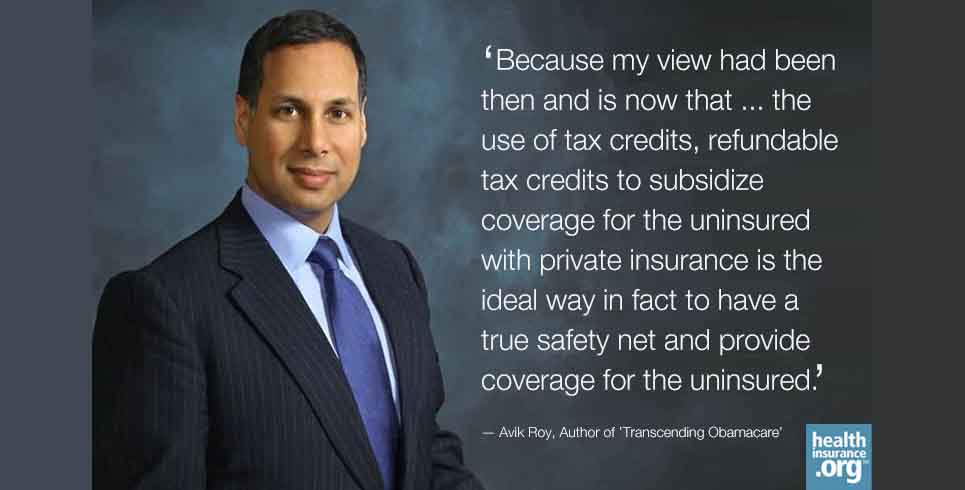

Avik Roy, author of "Transcending Obamacare," left, and Curbside Consult Host Harold Pollack

Regular readers might remember that I have frequently tangled with Avik Roy, a conservative health policy expert who advised to Mitt Romney in the 2012 campaign, and the author of a short e-book, "How Medicaid fails the poor," whose title is self-explanatory. Avik and I have serious and deep differences over these issues. Our different worldviews are exemplified by his comment: "It's Medicaid, i.e., welfare dependency, that leads to family breakdown and social disrepair."

Given our differences, you might be surprised that we had the civil conversation we did about his new "universal exchange" health care plan.

For several reasons, every progressive should read Roy's plan.

- It is a serious, thought-provoking read. That's not only because it is one of the few conservative proposals to acknowledge the reality of the 2012 election (and the eventually successful rollout of ACA since last Fall). Obamacare is now part of the fabric of American life. Republicans can hinder or modify ACA. They cannot and will not "repeal" Obamacare, because this now would require snatching coverage from millions of people while disrupting coverage for tens of millions of others. That's not going to happen. Yet because ACA establishes market-based insurance exchanges, health reform offers generative opportunities for conservatives willing to take notice.

- "Transcending Obamacare" offers valuable insights into what Republicans really could do in pushing ACA in a more conservative direction. Roy would maintain several key features of ACA. But he would repeal the individual and employer mandates. He would constrain essential health benefits, narrow current ACA subsidies, encourage health savings accounts, allow health insurance premiums to raise more sharply with age, and more.

- Roy's plan has been assembled with greater professionalism and care than other Republican proposals I've seen. Since 2010, most such proposals have been basically vaporware, obfuscating critical, politically unpalatable details and implications. "Transcending Obamacare" certainly doesn't fill in every detail. (See, e.g., this critique by Tim Jost.) Still, Roy's plan is clear enough in its 50,000-foot vision of what it seeks to do.

- Most striking, "Transcending Obamacare" proposes a gradual, but fundamental change to Medicare as we know it. Indeed the real target of Roy's Universal Exchange plan is not Obamacare, but the broader structure of American health policy put into place in 1965 with the advent of Medicare and Medicaid. Indeed the financial implications of Roy's plan are much larger for Medicare than they are for anything he has in mind to alter the structures of Obamacare.

Current retirees could continue on traditional Medicare pretty much unaffected. But Roy would raise the Medicare eligibility age by four months every year. So in the coming decades, an increasing proportion of seniors would obtain coverage through private health plans or through the new health insurance marketplaces. Poor and near-poor Americans would receive subsidies through exchanges and other means (with other protections for individuals with costly conditions). They could also choose to opt into traditional Medicare.

Yet subsidies under Roy's plan would phase out at about 317 percent of the poverty line. That's about $37,000 for an individual, about $50,000 for a couple. Median income among Americans 65 and older is about $33,000. So this plan proposes a gradual but significant cost-shift over time from the federal government onto other payers, most notably onto middle-class and affluent retirees.

Because Medicare provides lower reimbursement rates than private insurers do, it is unclear that Roy's plan would reduce national health expenditures. Roy would reduce federal spending by reducing the large actuarial subsidy now being received through Medicare by roughly the top half of Americans during their retirement years. Many seniors within the current generation of retirees seem unaware of the dramatic actuarial subsidies they have received. With no small irony or cognitive dissonance, many fiercely oppose far less costly measures designed to insure younger Americans. Plans such as this one force us all to confront this basic reality.

I don't see the American public supporting such fundamental alteration of social insurance. I don't support it, either. Yet Roy's proposal forces us to ponder what we really want Medicare to be and do. Not coincidentally, it raises intriguing dilemmas for Republican politicians, whose party base encompasses so many Americans nearing or past the usual age of retirement. What is the conservative response, now that Obamacare is the new status quo?

Transcript of Part 1 (of 3):

Harold: : This is Pollack. Welcome to another edition of Curbside Consult and I'm delighted today to have Avik Roy here to discuss with me his new health plan, "Transcending Obamacare."

Avik: : Hi Harold, how are you?

Harold: : Very well. Why don't we start by just describing how this plan came to be. We'll give a 50,000-foot discussion before getting down to the seven-inch level of detail that I'm sure we'll get to before too long.

Avik: : Well, let's start going back to 2012. My view and I think the view of most people in 2012 was that if you wanted to repeal Obamacare – as nearly all Republicans had sought at that time – you had to win the 2012 election. Because if President Obama was re-elected then the subsidies, etc, the whole exchange system, and everything would go online, the Medicaid expansion ...

I think we all have a view, based on history, that once a large program like that goes online it's not something you can just simply repeal. At least that was a view that Republicans had in 2012, and that's why they put a lot of energy into trying to win the 2012 election. And I actually ...

Harold: : By the way who won the 2012 election?

Avik: : Our president Obama.

Harold: : Thank you, I just wanted to get that on the record.

Tax credits – a 'centrist solution'

Avik: : That's fine. So President Obama defeated my guy Mitt Romney, who I advised in that election. So you can blame me for the fact or thank me for the fact that President Obama won, depending on your point of view. But I felt then – even going into that election, and certainly once it was over – it was clear in my view that Obamacare was here to stay. To me that wasn't all doom and gloom for conservatives who care about health care reform.

Because my view had been then and is now that exchanges – or let's put it another way – the use of tax credits, refundable tax credits to subsidize coverage for the uninsured with private insurance is the ideal way in fact to have a true safety net and provide coverage for the uninsured.

So my hope – and perhaps it's an unrealistic hope – but my hope is that the fact that the left and let's just say at least certainly mainstream Democrats and their allies, have been so energetic in their defense of tax credits for the purchase of private insurance that this could be an opportunity for bipartisan co-operation. There are more cynical ways to look at that: The left complains that "it's all really a conservative idea. Obamacare is a conservative idea therefore blah, blah, blah ... "

However you look at it, it seems to me that – the way I put it in a lot of my op-eds recently is that Paul Ryan's plan for Medicare reform and the Obamacare exchanges are actually very similar if you strip away the party affiliations of the people who proposed them. In fact, Paul Ryan's plan for Medicare reform comes from Democratic scholars like Henry Aaron and Bob Reischauer. There is a bit of the inverted scenario there as well.

So the whole point of all this is to say that exchanges or tax credits for the purchase of private coverage is an attractive centrist solution shall we say to the problem of the uninsured. My argument has been – looking at systems like Switzerland that have shown excellent fiscal performance using such a model – that we could actually solve both progressive goals and conservative goals. That is to say, we could expand coverage while also putting the fiscal situation in balance at the same time. You can even do that while reducing spending.

Something for the right – and left

There were a lot of opportunity to actually bring both sides together with such an approach. And again, from my point of view, it is very important to have something that can actually attract support from both parties.

I wrote the piece for National Review in November 2012 or December of 2012 it was officially published explaining this, because Rich Lowry, the editor of the National Review, had asked me to write a sort of "okay what should we do now?" piece. So I did that.

And the reaction was interesting on both sides – I think people on the left were like: "See, there goes the 'Obamacare surrender," by the right. And conservatives – some of them – said the same thing.

But some of them said, "No, this is actually extremely interesting and maybe there is a path forward for conservatives." It was clear in those ensuing months that nobody else was doing that – with the lone exception of Doug Holz-Eakin, the former CBO director, in a piece we wrote together for Reuters – almost nobody else on the right was interested in joining me in articulating this concept, or exploring or fleshing it out this concept, even if they might sympathize with it in private.

So I realized that it really fell to me to develop this concept as extensively and as rigorously as possible. I spent the next 21 months, effectively, from November of 2012 until now, August 2014, doing just that: Developing the concept, really trying to think through and work through how one would actually do something along these lines – which is to deregulate the exchanges to a degree, or reform exchanges, so that the cost of insurance plans on the exchange can be more affordable. And then gradually migrate people on other programs like Medicaid and Medicare onto these reformed exchanges as a means of entitlement reform.

That is basically the simple architecture, the concept. But as you know, Harold, the guts of it are a lot more complex and a lot more detailed than that. And that required a lot of work. It required fleshing out qualitatively what kind of policy you would want to do that. And then working with as many people as were interested in reaching out to me – including you, as you know – just to kind of think through all the details of how this would work, try to figure out what are things I wasn't thinking about that other people were, things I was overlooking, technical considerations I hadn't thought about. And to model it fiscally: to use the best outside (that is to say nongovernmental) sources, to model fiscally how this plan would work.

All that took a long time – and then writing it up – it is a 20,000-word monograph. I thought, you know, you look at some of these plans that Republicans have put out, they tend to be (say) eight pages with a lot of bullet points. My goal was to put something out as detailed as I possibly could, and still have it actually be read by people. That way we can litigate these ideas and think them through, and if there are things that need to be improved or revised, this is the time to do that. Take a couple of years, put it out ahead of time, and see how it can be refined.

Areas for agreement

Harold: : This is Harold Pollack again at healthinsurance.org. I almost said HealthCare.gov. That would be the wrong website.

I am talking with Avik Roy about his new health plan – I do think that progressives should carefully read this. I and others would disagree with a lot that's in here. I think it is extremely valuable to see what a conservative vision would look like, that does have near-universal coverage and some of the elements that make it at least a basis for conversation.

It's explicit in the areas where we would disagree. It's actually fairly radical in terms of what is going on in Medicare in some ways and we'll get to that. I want to start with a few areas where we actually probably agree or at least have some basis for agreement. One is the Cadillac tax, which you keep in your plan. In fact you would start it sooner and you would get rid of some of the negotiated arrangements that essentially Democratic interest groups made in the passage of the bill.

I must say that to me, this is a political issue that has to be negotiated with a lot of stakeholders. But the idea of limiting the tax expenditures to people like you and me for health coverage is a very sensible idea. I think most health economists would agree that something of this structure, there is a lot of revenue there. And there is a lot of economic inefficiency there that the current system promotes. I was happy to see you keep that.

The Cadillac tax is unpopular and so I think you and I may both lose that one in terms of what happens in the U.S. Congress there, but I like that.

I thought also, there is less disagreement about how Medicaid and the exchanges should work together than there might appear to be on the surface. A lot of conservatives would like to see less emphasis on the Medicaid expansion on traditional Medicaid and more emphasis on putting people into the new exchanges.

From my point of view, for basically healthy low-income people particularly, this seems to me to be fine. In fact, Medicaid managed care looks a lot like what people might potentially get on an exchange anyway. I think if you ask a typical Medicaid recipient in many states: What does your life look like? They may well have an Anthem insurance card anyway.

It may be useful that there's an apparent disagreement between Democrats and Republicans because then we can use that as a basis of an apparent concession to get things moving – But I thought that that was also something that was fruitful. I do think that there's a lot in here that there is bi-partisan potential agreement on.

Maybe I should attack the plan more aggressively ...

I should say for our readers and listeners that you and I have tangled many times and I was a very strong supporter of ACA and you were on the other side. So maybe I should attack you more aggressively.

Preserving programs, but 'evolving'

Avik: : I am sure all your readers who follow health care policy well probably already think of me as their bete noir, so it may not be necessary but I would say that – Well, first of all let me just dispute your characterization of my plan as radical in some ways. One thing I would say – and we can talk about this later – one thing I really emphasize in the design of this plan was gradual evolution of the health care system in a different direction. Is the end result different than the system we have today? Absolutely.

But it takes 30, 40, 50, 60 years to get to that point. And that is okay because from a standpoint of the fiscal situation that I'm fairly concerned about – that's what you need. So long as the direction of the long-term problems are addressed, that is what the financial markets, that is what the debt markets in particular needs.

If you have confidence that the U.S. government is not going to go bankrupt. And also it helps us protect and preserve the promise to the people who depend on these programs today, that those programs will have the financial stability they need to be there for them tomorrow. So that's a big part of what I am really trying to do here, to preserve and protect people's existing arrangements and yet, gradually, with as much voluntarism as possible, evolve those arrangements in a different direction for future years. For example, a guy like me who is 41 years old, I don't expect to have Medicare in its current form when I am 65, because I know that in 25 years, the country is going to be in a lot worse fiscal shape than that it is today.

One way or another, these things are going to change. In terms of the Cadillac tax in particular – since we started with that – let me say that I am more confident than you are that the Cadillac tax in some form will be there because it's such a big chunk of the revenue stream or the funding the ACA in its current set up. You can't repeal the Cadillac tax without offsetting that in some other way: Either through substantial spending cuts or other tax increases. Given the policy appeal of something like the Cadillac tax, I would be very surprised to see it repealed.

I think what you could see – when I talked to Republicans or conservatives about my plan, they say that the Cadillac tax is really kludgy and clunky. Why not replace it with a standard deduction of the kind that economists have long favored as a replacement – a gradual replacement for the employer tax exclusion.

And as I note in the plan, I am okay with that so long as the fiscal effects are the same. Edmund Burke once said: If it's not necessary to change, it is necessary not to change. And I think I've tried to apply that principle in my approach to health reform, which is to say the Cadillac tax is already there. Since the policy outcome of keeping it versus changing it into a standard deduction is not that significantly different, just keep it as it is. Since I am doing a lot of other things – proposing a lot of other changes, let me at least find the excuses where possible not to change things.

Obamacare: not a government takeover ...

Harold: : Let me talk about the fiscal issues for a minute. One thing that is not as clearly stated in your document as it should be – and I think in your rhetoric – this is one area where you and I disagree – is the actual cost of the things that people fight about in health reform – the Medicaid expansion, the exchanges – those are not very expensive. The real money in health care is in the elderly and the disabled.

I happen to have in front of me Table 1.1 of a Congressional Budget Office document which just projects out the cost of Medicaid, CHIP, and the exchange subsidies out to 2040. What is really surprising about that, to many readers, is that all the ACA stuff, the increase is 1.5 percent of GDP. It's very little. Once ACA is fully engaged, the actual cost of getting low-income people into the exchanges, expanding Medicaid for the low-income population – the things were ideologically the most polarized – that's not where the money is. In fact, the real money you save in your plan is really in Medicare and in those features.

Avik: : Page 14 of my monograph, Figure 3, has a pretty similar chart. It describes the increase in spending for the coverage expansion of the ACA and overlays on top of that the legacy health care spending on Medicare and Medicaid, etc. to make exactly the same point, that there is this perception among conservatives that Obamacare is a government takeover of the health care system.

And it certainly expands – no one would dispute – that it expands the role of government in the health care system. But it's very important in my view that conservatives understand that the government has already been heavily involved in the health care system. The real step-change was in 1965 with the passage of the amendments to the Social Security Act that created Medicare and Medicaid.

And so, if conservatives want to tackle the problem of government involvement in the health care system and rationalize government involvement in health care system in a more efficient way, it is very important for conservatives to understand that actually it's a lot of conservative voters who benefit from government involvement in the health care system, particularly on the Medicare side. And that is something that a lot of conservative voters don't understand because no one has been telling them that.

Harold: : I think that they don't want to understand that. That's part of it. There is a huge element of cognitive dissonance going on where the Republican base is so weighted towards an older group of white voters, many from of whom are on Medicare, and who are actually the group of people who are the largest beneficiaries of the most imbalanced government transfers in a life cycle sense.

... and not a Trojan horse

Avik: : I think that is right. I have a PowerPoint that I give to conservative groups and Tea Party groups about my heath care plan. I lead with those charts, and I explain to them how much the federal government is already involved in the health care system – how so much of that is driven by spending on them. And it's something they don't realize.

You know people say, well – I get asked often when I do interviews on conservative talk radio or certain cable networks, they'll say, "Avik, don't you think that Obamacare is the Trojan horse for single payer?" I'm like: "Do you realize that 90 million Americans were already on single payer health care before Obamacare? Yes Obamacare expands a single-payer component health care by expanding Medicaid, but that's not a Trojan horse. It's spelled out in Title I.

Having that sense of proportion as to what Obamacare is doing in the health care system and what was there before – to me that is the first step in helping conservatives understand where there is common ground for reform. Because if conservatives believe that Obamacare is the government takeover of the health care system, and that government wasn't doing anything before then, then they are going to obviously support repeal of Obamacare and go back to the status quo ante.

However if they understand that actually the government has been involved in a lot of different ways and distorted a lot of different things, then you can actually start to have a constructive conversation. You say: "Okay. Here are all the things that the government is doing. Let us all agree that we want the poor and the disabled and the sick to have a safety net, but we don't want to spend your hard-earned taxpayer dollars subsidizing health care for Mitt Romney and Warren Buffett. If we all agree on that, surely we can come to some interesting approach that will be different from the kind of the box that conservatives had locked themselves in.

Implications for Medicare

Harold: : Again this is Harold Pollack on healthinsurance.org. I am talking to Avik Roy. Right now we are talking about Medicare. In a sense your plan is really using Obamacare in a sense as a platform to go after things that you don't like about the existing health care system before Obamacare particularly it's Medicare – sort of the heavy set-up of Medicare on autopilot for older Americans ...

Avik: : Older upper-income Americans.

Harold: : Yes, including upper-income. Your plan in a sense says we're going to use the exchanges as a platform to essentially over time raise the age of Medicare and effectively use the exchanges – the subsidies within the exchanges – so that lower- and middle-income older people get subsidized, but increasingly older people would have to essentially pay their own way in Medicare. Is that an accurate description?

Avik: : The important thing to understand about the exchanges is that exchanges provide premium support subsidies to anyone below a certain income threshold. Under the ACA, it's 400 percent of the federal poverty level. The idea here would be that upper-income retirees who are younger would be expected to either "pay" their own way as you put it or stay in the workforce, in which case their employers to continue to sponsor to their health coverage.

So it wouldn't be just up to them to just pay for it directly, necessarily. But low-income people, low- to middle-income people would still be protected by the same system that the ACA creates for people who are 64 and 63. My argument effectively is if it is humane to offer ACA-subsidized exchange-based coverage for 64-year-olds, surely it is also humane to offer the same type of coverage to 65-year-olds, especially if it guarantees the permanent financial solvency of the Medicare Trust Fund. This is an important point.

So current retirees, if you are already on Medicare, these changes don't affect you at all because you are already past the retirement age. The gradual raising the eligibility age for people my age doesn't affect people who are currently retirees. If you are on Medicare today, this change does not affect you at all. It will affect people like me. People like me won't be eligible for traditional Medicare until later in life. But if I am low-income I am still protected.

Effectively, the net effect of this is to substantially increase the amount of redistribution in the system. Instead of subsidizing upper-income retirees, we will continue to subsidize lower and lower middle-income retirees but not upper-income retirees who again will have the incentive to stay in the work force or pay for their health coverage themselves.

Will presidential contenders embrace the plan?

Harold: : Somewhat to my surprise, I am somewhat ambivalent about this – I'm surprised because you might expect me to more harshly disagree with you than I might. This is, though, a massive shift of cost and financial risk off the federal government onto various other payers and onto individuals. The political fight that this element of your plan would create is enormous. I'm curious how Republican presidential contenders are going to, whether they are going to run from that or embrace it.

Avik: : To their credit, whatever you think of the Paul Ryan plan, everyone thought that was going to be suicide for House Republicans when they enacted that budget in 2010. They got reelected in 2012, and they looked like the House majority is not in danger in 2014. Mitt Romney and Paul Ryan campaigned on this approach, not my approach but on an approach that's somewhat similar in 2012. And Republicans lost every other demographic except for older Americans.

I think the key insight of the Paul Ryan approach to Medicare reform is that you don't make major changes for current retirees. If you are already on Medicare, and you are already relying on the program, and you have planned your whole life around it – that is something that one needs to preserve. But I think people who are younger and who recognize the fiscal instability of the program are much more open to gradual changes that preserve the financial benefit and the structure overall, but make reasonable adjustments, again for young Americans.

The public polling all shows that raising the eligibility age for Medicare is something – of all the different Medicare reform proposals you might choose, that's one that has historically been among the – the public has been most amenable to. And it's especially from a policy standpoint, an attractive approach when you have the ACA exchanges to ensure that low-income and low- to-middle income people still have health coverage.

Part 2 of Harold Pollack's Curbside Consult with Avik Roy

Harold Pollack is the Helen Ross Professor at the School of Social Service Administration. He is also Co-Director of The University of Chicago Crime Lab. He has published widely at the interface between poverty policy and public health. Pollack serves as a Fellow at the MacLean Center for Clinical Ethics at the University of Chicago, and as an Adjunct Fellow at the Century Foundation.