Key takeaways

- The ACA’s premium subsidies are tax credits – but you don’t have to wait until tax season.

- Premium subsidies are larger and more widely available through the end of 2025, thanks to the American Rescue Plan and Inflation Reduction Act.

- The subsidy amounts fluctuate from one year to the next, due to changes in the cost of the benchmark plan in each area.

- Average subsidy-eligible enrollees get most of their premiums covered.

- Premium subsidies don’t apply to supplemental coverage.

- Cost-sharing reductions are a different type of ACA subsidy.

If you’re worried about the cost of health insurance premiums in the exchange/marketplace, it might help to know that – thanks to the Affordable Care Act’s generous subsidies, which have been temporarily enhanced under the American Rescue Plan and Inflation Reduction Act – your premiums could end up a lot lower than you expect.

Open enrollment for 2023 coverage runs from November 1, 2022 through January 15, 2023 in nearly every state.

Who's eligible for ACA subsidies?

Exchange / marketplace enrollment hit a record high in 2022, and more people are eligible for subsidies now that the American Rescue Plan has temporarily eliminated the “subsidy cliff.” Of the 14.5 million people who enrolled in private coverage through the exchanges during the open enrollment period for 2022, 89% were receiving premium subsidies.

Yet about two-thirds of uninsured Americans aren’t aware of the financial assistance that’s available for health insurance coverage. If you haven’t shopped for health coverage lately, it’s important to compare the available options during the open enrollment period for 2023 coverage. You might be surprised at how large your subsidy is, and how affordable your after-subsidy premium ends up being.

A few more quick facts about Obamacare subsidies:

- The subsidies are tax credits, which means you can opt to pay full price for your coverage (purchased through the exchange in your state) each month, and then get your tax credit when you file your tax return. But unlike other tax credits, the subsidies can be taken throughout the year, paid directly to your health insurer to offset the cost of your coverage.

- Premium subsidies are normally available if your projected household income doesn’t exceed 400% of the prior year’s poverty level. But from 2021 through 2025, this limit does not apply. The American Rescue Plan changed the rules for 2021 and 2022, and the Inflation Reduction Act extended that rule change through 2025. Instead of an income cap, the new rules allow for premium subsidies if the cost of the benchmark plan would otherwise exceed 8.5% of their ACA-specific modified adjusted gross income.

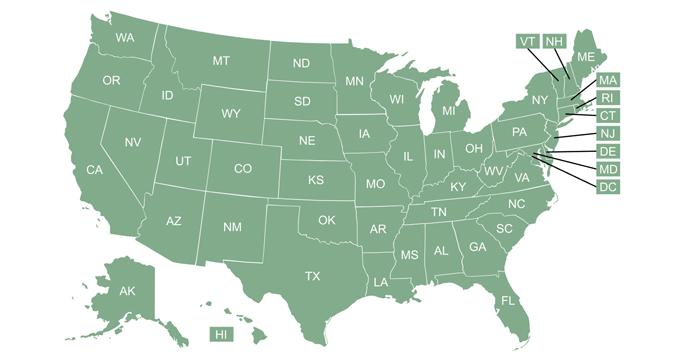

- On the lower end, subsidies are available in most states if your income is above 138% of the poverty level, with Medicaid available below that. But in the states that haven’t yet expanded Medicaid, premium subsidies are available if your income is at least equal to the poverty level. Unfortunately, Medicaid isn’t available below that level in those states, unless the applicant is eligible based on strict pre-ACA eligibility guidelines (ie, the states that have rejected Medicaid expansion have created a coverage gap; this is still the case in 11 states as we head into 2023).

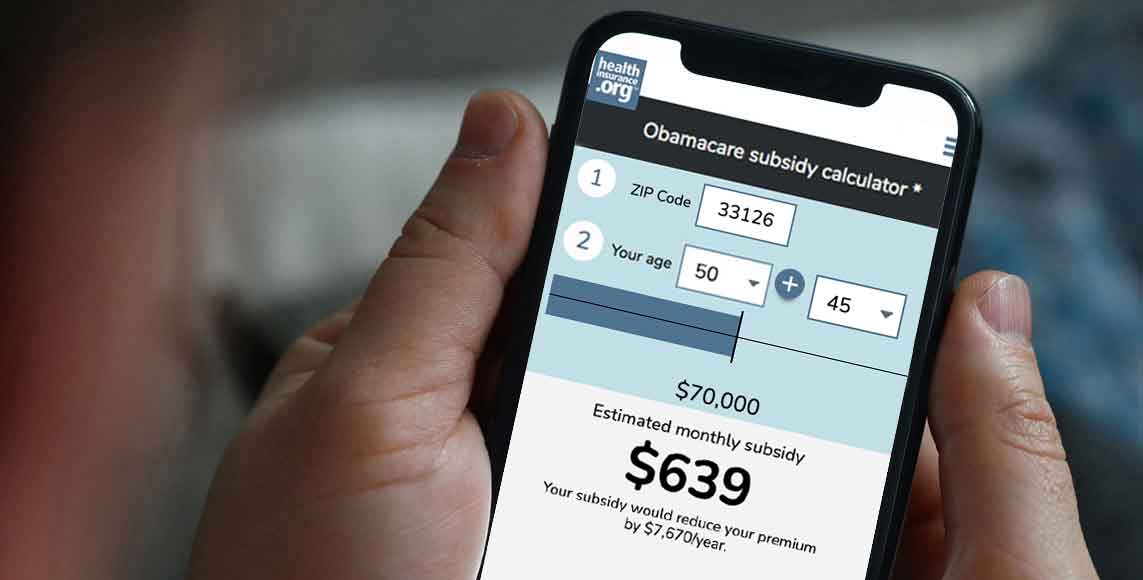

- Here’s where you can learn exactly how the subsidy amounts are determined. But you can also just use the subsidy calculator at the top of this page. Subsidy eligibility determinations are fairly simple: In a nutshell, you look at your income as a percentage of the poverty level, and then find where that puts you in the sliding scale of the percentage of income you’re expected to pay for the benchmark Silver plan (it’ll be somewhere between 0% and 8.5%, depending on your income). Then you see how much more than that amount the benchmark plan actually costs, and the difference is the amount of your subsidy — which can be applied to any metal-level plan in the marketplace.

- For 2023, premium subsidies are newly available to some people who have been impacted by the family glitch in previous years. The IRS finalized new regulations to fix the family glitch in October 2022. The family glitch fix will affect some families more than others.

- Premium subsidy amounts fluctuate from one year to another, based on changes in the cost of the benchmark plan in each area. Premium subsidies continue to be much higher in most of the country than they were in 2017, due to the way the cost of cost-sharing reductions (CSR) has been added to silver plan premiums in most states, and due to the American Rescue Plan and Inflation Reduction Act. But for 2019, 2020, 2021, and again for 2022, premiums decreased in some areas and new insurers entered some markets with lower prices, resulting in smaller benchmark premiums. When benchmark premiums decrease, either due to the introduction of new plans or a reduction in prices for existing plans, premium subsidy amounts will decline. But if the benchmark premium increases, premium subsidies will also increase. And for 2023, average benchmark premiums have increased by about 4%. And again, premium subsidy amounts are now much larger than they would otherwise be, thanks to the American Rescue Plan and Inflation Reduction Act.

- The subsidies cover the majority of the premiums for people who are subsidy-eligible. 89% of the people who were enrolled in exchange plans nationwide as of early 2022 were receiving premium subsidies. And the subsidies covered the majority of their premium costs. For some people who were previously ineligible for subsidies due to the “subsidy cliff,” the new subsidies under the ARP/IRA could amount to thousands of dollars a month. For others, the increase was much smaller but still amounts to significant savings.

- Premium subsidies don’t apply to supplemental coverage, including accident supplements, adult dental/visions plans (or pediatric dental/vision plans that are sold separately from metal coverage, as opposed to being embedded in the medical plan), critical illness plans, or stand-alone prescription drug insurance (but there are free prescription drug discount plans available). Subsidies also cannot be used to purchase short-term health insurance.

- Subsidies can lower your premium significantly, but the ACA also provides subsidies that can reduce your out-of-pocket costs when you need to use your coverage, as long as you enroll in a Silver plan. And even though the Trump administration stopped reimbursing insurers for the cost of those cost-sharing subsidies, the benefits are still available to eligible enrollees. Out of 10.2 million HealthCare.gov enrollees in 2022, nearly 5.5 million were receiving cost-sharing subsidies in early 2022.

It pays to calculate your subsidy!