Please provide your zip code to see plans in your area.

Featured

Featured

benchmark plan

What is a benchmark plan?

What is a benchmark plan?

There are two different meanings for the term benchmark plan. Both have to do with the Affordable Care Act, although they have very different purposes.

Benchmark plan is the term used to describe the second-lowest-cost Silver plan available in the exchange, and it’s also the term for the plan that each state designates as the standard for essential health benefits (EHBs).

It can be a bit confusing that the ACA designated two entirely different concepts with the same name. But we’ll explain each concept in greater detail below.

Why is the second-lowest-cost Silver plan called a benchmark plan?

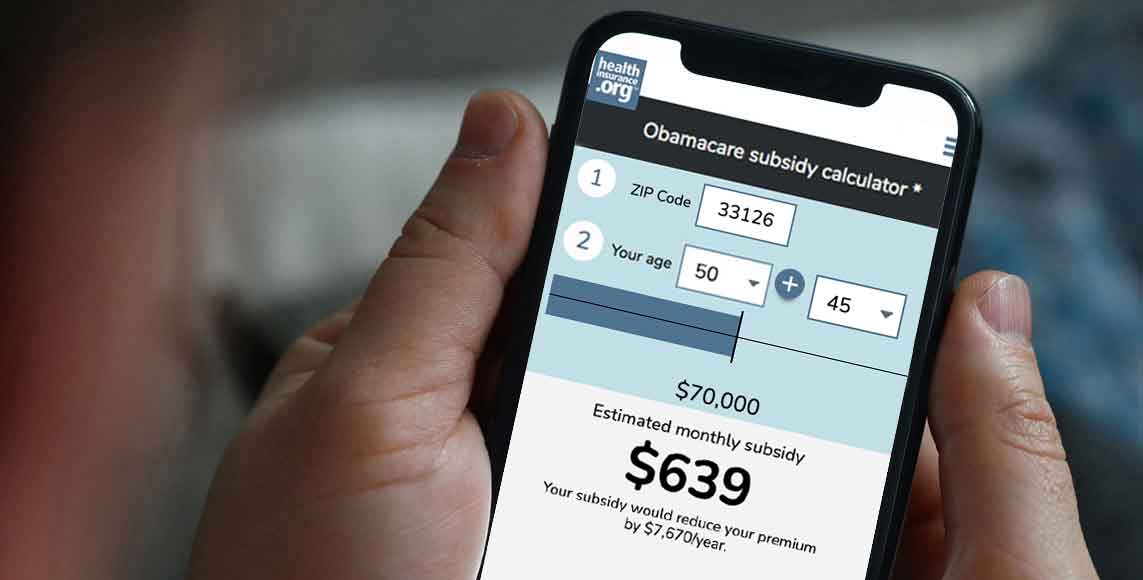

The second-lowest-cost Silver plan is important because its price is used to calculate premium subsidies. For an exchange enrollee with income in the subsidy-eligible range (which has been expanded for 2021 through 2025, under the American Rescue Plan and Inflation Reduction Act), the subsidy amount is based on the cost of the second-lowest-cost Silver plan in relation to the percent of the enrollee’s income that they’re expected to pay in after-subsidy premiums.

The second-lowest-cost-Silver plan is thus called a benchmark plan because it’s the plan that the enrollee will be able to purchase for exactly that percentage of their income; the subsidy amount is benchmarked based on that plan’s price. The enrollee can pick a lower-cost plan and pay a smaller amount in premiums, or they can pick a higher-cost plan and pay the difference in additional premiums.

The benchmark plan will vary from one part of a state to another, depending on the rating area and plan availability. And the benchmark plan will vary from one year to the next, sometimes being offered by different insurers in different years. This is because the benchmark plan is determined solely based on price: You look at all of the available plans in a given area, arrange them in order by premiums, and the benchmark plan is whatever plan ends up in the second-lowest-cost spot among all the available Silver plans.

Why is the state’s standard plan for essential health benefits called a benchmark plan?

The ACA created a broad framework for essential health benefits, but left it to states to determine exactly what would need to be covered. EHB requirements apply to individual and small group health plans with effective dates of 2014 or later. These plans are required to cover the essential health benefits, with no dollar cap on out-of-pocket costs.

The essential health benefits, as defined in the ACA, include ten broad categories of care, described in more detail here:

- hospitalization

- ambulatory services (outpatient care, office visits, etc.)

- emergency services

- maternity and newborn care

- mental health and substance abuse treatment

- prescription drugs

- lab tests

- chronic disease management, “well” services, and recommended preventive services

- pediatric dental and vision care

- rehabilitative and habilitative services

All individual and small group health plans sold since 2014 include coverage for all of these services (with the exception of pediatric dental if stand-alone plans are available for purchase). But the specifics of exactly what is covered vary from state to state.

That’s because the ACA allows each state to select a benchmark plan that will be used as the standard for essential health benefits coverage within the state. States were responsible for picking their own benchmark plan from a list of acceptable options, and health insurance carriers in the individual and small group markets in each state use the benchmark plan as a guide for creating their own EHB coverage (ie, if the benchmark plan covers a particular service, then all individual and small group plans in the state must also cover that service; this is why the plan is referred to a benchmark).

For 2014 to 2016, the benchmark plan was a plan that was sold in the state in 2012 (plus supplementation if there were any EHBs that weren’t covered by the plan that was chosen as the benchmark). For 2017 through 2019, the benchmark plan was a plan that was sold in the state in 2014. Starting with the 2020 plan year, states could continue to use their existing benchmark plans or make modifications under new guidelines that were designed to give states more flexibility in setting their benchmark plans.

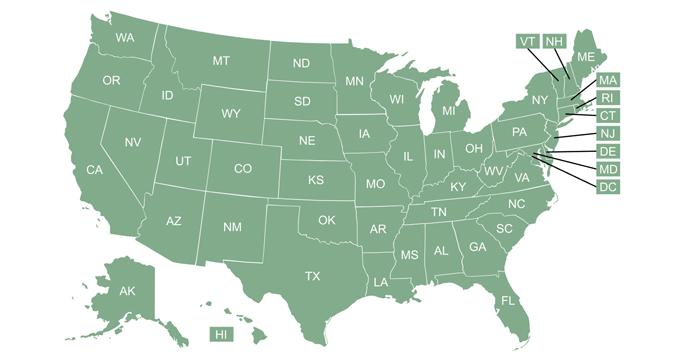

For the 2020 plan year, Illinois made modifications to its benchmark plan, and for the 2021 plan year, South Dakota made modifications to its benchmark plan. For 2022, Michigan, New Mexico, and Oregon made changes to their benchmark plans. For 2023, Colorado made changes to its benchmark plan, and Vermont has made changes to its benchmark plan that will take effect in 2024. You can see each state’s benchmark plan details here.