Please provide your zip code to see plans in your area.

Featured

Featured

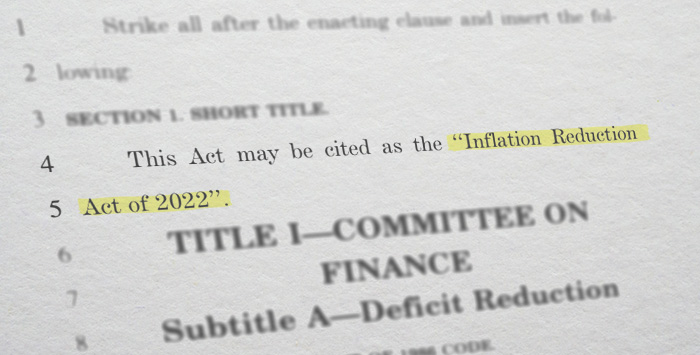

Inflation Reduction Act

What is the Inflation Reduction Act?

How does the Inflation Reduction Act help people who buy their own health coverage?

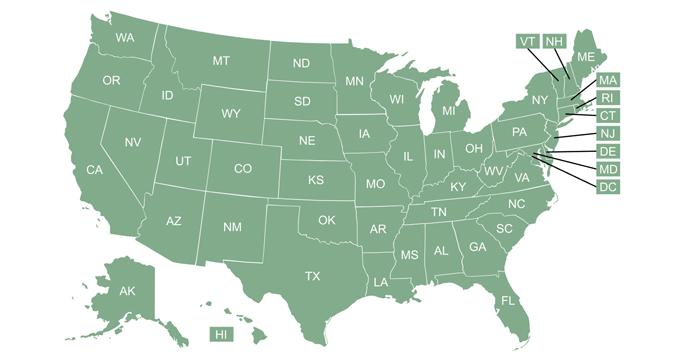

More than 14.5 million Americans purchased health coverage through the marketplace / exchange in 2022. Most of them were eligible for premium subsidies, and the IRA helps to ensure that their coverage options will remain affordable after the end of 2022.

Under the IRA, the enhanced subsidies that are in effect in 2022 (as a result of the American Rescue Plan) will continue to be in effect through 2025. Without the IRA, they would have expired at the end of 2022.

- This means the “subsidy cliff” continues to not be a problem, and subsidies continue to be larger than they would otherwise have been.

- It also means the year-round enrollment opportunity for subsidy-eligible low-income households will continue to be available through 2025.

- Some of the American Rescue Plan’s subsidy provisions had already expired by the end of 2021. They included a COBRA subsidy, unemployment-related subsidies, and a one-time amnesty from having to repay excess premium subsidies to the IRS. None of these provisions were revived by the IRA.

How does the Inflation Reduction Act help Americans with Medicare coverage?

The IRA includes numerous provisions that will improve Medicare’s prescription drug coverage, with changes phasing in over the next several years.

These changes will affect more than 50 million Americans are enrolled in Medicare Part D coverage, either as a stand-alone plan or as part of a Medicare Advantage plan – and will also affect pharmaceutical benefits Medicare enrollees receive under Medicare Part B.

These IRA provisions that impact Medicare coverage will take effect in 2023:

- Recommended vaccines covered by Medicare Part D will no longer have any out-of-pocket costs.

- Copays for all covered insulin products will be capped at $35/month

- Drug manufacturers will have to pay rebates to Medicare if drug prices increase faster than inflation.

IRA provisions that will be phased in over the next several years include:

- No out-of-pocket costs once an enrollee reaches the Medicare Part D catastrophic coverage phase.

- Availability of full Part D Low-Income Subsidy (Extra Help) to more enrollees.

- A 6% cap on annual Part D premium increases.

- A cap on out-of-pocket costs under Part D.

- CMS negotiations with drug manufacturers over the price of certain high-cost prescription drugs.

Related articles

The Inflation Reduction Act would extend ARP's health insurance subsidy enhancements – helping millions eligible for ACA marketplace subsidies.

The subsidy cliff has been temporarily eliminated under the American Rescue Plan and Inflation Reduction Act, saving some enrollees thousands of dollars per year through 2025.

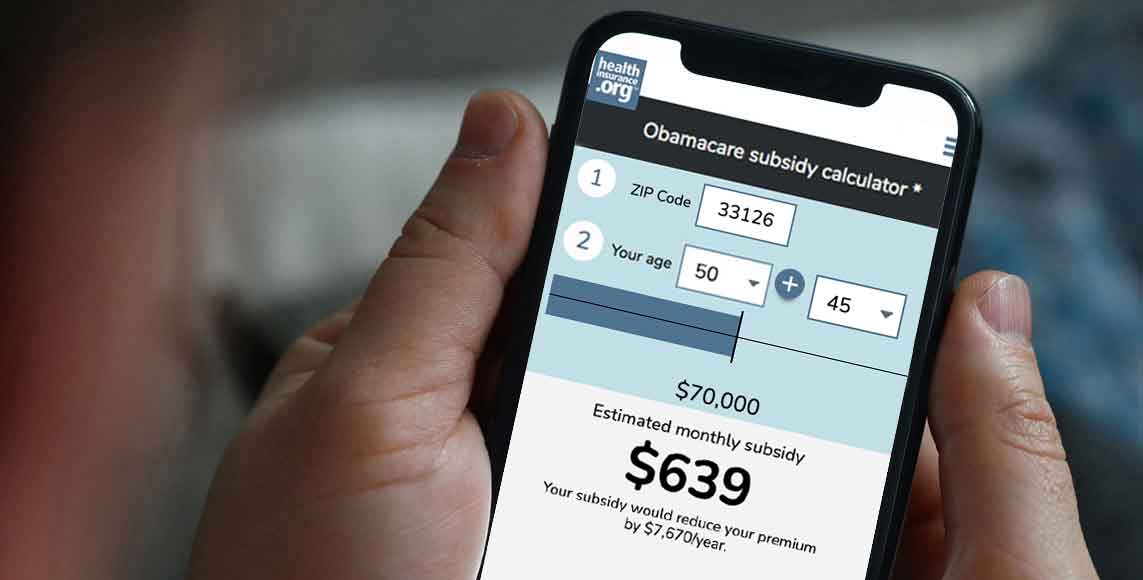

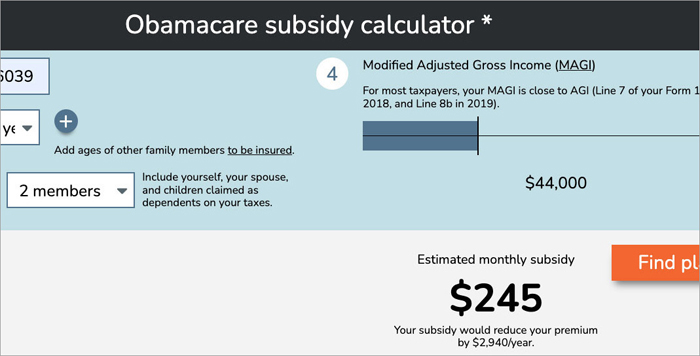

Does this change the actual amount that I pay for my coverage each year? How has the American Rescue Plan (ARP) affected this? And what about the Inflation Reduction Act (IRA)?

Learn how the Affordable Care Act's premium tax credits (premium subsidies) are calculated, and who is eligible to receive them under the American Rescue Plan and Inflation Reduction Act.

Worried about the cost of health insurance premiums? Use our free Obamacare subsidy calculator to see how much you'd save with an ACA-compliant plan.