Medicaid eligibility and enrollment in DC

DC’s Medicaid eligibility guidelines are among the most generous in the U.S.

Who is eligible for Medicaid in the District of Columbia?

Medicaid eligibility levels in the District of Columbia are among the most generous in the nation. As a result, roughly 45% of DC’s population is covered by Medicaid (305,000 people, out of a population of about 672,000).

The following are the District of Columbia’s Modified Adjusted Gross Income (MAGI) limits for some of the main groups covered by Medicaid (including a 5% income disregard required under federal rules for income-based Medicaid eligibility determination):

- 324% of the federal poverty level (FPL) for children 0-18

- 324% of FPL for pregnant women

- 221% of FPL for parents with dependent children

- 215% of FPL for other, non-elderly adults (this is the Medicaid expansion population. In most states, this group is only eligible for Medicaid with household income up to 138% of FPL, so DC’s eligibility limits are much more generous)

Visit the District’s Department of Health Care Finance site for eligibility criteria for other Medicaid-covered groups.

for 2026 coverage

0.0%

of Federal Poverty Level

Apply for Medicaid in District of Columbia

Online at DC Health Link; submit a Combined Application for Benefits in person at an Income Maintenance Administration (IMA) Service Center; or phone (202) 727-5355 for help.

Eligibility: Children 0-18 with incomes up to 319% of FPL; pregnant women with incomes up to 319% of FPL; parents with dependent children with incomes up to 216% of FPL; other non-elderly adults with incomes up to 210% of FPL

ACA’s Medicaid eligibility expansion in the District of Columbia

DC decided early on to participate in Medicaid expansion and sought federal approval just months after the Affordable Care Act was signed into law. Enrollment in the District’s ACA Medicaid expansion began in 2010. Five states and the District of Columbia took advantage of an option in the ACA to expand Medicaid ahead of schedule (the scheduled start date was January 2014) and obtained federal matching funds to provide coverage for applicants with income up to 138% of the poverty level (this includes an additional 5% income disregard that is built into the ACA’s formula for calculating Medicaid eligibility based on modified adjusted gross income).

Soon thereafter, DC further expanded Medicaid, to cover adults with income up to 205% of the poverty level (200% plus the 5% income disregard). And this was subsequently increased again: DC currently provides Medicaid coverage to parents/caretakers of minor children if their household income doesn’t exceed 221% of the poverty level, and to other non-disabled adults under age 65 if their household income doesn’t exceed 215% of the poverty level.

So although Medicaid eligibility for most adults ends at 138% of the poverty level in most other states, it extends well above that in DC. This is a big part of the reason DC Health Link (the exchange in DC) has such a low percentage of enrollees eligible for premium subsidies; a large segment of the population that would — in other states — be eligible for subsidized private plans in the exchange is instead eligible for Medicaid in DC.

And the much higher income threshold for Medicaid eligibility — combined with the requirement that people not be disenrolled from Medicaid between March 2020 and March 2023 — is the likely explanation for DC’s declining marketplace enrollment throughout the COVID pandemic. In most of the country, marketplace enrollment reached a record high in 2022 and again in 2023, but DC’s private individual/family coverage enrollment declined in 2022 and 2023. At the same time, enrollment in DC Medicaid has continued to increase.

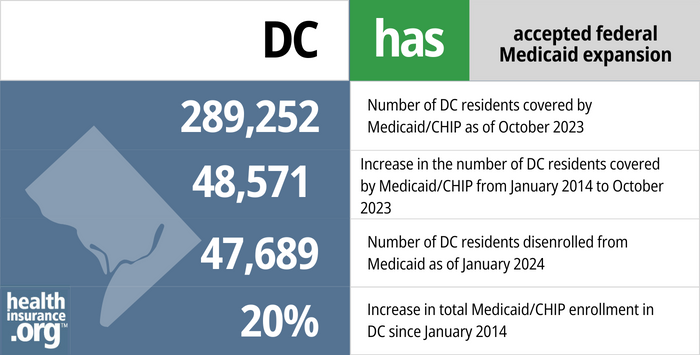

- 283,612 – Number of DC residents covered by Medicaid/CHIP as of October 20231

- 48,571 – Increase in the number of DC residents covered by Medicaid/CHIP from January 2014 to October 20232

- 47,689 – Number of DC residents disenrolled from Medicaid as of January 20243

- 20% – Increase in total Medicaid/CHIP enrollment in DC since January 20142

Explore our other comprehensive guides to coverage in DC

This guide to health insurance in Washington, DC will help you understand the coverage options available to you and your family, and whether you might be eligible for financial assistance with your health coverage.

Want to improve your smile and save money when you visit the dentist? Dental insurance might be a good addition to your medical coverage. Our guide will help you understand your dental coverage options in the District of Columbia.

Nearly 95,000 DC residents had Medicare coverage as of 2023.4 Our Washington, DC Medicare guide explains the various parts of Medicare, coverage options for Medicare Advantage and Part D, and the District’s rules regarding Medigap (Medicare Supplement) availability.

There are no insurers that offer short-term health insurance in Washington, DC. The District enacted legislation that limits short-term plans to three months, prohibits renewals, and prevents short-term health insurance from excluding pre-existing conditions or basing eligibility on medical history. This essentially made short-term health insurance a non-starter in DC, and the plans are no longer available for purchase.

Frequently asked questions about DC Medicaid eligibility and enrollment

How can I enroll in Medicaid in the District of Columbia?

You can apply for Medicaid in the District of Columbia online, over the phone, or in person. You can also fill out and submit a paper application.

- Online: Use the health insurance marketplace, DC Health Link.

- By phone: Call the DC Health Link Customer Service at 1-855-532-5465

- In Person: Apply in person at an Income Maintenance Administration (IMA) Service Center. Locate a center online or call 202-727-5355 for help.

- Paper Application: Download an application form, complete it, and then submit it by mail, in person, or by fax. Visit DCHealthLink.com or call 1-855-532-5465 for help

How does Medicaid provide financial assistance to Medicare beneficiaries in DC?

Many Medicare beneficiaries receive Medicaid financial assistance that can help them with Medicare premiums, lower prescription drug costs, and pay for expenses not covered by Medicare – including long-term care.

Our guide to financial assistance for Medicare enrollees in Washington, DC includes overviews of these programs, including Medicaid long-term care benefits, Extra Help, and eligibility guidelines for assistance.

How is the District of Columbia handling post-pandemic Medicaid renewals?

From March 2020 through March 2023, as a result of the COVID pandemic, states could not disenroll anyone from Medicaid. As a result, Medicaid enrollment in DC grew by about 20% during the pandemic. The federal ban on disenrollments ended on March 31, 2023. Over the course of a year-long period that states could choose to begin in February, March, or April 2023, states are required to recheck eligibility for everyone enrolled in Medicaid, and disenroll people who are no longer eligible. States had the option to have disenrollment effective as early as April 1, but DC pushed that out a couple of months, with the first round of disenrollments effective June 1.

Approximately two-thirds of DC’s Medicaid enrollees will have their coverage passively (automatically) renewed based on data the District can access via electronic sources. But when ongoing eligibility cannot be confirmed automatically, a member will need to submit additional information in order to prove their eligibility and keep their coverage. This can be done via District Direct, which is an online eligibility system (note that this has replaced the previous eligibility system the District used pre-pandemic).

The District of Columbia began the automatic (ex parte) renewal process in late March, for people with a May 2023 renewal date. For those whose coverage could not be automatically renewed, a renewal packet was sent out in early April, with a due date of May 31. If the person is no longer eligible or if they fail to respond to the request for updated information, their coverage will terminate as of May 31, meaning that they’ll need to have new coverage in place starting June 1 in order to avoid a gap in coverage. This process will then be repeated every month for a year, until all members have had their eligibility redetermined. The District expects total Medicaid enrollment to drop by about 10% over the course of the year-long “unwinding” period.

People who are no longer eligible for Medicaid will have the option to transition to other coverage. Depending on their circumstances, this could be an employer’s plan, Medicare, or an individual/family plan purchased through DC Health Link (the exchange/marketplace in DC). In all three cases, there’s a time-limited special enrollment period that allows a person to enroll due to the loss of Medicaid, even if they’re doing so outside of the annual open enrollment period for the new coverage.

What other coverage programs are available in DC?

Under its early-adopter approach to Medicaid expansion, DC moved about 34,000 people who had been enrolled in DC HealthCare Alliance — a District-funded program that allows low-income residents to obtain medical and dental services at no cost from participating providers — to the Medicaid program. Enrollment in DC Healthcare Alliance had reached 50,000 by 2009; most of those people became eligible for Medicaid instead once Medicaid was expanded.

So by opting to expand Medicaid early, DC was able to take advantage of federal funding to help cover a low-income population that was already being covered in a DC-based program that received no federal funding; expanding Medicaid early was obviously a good financial move for DC. In addition, the benefits through DC HealthCare Alliance are more limited than Medicaid, with no funding for mental health care or medical transportation. So Medicaid provides better coverage for enrollees as well.

DC Healthcare Alliance coverage is still available to people who aren’t eligible for Medicaid, but who have income at or below 215% of the poverty level (there used to also be a resource/asset limit of $4,000 for a single person and $6,000 for a family, but that was eliminated in 2022 and eligibility is now just based on income). To be eligible, people must live in the District, but unlike Medicaid, there are no immigration status requirements. So Alliance coverage is available to undocumented immigrants, and provides no-cost health care to enrollees.

The enrollment and recertification processes for DC Healthcare Alliance were relaxed as a result of the COVID pandemic, reducing the barriers to entry for this program. Renewals were paused during the pandemic, but resumed again in July 2022. However, the program now uses an annual renewal process, instead of redetermining eligibility every six months. And as noted above, there is no longer an asset/resource limit to qualify for the program. As of the summer of 2022, there were about 25,000 people covered under the Alliance program.

For immigrant children under the age of 21, the Immigrant Children’s Program in DC provides coverage for those with income up to 324% of the poverty level, regardless of assets. As of July 2022, there were 4,790 people covered under ICP. (This program used to have an eligibility limit of 200% of the poverty level.)

Cover All DC is an additional program available to undocumented immigrants (or anyone who isn’t eligible for Medicaid or private coverage through DC Health Link), regardless of income, so it’s for those with income above 215% of the poverty level. It allows enrollees to purchase private health insurance, with no financial assistance. The ACA specifically prevents undocumented immigrants from enrolling through the exchanges, so Cover All DC is separate from the exchange.

Legislation impacting DC Medicaid

Generous Medicaid program contributes to low uninsured rate

As of 2015, the Kaiser Family Foundation estimated that there were still 42,000 uninsured residents in DC, and 48% of them were eligible for Medicaid. That said, the District’s uninsured rate is among the lowest in the nation, at 3.5% in 2019. Only Massachusetts had a lower uninsured rate at that point. DC’s uninsured rate is down from 6.7% in 2013, and from more than 18% in the late 1990s. The drop in the uninsured rate is due in large part to the District’s efforts to implement the DC Healthcare Alliance, expand Medicaid and integrate the two programs.

District of Columbia Medicaid managed care

In general, children, pregnant women, parents, and other non-elderly adults enrolled in DC Medicaid are covered by managed care plans, as opposed to fee-for-service Medicaid. As of early 2023, about 87% of DC’s Medicaid population was enrolled in managed care. This included nearly all of the people who were enrolled in MAGI-based Medicaid (ie, eligibility based solely on income, including children, pregnant women, and adults under age 65), and about half of the people enrolled in non-MAGI Medicaid (ie, eligibility based on income and assets, including people 65 and older, as well as those whose eligibility is due to a disability).

District of Columbia Medicaid enrollment numbers

Footnotes

- “October 2023 Medicaid & CHIP Enrollment Data Highlights” , Medicaid.gov, Accessed February 2024 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2024 ⤶ ⤶

- “DC Department of Health Care Finance Eligibility Monitoring Dashboard” , app.powerbigov.us, Accessed February 2024 ⤶

- ”Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶