Medicaid eligibility and enrollment in New York

New York’s Medicaid program covers more than 7.5 million people

Who is eligible for Medicaid in New York?

Income-based (MAGI) Medicaid in New York is available to the following populations (including a built-in 5% income disregard that’s used for income-based eligibility determinations):1

- Adults under age 65 with household income up to 138% of the poverty level. (Above this level, up to 200% of the poverty level, Essential Plan coverage is available)2

- Pregnant women and children under the age of one are eligible with an income of up to 223% of the poverty level (for Medicaid eligibility determinations, a pregnant woman counts as two people for household income calculations). Medicaid for the mother continues for 12 months postpartum, due to legislation the state enacted in 2022.

- Children from age one to eighteen are eligible for Medicaid with a household income up to 154% of poverty, but the state also has separate CHIP (Children’s Health Insurance Program) coverage available for children with household incomes up to 405% of poverty level – the highest threshold in the country.

Medicaid is also available to some low-income people who are 65 or older, blind, or disabled, if they also have assets/resources within allowable ranges.3

for 2026 coverage

0.0%

of Federal Poverty Level

Apply for Medicaid in New York

CHIP and Medicaid enrollment can both be completed through NY State of Health.

Eligibility: Adults with incomes up to 138% poverty level. Pregnant women and infants with income up to 218% of poverty level. Separate CHIP is available in NY for all children with income up to 400% of poverty level.

ACA’s Medicaid eligibility expansion in New York

New York has long been a healthcare reform front-runner, creating a guaranteed issue individual health insurance market decades ahead of the Affordable Care Act (ACA), and also expanding Medicaid to cover many low-income parents and childless adults long before the ACA reformed the nation’s health insurance system.

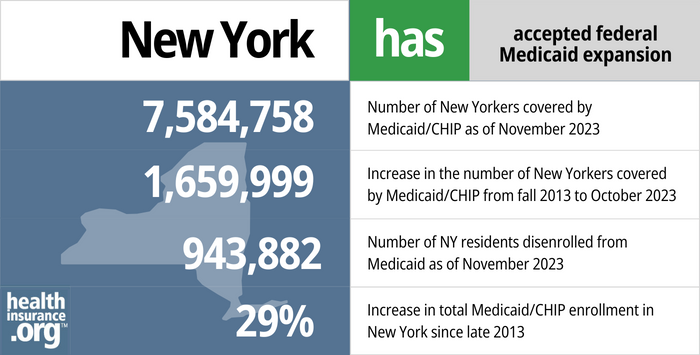

The state accepted the ACA’s provision to use federal funding to expand Medicaid in New York as of January 1, 2014, and Medicaid enrollment in New York was 29% higher by the fall of 2023 than it had been a decade earlier.4

- 7,584,758– Number of New Yorkers covered by Medicaid/CHIP as of November 20235

- 1,659,999 – Increase in the number of New Yorkers covered by Medicaid/CHIP from fall 2013 to October 20236

- 943,882 – Number of NY residents disenrolled from Medicaid as of November 20237

- 29% – Increase in total Medicaid/CHIP enrollment in New York since late 20136

Explore our other comprehensive guides to coverage in New York

We’ve created this guide to help you understand the New York health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

In 2023, seven insurers offer stand-alone individual/family dental coverage through NY State of Health.8

Medicare enrollment in New York stood at nearly 3.8 million people as of 2023.9 Our guide will help you better understand Medicare coverage options and Medicare-specific regulations in New York.

The sale of short-term health plans is not permitted in New York.10

Frequently asked questions about New York Medicaid

How do I enroll in Medicaid in New York?

- New York offers several options for enrolling in Medicaid:

- NY State of Health, The Official Health Plan Marketplace or (855) 355-5777

- Managed Care Organizations (MCOs)

- Navigators and Certified Application Counselors

- Medicaid Helpline: (800) 541-2831

- If you are 65 or older or have Medicare, apply by visiting a Human Resources Administration Office (in NYC) or a Local Department of Social Services Office (outside NYC)

How does Medicaid provide financial assistance to Medicare beneficiaries in New York?

Many Medicare beneficiaries receive Medicaid financial assistance that can pay for Medicare premiums, lower prescription drug costs, and cover expenses not reimbursed by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New York includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

How many people have been disenrolled from Medicaid in New York during unwinding?

The COVID-related federal continuous coverage requirement for Medicaid ended in March 2023, and states had to then begin redetermining eligibility for everyone enrolled in the Medicaid program, with a year-long “unwinding” window to complete that process.

As of early 2024, about 1.1 million people in New York had been disenrolled from Medicaid during the unwinding.11 But the large majority of eligibility redeterminations — 81% as of late 2023 — had resulted in a coverage renewal and the enrollee being able to keep their coverage, putting New York among the top five highest performing states in terms of keeping people enrolled in Medicaid during the unwinding process.12

New York has an overview page where they have provided additional information related to the end of the continuous coverage requirement and the return to normal eligibility redeterminations for Medicaid, Child Health Plus, and the Essential Plan (disenrollments were paused for all three during the pandemic).

New York has kept each enrollee’s already-scheduled renewal date, as opposed to prioritizing any particular population for eligibility redeterminations. And New York’s first round of disenrollments didn’t come until July 2023.

New York Medicaid enrollees need to pay close attention to any communications they receive from their local Medicaid office or NY State of Health, and reply as soon as possible if additional information is needed. If they are no longer eligible for Medicaid, they should familiarize themselves with their coverage options. This could include an employer-sponsored plan (if available), Medicare, or a plan purchased through the exchange/Marketplace (note that there is a limited enrollment window to sign up for any of those coverages). Some enrollees who lose eligibility for Medicaid will find that they’re eligible for New York’s Essential Plan, which is available to people with household income up to 200% of the poverty level. And enrollment in the Essential Plan continues year-round.

CMS reported that by October 2024, more than 28,000 New York residents had transitioned from Medicaid to a qualified health plan in the Marketplace, and more than 185,000 had transitioned to the Essential Plan.13

It’s also important to note that New York is working to expand the Essential Plan, starting in 2024, so that it will cover more people. It’s currently available to those with income up to 200% of the poverty level, with no monthly premiums. If the state’s plan is approved by the federal government, people with income up to 250% of the poverty level could enroll in the program, albeit with a $15/month premium for those above 200% of the poverty level. The state hopes to implement this expansion by April 2024.14

Legislation impacting New York Medicaid

Medicaid expansion in New York: Most enrollees were already eligible under NY’s generous pre-ACA rules

Total New York Medicaid enrollment, including both pre-ACA eligibility categories and ACA Medicaid expansion categories, was nearly 7.6 million as of late 2023.5

As of September 2022, New York’s Medicaid expansion was covering more than 2.5 million of the state’s Medicaid enrollees.15 But New York’s eligibility guidelines were already so generous that fewer than 433,000 of those people were newly eligible as a result of the ACA’s expansion of Medicaid. The rest — more than 2 million people — were already eligible for Medicaid before 2014 under New York’s rules.

However, the federal government pays 90% of the cost for the entire Medicaid expansion population, which is significantly higher than the federal government’s funding for the rest of the state’s Medicaid population. So the expansion of Medicaid in New York under the ACA has been particularly beneficial to the state from a financial perspective.

For non-expansion enrollees, New York and the federal government split the cost (since New York is a relatively wealthy state, they receive the lowest possible federal match, which is 50%).

New York has the majority of its Medicaid population enrolled in managed care programs, under an 1115 waiver that dates back to 1997. The state contracts with a variety of private insurers to manage enrollees’ Medicaid coverage, and plan availability depends on the county where an enrollee lives.16

Medicaid expansion in New York

New York’s progressive stance on access to health care meant that much of the state’s low-income population were already eligible for Medicaid or Family Health Plus for many years before the ACA.

In 2000, New York began implementing Family Health Plus, which was designed to insure up to 600,000 of the state’s low-income working adults. The pre-2014 New York Medicaid program covered childless adults with incomes up to 50% of the poverty level, and Family Health Plus expanded coverage up to 100% of poverty. For parents with dependent children, the existing eligibility rules allowed Medicaid coverage up to 75% of poverty level, and Family Health Plus increased that threshold to 150%.

The ACA’s Medicaid provisions allowed New York to utilize enhanced federal funding to expand Medicaid to everyone with incomes up to 138% of poverty.

New York went a step further than most other states by implementing the ACA’s Basic Health Program, which covers people with income a little too high for Medicaid. The Essential Plan became available in January 2016, and it covers New York residents with income up to 200% of the poverty level. There is no longer a premium for The Essential Plan. For more information, read here.

As noted above, New York is working to expand Essential Plan coverage to include those with income up to 250% of the poverty level, albeit with a modest $15/month premium for those above 200% of the poverty level. If approved by the federal government, the expanded eligibility would take effect in April 2024.14

Footnotes

- Medicaid, Children’s Health Insurance Program, & Basic Health Program Eligibility Levels. Centers for Medicare and Medicaid Services. December 2023. ⤶

- Essential Plan Information. New York State of Health. Accessed February 2024. ⤶

- New York State Income and Resource Standards for Non-MAGI Population. New York State Department of Health. Effective January 2024. ⤶

- Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment. KFF. October 2023. ⤶

- New York State Medicaid Enrollment Databook. New York State Department of Health. November 2023. ⤶ ⤶

- Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment, KFF.org, Accessed February 2024. ⤶ ⤶

- New York State Public Health Emergency Unwind Dashboard“, NY State of Health, data for June through November 2023 ⤶

- “New York dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Availability of short-term health insurance in New York” healthinsurance.org, March 3, 2023 ⤶

- Medicaid Enrollment and Unwinding Tracker. KFF. February 2024. ⤶

- New York State Public Health Emergency Unwind Dashboard. New York Department of Health. November 2023. ⤶

- State-based Marketplace (SBM) Medicaid Unwinding Report, data through October 2023. Centers for Medicare and Medicaid Services. Accessed February 2024. ⤶

- New York Addendum to 1332 Waiver. New York Department of Health. December 2023. ⤶ ⤶

- Medicaid Expansion Enrollment. KFF. September 2022. ⤶

- Managed Care Organization (MCO) Directory by County. New York State Department of Health. Accessed February 2024. ⤶