Health insurance will soon be more affordable for many low- and middle-income families in America. Starting in January, premium tax credits will be available to help low- and middle-income Americans purchase affordable health coverage in their state marketplaces (also known as exchanges). We at Families USA estimate that nearly 26 million Americans will be eligible for premium tax credits to help make health coverage affordable.

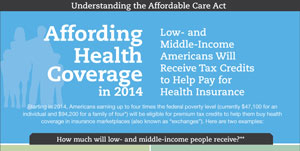

Premium tax credits will be available to individuals and families with incomes between 100 and 400 percent of poverty (between $11,490 and $45,960 for an individual and between $23,550 and $94,200 for a family of four). These new premium tax credits actually work like a subsidy rather than like a typical tax credit: 1) you don’t have to owe taxes to receive the subsidy; and, 2) you receive the help when you buy insurance and you don’t have to wait to get the help or be reimbursed later after you file taxes.

The new premium tax credits will ensure that low-and middle-income individuals and families will not have to spend more than a set percentage of their income on health insurance. They will be set up on a sliding scale, meaning that those with lower-incomes will receive a more substantial benefit than those with higher incomes. Once the size of the tax credit is calculated for an individual or family, it then can be used to purchase from a range of plans of different types and prices offered in the state marketplace. To see two illustrations of the size of the new premium tax credits and how they are calculated, see our infographic at the right.

Families USA worked with the Lewin Group to come up with estimates of how many people in each state and across the country will be eligible for these premium tax credits. State reports are available here. Taken altogether, we estimate that nearly 26 million Americans will be eligible for premium tax credits, with the overwhelming majority of those (about 88 percent) from working families.

Of those eligible, about 56 percent will have incomes between 200 and 400 percent of poverty (between $47,100 and $94,200 for a family of four). Young adults (aged 18-34) are the likeliest age group to be available for the tax credits, making up more than 36 percent of those eligible. We also looked at who is eligible by race and ethnicity and found that about 58 percent of those eligible will be white, non-Hispanic, about 23 percent will be Hispanic, and about 11 percent will be black and non-Hispanic. These numbers show that premium tax credits will help people from very different walks of life.

With these tax credits comes the peace of mind for many who are unable to access affordable health coverage. States across the country need to work to inform their residents of the opportunity to take advantage of these premium tax credits. This will ensure that the largest number of those eligible see the intended benefits. This work needs to begin now, as open enrollment in state marketplaces starts in October. Coverage will then begin in January, when comprehensive, affordable health coverage will finally become a reality for millions of Americans.