What is ACA-compliant coverage?

ACA-compliant refers to a major medical health insurance policy that conforms to the regulations set forth in the Affordable Care Act (Obamacare).

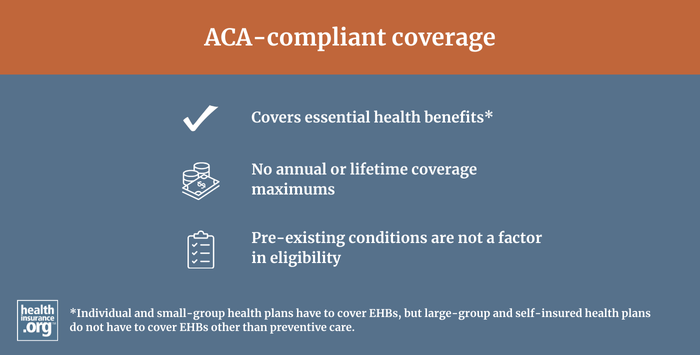

ACA-compliant individual and small-group policies must include coverage for the ten essential health benefits with no annual or lifetime coverage maximums. They are guaranteed issue during open enrollment, so pre-existing conditions are not a factor in eligibility. They cannot be arbitrarily rescinded, and carriers must comply with the medical loss ratio (MLR) rules that require them to spent at least 80% of premiums (85% for large group plans) on medical expenses.

All newly purchased individual and small group health insurance policies are required to be ACA-compliant, regardless of whether they are sold on or off-exchange. This has been the case since January 1, 2014. (Employees may still enroll in existing small-group plans that were in effect before 2014, but if a small business purchases a new plan, it must be ACA-compliant.)

The ACA's requirements for large group plans (51 or more employees in most states, but 101 or more employees in California, Colorado, New York, and Vermont) and self-insured plans are different, so ACA compliance is different for those plans. But from the employee's perspective, the coverage is still ACA-compliant, and the employee is in compliance with the individual mandate (which still exists, albeit without a penalty for non-compliance). The same is true for people who get their coverage from Medicare or Medicaid.

Obamacare subsidy calculator *

Grandfathered plans

Plans that were in force prior to 2014 have varying degrees of exemptions from the ACA's rules. Grandfathered plans must have already been in effect as of March 23, 2010, and while they are required to comply with some of the ACA's regulations, they are exempt from many others.

Grandfathered plans may remain in force indefinitely as long as they are still offered by the carrier and do not make any substantial changes to the plan. But they are dwindling in number due to the normal turnover of insurance products. No individual or business has been able to purchase a new grandfathered plan since March 23, 2010, although eligible employees may still enroll in existing grandfathered plans.

Grandfathered plans count as minimum essential coverage. So if and when a grandfathered plan is terminated, the termination will trigger a special enrollment period during which a new plan can be purchased.

Grandmothered plans

Individual and small group policies with effective dates prior to 2014, but after March 23, 2010, are not grandfathered, but many are still in existence and they do not have to be fully ACA-compliant.

Originally, these plans were all scheduled to terminate and be replaced with ACA-compliant plans at their 2014 renewal date. But the Obama Administration announced in March 2014 that they could be renewed for another year instead, without becoming fully compliant with the ACA's regulations. Ultimately, that extension has been renewed several times and these plans are now eligible to be renewed until further notice from the federal government, at the discretion of each state and health insurance company.

These plans are called "grandmothered" or "transitional" policies. They must abide by some ACA regulations, such as the ban on lifetime and annual limits for essential health benefits, but the coverage they offer can remain generally the same as it was prior to 2014. The majority of the states have opted to go along with the federal guidance that allows grandmothered plans to renew, but the number of people enrolled in these plans has been steadily decreasing over time.

Grandmothered plans also count as minimum essential coverage.

Plans that aren't regulated by the ACA

In addition to grandfathered plans and grandmothered plans (both of which are major medical health insurance), there are other plans that are not regulated by the ACA, and are thus not required to follow the guidelines of the ACA.

They include short-term medical insurance (also referred to as temporary health insurance), accident supplements, fixed-dollar indemnity plans, dental/vision plans, some limited-benefit policies, critical-illness policies, and medical discount plans. These plans are not ACA-compliant coverage, and they continue to operate under state regulations much the way they did prior to the ACA.

They also do not fulfill the shared responsibility provision, since they are not minimum essential coverage. Although there's no longer a federal penalty for not having minimum essential coverage, there is a penalty if you're in DC, New Jersey, California, Massachusetts, or Rhode Island. Short-term health insurance is not available in any of those states, but other types of non-ACA-compliant coverage, such as fixed indemnity plans, do tend to be available, and will not count as fulfilling a state-based individual mandate.