Q. I'm following an online debate about health plans before and since ACA. One person (a non-smoking male, age 35, with no dependents, from Missouri) is saying that before the ACA was implemented, his plan cost $150 a month and he only had a $50 deductible "for everything." That seems surprisingly inexpensive. Were individual plans that inexpensive before Obamacare took effect?

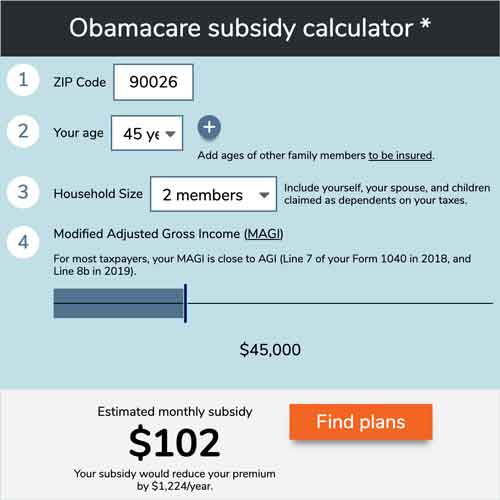

Use our calculator to estimate how much you could save on your ACA-compliant health insurance premiums.

A. It's extremely unlikely that this person had a true major medical plan. $50 deductibles disappeared in the individual market long before the ACA. Without seeing more details about this person's plan, it's hard to say exactly what he had. It might have been a fixed indemnity plan with a $50 deductible, or something along the lines of this pre-ACA plan we profiled several years ago.

It's also possible that he had employer-sponsored coverage. (Deductibles tend to be lower in the employer-sponsored market, and employers pay the bulk of their employees' premiums, but costs have increasingly been shifted to employees over the years, in a trend that pre-dates the ACA.)

Missouri's market was pretty standard pre-ACA. These data from ehealthinsurance are a good approximation of what people were buying in the individual market and how much it cost. Nationwide, as of 2013 – for true major medical plans – the average premium for a single individual was $197/month, and the average deductible was $3,319.

So it's very possible that his premium was $150 – men had lower rates and he was on the younger end of the spectrum. But it didn't have a $50 deductible if it was a real major medical plan.

Most enrollees receive subsidies and pay far less than pre-ACA rates

Although this particular plan may not have been worth reminiscing over, there are some people whose premium costs increased as a result of the ACA (we'll get to this in a moment). That's not the case for most people, however. Most enrollees who buy their own health insurance in the marketplace/exchange are eligible for premium subsidies that cover the majority of the cost of their coverage.

For the first several years that ACA-compliant plans were available, enrollees with household income above 400% of the federal poverty level were ineligible for premium subsidies. That upper income limit was eliminated for 2021 and 2022 by the American Rescue Plan, and consumer advocates are encouraging Congress to make that provision permanent, to ensure that coverage remains affordable for households that earn more than 400% of the poverty level (with no subsidy at all, coverage was often entirely unaffordable for households a little above that threshold).

In early 2021, before the American Rescue Plan was implemented, 86% of all marketplace enrollees nationwide were receiving premium subsidies. And those subsidies covered the majority of the average premiums: The average premium amount was $575/month, while the average subsidy amount was $486/month.

The American Rescue Plan has since increased the number of people who are eligible for subsidies, and has also increased the size of the subsidies. HHS reports that more than a third of the people who have used the marketplace since the ARP subsidies went live in April 2021 have obtained coverage for less than $10/month. This is far less than people were paying for major medical coverage in the pre-ACA days.

Full-price premiums are higher (but they would have grown even without the ACA, and medical underwriting can't be ignored)

Among people who shopped on the ehealthinsurance platform during the open enrollment period for 2020 coverage, the average individual premium was $456/month. And among people who shopped on HealthCare.gov, the average premium was $576/month before any subsidies were applied. (Both platforms were selling ACA-compliant plans, but people shopping outside the exchange are more likely to select lower-cost options, as they have to pay the full cost themselves, with no subsidies.) Compared with the $197/month average premium in 2013, that's a pretty drastic increase. (Again, the full price only applies to people who don't get premium subsidies.)

But it's worth noting that premiums were increasing substantially in the pre-ACA years as well, and would have been much higher by now even if health care reform hadn't been implemented and coverage in the individual market hadn't been improved. The $197/month premium would have been long gone by now.

The rate increases in the individual market since the ACA was implemented are due to a combination of medical cost inflation (which was already a factor pre-ACA), more robust benefits, and the elimination of medical underwriting. (It's noteworthy that in New York, which had eliminated medical underwriting many years before the ACA – but which did not have any premium subsidies or individual mandate pre-ACA –inflation-adjusted premiums are still lower than they were in 2013.)

People who have pre-existing medical conditions likely recognize how beneficial the ACA has been, as their access to individual-market coverage would have been limited, expensive, or non-existent prior to 2014, depending on where they lived. Pre-ACA, more than half of the people who needed individual market coverage were either rejected altogether, advised to not apply due to their medical history, or offered coverage that either came with pre-existing condition exclusions or a higher premium based on pre-existing conditions.

But people who are healthy and also ineligible for subsidies have been understandably frustrated by the sharply higher premiums (despite the fact that their premiums would have continued to climb sharply each year even without the ACA). And it's also important to remember that pre-existing conditions can develop overnight.

Not receiving a subsidy? Double-check your eligibility!

It's also worth double-checking subsidy-eligibility in the exchange, especially now that the American Rescue Plan has eliminated the "subsidy cliff" for 2021 and 2022. Applicants with income above 400% of the poverty level can qualify for a subsidy if the cost of the benchmark plan would otherwise be more than 8.5% of their household income. People who were previously ineligible for a subsidy might now qualify for one, but this is only available if you shop in your state's marketplace (ie, you can't claim the subsidy on your tax return if you buy your coverage outside the exchange).

You can use our subsidy calculator to get an estimate of how much your subsidy would be if you enroll in a plan through the marketplace in your state.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.