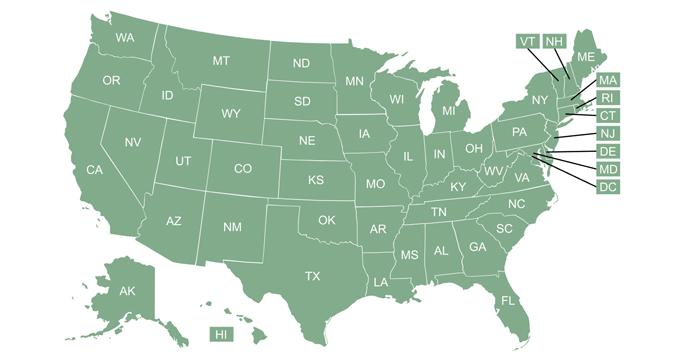

Please provide your zip code to see plans in your area.

Featured

Featured

employer tax credits

What are employer tax credits?

Employer tax credits – or Small Business Health Care Tax Credits – provide a tax credit of up to 50 percent of small-business premium costs. Employers with fewer than 25 full-time workers and average annual wages less than $50,000 are eligible. Read more about the credit.

Related articles

It's important for the self-employed to know all the ways they can save a few dollars here and there. One obvious place to look is on their tax forms, but one look isn't enough.

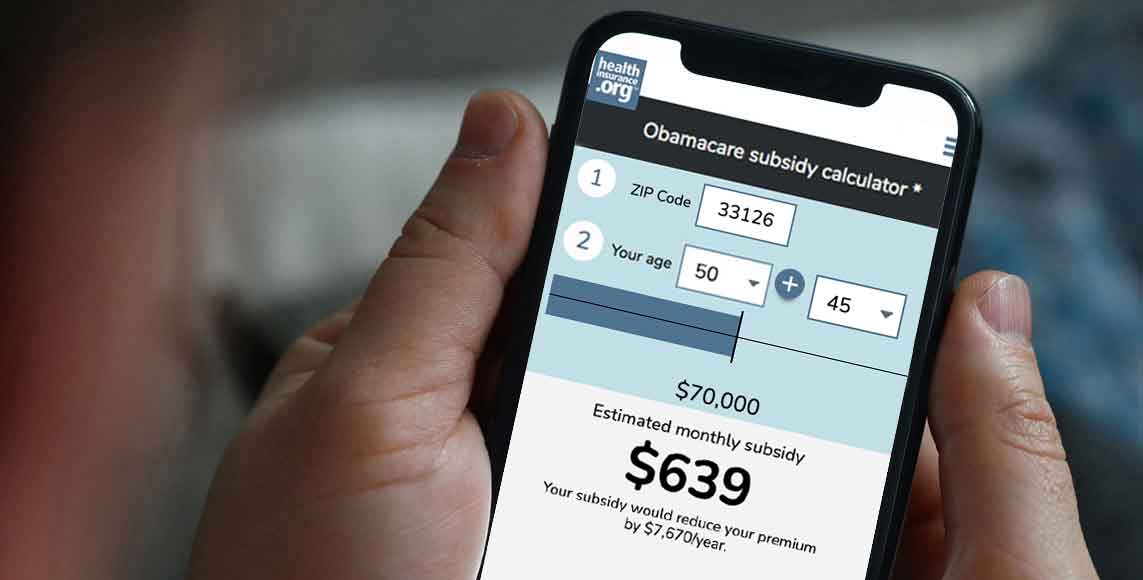

Suspect that your employer’s health benefits are subpar? ACA marketplace subsidies could provide relief.

If you’re self-employed, you can generally deduct the full amount you pay in premiums without having to itemize your deduction.

Sweeping health reform legislation delivered a long list of provisions focused on health insurance affordability, consumer protections.