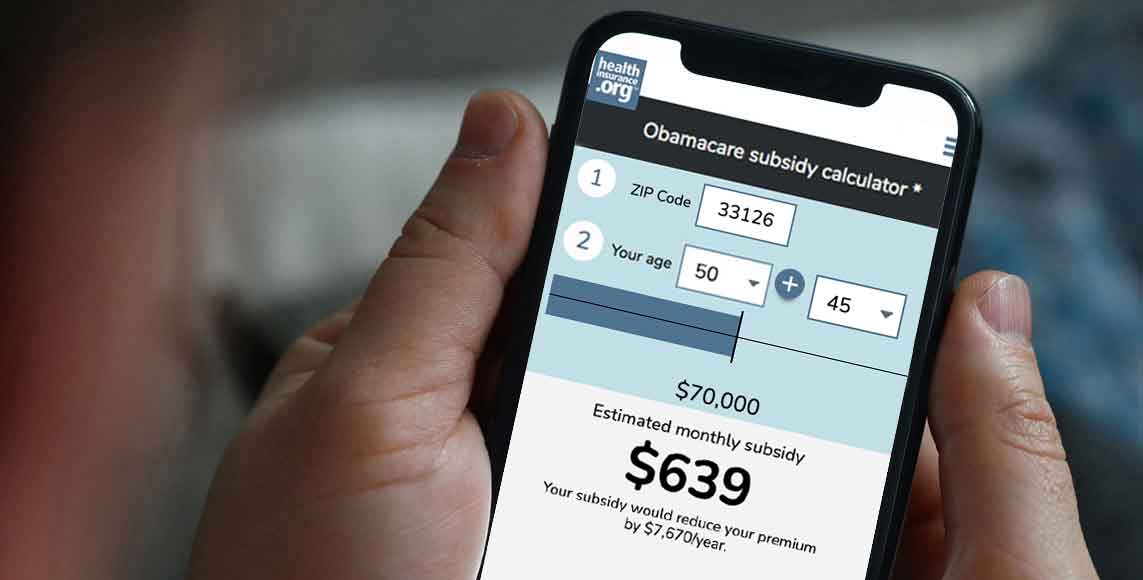

Please provide your zip code to see plans in your area.

Featured

Featured

No Surprises Act

What is the No Surprises Act?

What is the No Surprises Act?

The No Surprises Act is a federal law that took effect January 1, 2022, to protect consumers from most instances of “surprise” medical bills. The legislation was included in the Consolidated Appropriations Act, 2021, which was signed into law by President Trump in December 2020, after receiving strong bipartisan support in Congress.

The Biden administration spent much of 2021 working on implementation of the new law, with various interim final regulations and final regulations issues. An overview of the rulemaking process for the No Surprises Act is available on the CMS website, and CMS also has a helpful overview page, explaining various details of the No Surprises Act.

What are surprise medical bills?

The term “surprise medical bills” is a common reference to “surprise balance billing.” Balance billing happens when an out-of-network medical provider sends a patient a bill for their services, beyond the amount (if any) the patient’s health insurance paid. Surprise balance billing refers to two types of situations in which the patient has little to no control over whether they’re treated by an out-of-network provider:

- Emergencies. The general rule is to go to the closest emergency room. This may or may not be in-network, and it may or may not have out-of-network providers caring for patients. But the patient is not in a position to determine whether the care they’re receiving is in-network. Under the No Surprises Act, consumer protections also extend to hospitalization immediately following emergency room care, until the patient can safely be transferred to an in-network facility.

- Non-emergency situations in which the patient goes to an in-network hospital but is unknowingly treated by an out-of-network provider. For example, you might choose an in-network hospital for your planned surgery, but not realize that the radiologist or anesthesiologist, or assistant surgeon isn’t in your insurance network. In some cases, you might never interact with this provider at all. (“Facility” refers to hospitals, hospital outpatient departments, critical access hospitals, and ambulatory surgical centers. Out-of-network care received at other types of in-network medical provider locations is rare, but is not subject to the No Surprises Act.)

In those scenarios, it was quite common for patients to receive an unexpected (surprise) balance bill for the care that they unknowingly received from a medical provider who wasn’t in their insurance plan’s network.

How common were surprise medical bills?

Various studies indicated that about 20% of emergency room visits resulted in surprise medical bills from out-of-network providers. And up to 16% of in-network hospitalizations resulted in surprise balance bills from out-of-network providers who participated in the patient’s care. It’s estimated that about 10 million surprise balance bills will be avoided annually as a result of the No Surprises Act.

How does the No Surprises Act protect consumers?

Under the No Surprises Act, out-of-network providers cannot send patients a balance bill for emergency treatment or for out-of-network care provided at an in-network hospital. Instead, the patient can only be charged their regular in-network cost-sharing amounts. And health plan ID cards must display the plan’s in-network deductible and out-of-pocket maximum, so that the information is readily available.

Note that the law doesn’t change anything about how claims are approved in general, so insurers can still deny claims depending on the circumstances (and the normal appeals process would apply in that case). But assuming the care is covered under the plan, the surprise out-of-network care has to be treated — from the consumer’s perspective — as if it’s in-network.

Since an out-of-network provider does not have a contract-negotiated rate with the insurance company, the provider and the insurer then have to work out an acceptable payment rate, without having the patient caught in the middle. If the provider and the insurer can’t reach an agreement, there’s an Independent Dispute Resolution (IDR) process that either party can request.

The IDR is moderated by an HHS-certified third party. Both the provider and the insurer submit their best offer, and the IDR entity decides which one to accept. The losing party has to pay the IDR fee, and likely has to accept a payment rate that’s worse (from their perspective) than what they would have had if the earlier negotiation process had been successful. So there is an incentive for providers and insurers to reach an agreement on payment rates without activating the IDR process.

Some aspects of the IDR process were challenged in court by some medical providers, and a judge ruled in their favor in February 2022. The final rule that CMS issued in August 2022 took into account the fact that certain aspects of the IDR process that had been clarified in prior guidance were vacated by that court ruling. The No Surprises Act and the rest of the federal rules for its implementation remain intact. But there are concerns that the vacated provisions of the IDR process were included in order to hold down health care costs and insurance premiums, and that without them, costs and premiums will rise.

How did the No Surprises Act help marketplace plan buyers?

All health plans sold in the marketplace/exchange are subject to the No Surprises Act’s regulations. This means that consumers who purchase coverage through the marketplace can rest assured that they will not receive surprise medical bills if they go to an in-network hospital, or if they receive care from an out-of-network medical provider in an emergency department.”

Does the No Surprises Act protect against all surprise medical bills?

No. Ground ambulance charges, which are a significant source of surprise balance billing, are not regulated under the No Surprises Act.

But the law did call for the creation of a commission to study ground ambulance charges, and the hope is that consumer protections against surprise balance billing for ground ambulance charges can then be addressed in future legislation, with specifics based on the committee’s findings. The Biden administration announced the establishment of the advisory committee in November 2021, and invited experts to apply for a position on the committee. The committee members were announced in December 2022, and will have their first meeting in January 2023.

Can patients still receive balance bills under the No Surprises Act?

Yes, depending on the circumstances. The No Surprises Act doesn’t apply to situations in which a patient chooses to use an out-of-network provider (as opposed to situations in which the patient had no choice or was unknowingly treated by an out-of-network provider at an in-network facility). So if a person goes to an out-of-network facility or doctor in a non-emergency situation, balance billing can still be expected, and a health plan’s normal rules for out-of-network coverage would be used.

And in limited non-emergency situations, out-of-network medical providers can ask patients to waive their rights under the No Surprises Act. In that case, if the patient signs a form indicating that they agree to the out-of-network charges, they can still receive a balance bill. And the out-of-network medical provider can refuse to provide treatment if patients don’t waive their balance billing protections.

But waivers are not allowed in the majority of scenarios that generate surprise balance billing, including emergency care, ancillary services (including anesthesiology, pathology, radiology, and neonatology), assistance surgeons, internists, and hospitalists, radiology and lab work, and situations in which there is no in-network provider available at the facility who can administer the necessary care. In other words, the waiver of rights form can only be used if the patient is genuinely being given the option to use an in-network provider and decides to use the out-of-network provider instead.

What can I do if I think I’ve received a surprise medical bill?

If you receive a surprise medical bill from an out-of-network provider and you believe that the No Surprises Act’s rules are applicable to the situation, you should contact the provider who sent you the bill.

Do the No Surprise Act’s consumer protections apply to all plans?

For the most part, yes. The law is applicable to plan or policy years that start on or after January 1, 2022. Most health plans, including all plans sold in the ACA-compliant individual market and the majority of employer-sponsored plans, renew on January 1. For those plans, the new rules took effect January 1, 2022. But for a plan that doesn’t follow the calendar year, including some grandfathered health plans and some employer-sponsored health plans, the new rules took effect on whatever date in 2022 that their plan year began.

The No Surprises Act doesn’t apply to plans that aren’t considered minimum essential coverage, such as short-term health plans, fixed indemnity plans, or health care sharing ministry plans.

Does the No Surprises Act help me if I don’t have health insurance?

Yes. As of January 2022, medical providers have to provide uninsured or self-pay patients with an itemized good-faith estimate of medical costs, upon request or after the service is scheduled. This applies to people who don’t have health insurance, as well as those who plan to self-pay rather than submit a claim to an insurance plan. People with various types of non-ACA-compliant coverage, including health care sharing ministry plans, are considered self-pay patients.

There’s also a dispute resolution process for uninsured/self-pay consumers, which can be initiated if the actual bill exceeds the good faith estimate by more than $400. There’s a $25 fee for this service, but if the billing dispute is resolved in the consumer’s favor, the fee is paid by the medical provider instead.