Please provide your zip code to see plans in your area.

Featured

Featured

SHOP exchange

What is a SHOP exchange?

The Small Business Health Options Program (SHOP) is an insurance exchange designed to help small businesses compare health plans and enroll in coverage for their employees.

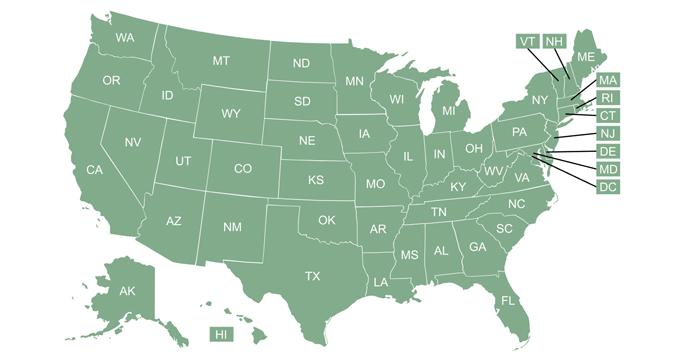

Created through the Affordable Care Act, SHOP was an option in every state. But in the 39 states that use HealthCare.gov, the availability of small-business plans in the exchange changed in 2018. And some states that operate their own exchanges no longer offer SHOP coverage due to lack of insurer participation. As of 2017, there were fewer than 39,000 people enrolled in SHOP coverage across the 26 states with fully federally run SHOP platforms.

The decline of insurer participation in the SHOP program was due in part to lackluster enrollment early on, as well as a rule change in 2016. Under the new rule, individual-market insurers that offer coverage through HealthCare.gov are no longer required to offer SHOP coverage. (Prior to 2018, those insurers were required to offer at least one silver and one gold SHOP plan in order to be allowed to offer individual market coverage in the exchange.)

Instead of having small businesses use the exchange to enroll, HealthCare.gov now directs them to seek a broker or contact an insurance company directly.

Some state-run exchanges have robust SHOPs

Although SHOP participation and enrollment flagged in most states, SHOP enrollment in some state-run exchanges has been fairly brisk. Covered California’s SHOP exchange had 47,000 members enrolled and Washington, DC’s SHOP exchange had more than 77,000 members as of 2018.

Eleven states still have SHOP platforms for small businesses, although some of them have switched to a direct-to-carrier enrollment model, instead of maintaining an enrollment portal that small businesses can use:

- California

- Connecticut

- Colorado (SHOP is no longer administered by the exchange, but Kaiser still offers SHOP-certified plans in Colorado)

- District of Columbia

- Idaho

- Maryland

- Massachusetts

- New Mexico

- New York

- Rhode Island

- Vermont

Washington and Minnesota have state-run health insurance exchanges, but no longer have SHOP plans available due to lack of insurer participation.

In most states, SHOP marketplaces (and small group plans in general) are available to businesses with up to 50 employees, but there are four states that changed their laws to match the original intent of the ACA. As a result, small business health plans are available to businesses with up to 100 employees in Vermont, New York, Colorado, and California.

Small-business healthcare tax credit

Businesses that purchase SHOP coverage are eligible for a small-business health care tax credit. However, the tax credit is only available for up to two years.

And as described here, availability of the tax credit is limited if a business is in an area where there are no longer any SHOP plans available. Businesses that had a SHOP-certified plan during the first year of their two-year tax-credit eligibility window can continue to receive the tax credit for a non-SHOP plan if SHOP plans are no longer available during the second year. But businesses in areas without SHOP plans cannot newly enroll in a non-SHOP plan and claim the tax credit. As of 2019, there are SHOP-certified plans available in at least some parts of 23 states.