Home > Health insurance Marketplace > New York Heath Insurance Marketplace

New York Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

New York health insurance Marketplace guide

We’ve created this guide, including the FAQs below, to help you understand the health coverage options and financial assistance available to you and your family in New York. The options found in New York’s Marketplace may be a good choice for many consumers, and we will guide you through the options below.

New York residents use a fully state-run health insurance Marketplace known as NY State of Health, where a dozen private insurers offer health plans.1

The Marketplace also provides residents access to apply for the state’s Basic Health Program known as the Essential Plan (BHP),2 which offers premium-free coverage to residents whose income is too high to qualify for Medicaid or Child Health Plus, but not more than 250% of the federal poverty level. This income limit was previously 200% of FPL, but increased to 250% of FPL as of April 2024, making premium-free Essential Plan coverage newly available to 100,000 additional New Yorkers.3

New York has also received federal approval to use 1332 waiver pass-through funding to provide additional cost-sharing reductions for some Marketplace enrollees starting in 20254 (more details below).

New York State of Health also offers a small business portal where employers with up to 100 employees can compare group health plans. In most states, “small group” means up to 50 employees, but New York is one of four states where small group plans are available to groups of up to 100 employees.5

Frequently asked questions about health insurance in New York

Who can buy Marketplace health insurance?

To purchase health coverage through the New York Health Insurance Marketplace, you must:8

- Live in New York

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare9

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your household income. In addition, to qualify for financial assistance with your New York Marketplace plan you must:

- Not have access to affordable employer-sponsored health coverage. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid, Child Health Plus, or The Essential Plan.

- Not be eligible for premium-free Medicare Part A.10

- If married, file a joint tax return.11

- Not be able to be claimed by someone else as a tax dependent.11

When can I enroll in an ACA-compliant plan in New York?

In New York, the open enrollment period has both a start and end date that differ from the schedule used in most other states (as noted below, the start date is expected to change for 2025 coverage, due to new federal rules). Open enrollment in New York starts November 16, and normally continues through January 31.12

For 2024 coverage, however, New York State of Health kept enrollment open through May 31, 2024, due to the “unwinding” of the pandemic-era continuous coverage rule for Medicaid. So enrollment in 2024 qualified health plans in New York continued through May 2024, without the need for a qualifying life event.13

For 2025 and future years, the federal government has finalized a rule change that requires all state-run exchanges to begin open enrollment on November 1 (or earlier, if a state was already using an earlier date), and end it no sooner than January 15 (or earlier if a state was already using an earlier date).14 So the expectation is that New York’s open enrollment period will switch to having a November 1 start date, beginning with the enrollment period in the fall of 2024.

Enrollment in Medicaid, Child Health Plus, and the Essential Plan continues year-round for eligible people.

For qualified health plans (ie, not Medicaid, CHP, or the Essential Plan), enrollment outside of the annual open enrollment window is only possible if you qualify for a special enrollment period, which is typically triggered by a specific qualifying life event.

New York is one of several states where pregnancy counts as a qualifying event. In most states, it’s the birth that triggers a special enrollment period, but New York allows the expectant mother to sign up for health insurance due to the pregnancy.15

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a New York Marketplace plan?

To enroll in an ACA Marketplace plan in New York, you can:

- Visit NY State of Health to access New York’s Marketplace, an online platform where you can compare plans, determine whether you’re eligible for financial assistance, and enroll in the plan that best meets your needs.

- Purchase NY State of Health Marketplace health coverage with the help of an insurance agent or broker, a Navigator, or a certified application counselor.16

You can contact NY State of Health by phone at 1-855-355-5777 (TTY: 1-800-662-1220)

How can I find affordable health insurance in New York?

New York residents use NY State of Health to enroll in health coverage and obtain income-based subsidies.

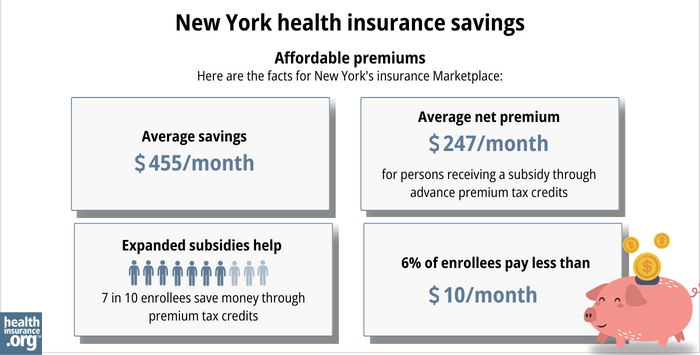

In the New York exchange, about 70% of enrollees were receiving premium subsidies as of early 2024 with an average subsidy of $455/month. After the subsidies were applied, enrollees’ net premiums averaged $247/month for those eligible for subsidies.17

In addition to the private qualified health plans available through the state exchange, almost 1.2 million people were enrolled in Basic Health Program coverage through New York’s Essential Plan as of January 2024, and that had grown to almost 1.4 million by May 2024 (as described below, eligibility was expanded in April 2024, leading to increased enrollment).18 Essential Plan enrollment is completed via NY State of Health, just like qualified health plan enrollment. But BHP coverage in New York dwarfs qualified health plan enrollment.19

The Essential Plan has zero premiums and low cost-sharing. It was previously available to adults with household incomes up to 200% of the poverty level. But the state obtained federal permission to extend the eligibility limit to 250% of FPL, starting in April 2024.3 For a single adult in 2024, this allows access to the Essential Plan with a household income of up to $37,650.20

(New York had previously paused the proposal to extend Essential Plan eligibility in the fall of 2023,21 but subsequently asked the federal government to continue with the review and approval process,22 including an addition to ensure that DACA recipients can enroll in the Essential Plan — which was granted as part of the waiver approval.3)

Source: CMS.gov23

In addition to the ACA’s premium tax credits (subsidies), people with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions(CSR) that reduce the out-of-pocket costs on Silver plans.

Because Essential Plan coverage now extends to 250% of the poverty level in New York, cost-sharing reductions are no longer available for new enrollees in the Marketplace, as they’re eligible for the Essential Plan instead (but New York will start to offer additional cost-sharing reduction benefits in 2025, discussed below).

However, 22% of the people who enrolled during open enrollment for 2024 — when Essential Plan eligibility still ended at 200% of FPL — were eligible for CSR benefits.17

In 2024, New York received federal permission to modify the 1332 waiver that allowed for the extension of the Essential Plan. Under the terms of the modification, New York will be allowed to use pass-through funding to provide cost-sharing reductions to Marketplace enrollees with income up to 400% of the federal poverty level, as well as cost-sharing reductions for diabetes treatment and pregnancy and postpartum services.

The state has received approval to begin offering these additional benefits as of the 2025 plan year,4 and New York officials have confirmed that the additional cost-sharing reductions will be available for plans effective beginning January 1, 2025 (enrollment begins November 1, 2024).24

A note about standardization of qualified health plans in New York: Insurers that offer plans through NY State of Health must offer one standard plan design in each metal level in every county where the insurer offers plans (here are the 2024 standardized plan details). Carriers can also offer up to two non-standard plan designs at each metal level.25

Since 2021, New York has required state-regulated (non-self-insured) health plans, including Marketplace plans, to cap out-of-pocket costs for insulin at no more than $100 per month.26 Legislation passed in the Senate in 2023 to lower that cap to $30, but did not advance in the Assembly.27 In 2024, the Senate passed legislation to eliminate cost-sharing for insulin, but it had not been taken up by the Assembly as of mid-2024.28

How many insurers offer Marketplace coverage in New York?

Twelve insurers offer 2024 qualified health plans on the New York exchange. There are also a dozen insurers that offer Essential Plan coverage for 2024 (the two lists are nearly the same, but there are some insurers that only offer one or the other).1

All 12 insurers plan to continue to offer coverage in 2025.29

Are Marketplace health insurance premiums increasing in New York?

For 2025, the insurers that offer individual/family health plans in New York (including two that only offer plans outside the exchange) will implement the following average rate increases, which amount to an overall weighted average rate increase of 12.7%.29

New York’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Capital District Physicians’ Health Plan (CDPHP) | 13.7% |

| Health Insurance Plan of Greater New York (Emblem) | 35.6% |

| Anthem HP (formerly Empire HealthPlus) | 12.7% |

| Excellus Health Plan | 18.3% |

| Fidelis (New York Quality Health Care Corp) | 5.9% |

| Healthfirst PHSP | 12.7% |

| Highmark Western and Northeastern New York (formerly HealthNow) | 26.5% |

| Independent Health Benefits Corporation | 24.4% |

| Metro Plus Health Plan | 23.6% |

| MVP Health Plan | 17.9% |

| Oscar | 19.4% |

| UnitedHealthcare of New York | 0% |

Source: New York State Department of Financial Services29

It’s important to understand that net rate changes for people who receive premium subsidies can be quite different from the overall rate changes for that person’s plan, since it also depends on how the benchmark plan (second-lowest-cost silver plan) premium changes.

And the majority of the people who enroll through NY State of Health are enrolled in the Essential Plan (available if household income is up to 250% of the federal poverty level), which has no premiums.

For perspective, here’s a summary of how average full-price (pre-subsidy) premiums for qualified health plans in New York’s individual/family market have changed over the years:

- 2015: Average increase of 5.7%.30

- 2016: Average increase of 7.1%.31

- 2017: Average increase of 16.6%.32

- 2018: Average increase of 13.9%.33

- 2019: Average increase of 8.6%.34

- 2020: Average increase of 6.8%.35

- 2021: Average increase of 1.8%.36

- 2022: Average increase of 3.7%.37

- 2023: Average increase of 9.7%.38

- 2024: Average increase of 13.5%.39

How many people are insured through New York’s Marketplace?

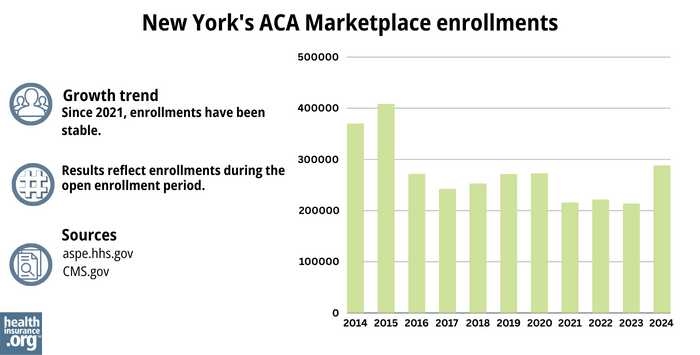

CMS reported that 288,681 people enrolled in private qualified health plans through NY State of Health during the open enrollment period for 2024 coverage (this total does not include Essential Plan enrollments).40

Open enrollment continued through May 31, 2024 in New York (it normally ends January 31, but was extended due to the “unwinding” of the Medicaid continuous coverage rule).13

But by early May 2024, enrollment in QHPs through NY State of Health had dropped to 233,151.41 This was due to the expansion of Essential Plan eligibility starting in April, when people with household income between 200% and 250% of FPL became eligible for the Essential Plan and were able to transition from QHPs to the Essential Plan.

The chart below shows enrollment in NY State of Health QHPs over time. Enrollment in QHPs dropped in 2016 when the Essential Plan debuted, because many people previously eligible for subsidized QHPs transitioned to the Essential Plan starting in 2016. The same thing is happening in 2024 with the expansion of the Essential Plan.

But earlier in 2024, QHP enrollment was higher than it had been in several years. The enrollment growth in 2024 was likely driven by a combination of the continued subsidy enhancements under the American Rescue Plan, as well as the Medicaid unwinding process that began in the spring of 2023. By June 2024, more than 2 million people in New York had been disenrolled from Medicaid.42

Some of them had transitioned to QHPs in the Marketplace, helping to drive 2024 enrollment. CMS reported that by April 2024, nearly 84,000 New York residents had transitioned from Medicaid to a qualified health plan in the Marketplace, and more than 416,000 had transitioned to Essential Plan coverage.43

The chart below shows QHP enrollment by year in New York. But it’s important to note that New York’s Basic Health Program (BHP) covers far more people than the QHPs in the state, with nearly 1.4 million people enrolled in New York’s BHP as of May 2024.18

Source: 2014,44 2015,45 2016,46 2017,47 2018,48 2019,49 2020,50 2021,51 2022,52 2023,53 202454

What health insurance resources are available to New York residents?

NY State of Health 855-355-5777

State Exchange Profile: New York

The Henry J. Kaiser Family Foundation overview of New York’s progress toward creating a state health insurance exchange.

Health Care For All New York (HCFANY)

Explore our other comprehensive guides to coverage in New York

Dental coverage in New York

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New York.

New York’s Medicaid program

Learn about New York's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Medicare coverage and enrollment in New York

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in New York as well as the state’s Medicare supplement (Medigap) regulations.

Short-term coverage in New York

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in New York.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Press Release: NY State of Health Offers Broad Choices of Affordable, Comprehensive Health and Dental Insurance Plans for 2024. New York State of Health. October 2023. ⤶ ⤶

- “Essential Plan Fact Sheet” nystateofhealth.ny.gov, March 2022 ⤶

- ”Governor Hochul Announces Federal Approval to Expand Access to High-Quality, Affordable Health Insurance” New York State Governor Kathy Hochul. March 4, 2024. ⤶ ⤶ ⤶

- ”Section 1332: State Innovation Waivers, New York” and “Letter from CMS to New York, approving 1332 waiver amendment” CMS.gov. Sep. 25, 2024 ⤶ ⤶

- Market Rating Reforms — State Specific Rating Variations. Centers for Medicare and Medicaid Services. Accessed December 2023. ⤶

- ”2024 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed Jan. 7, 2025 ⤶ ⤶

- ”Summary of Requested & Approved 2025 Rate Actions” New York State Department of Financial Services. Aug. 30, 2024. ⤶

- Qualified Health Plans Information. New York State of Health. Accessed December 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- “Enrollment Periods” newyorkstateofhealth.ny.gov, Accessed September 2023 ⤶

- Press Release: On the Tenth Anniversary of New York’s Marketplace, NY State of Health Announces the Beginning of the 2024 Annual Open Enrollment Period for Health Insurance. NY State of Health. November 2023. ⤶ ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2025; Updating Section 1332 Waiver Public Notice Procedures; Medicaid; Consumer Operated and Oriented Plan (CO-OP) Program; and Basic Health Program. U.S. Department of the Treasury; U.S. Department of Health and Human Services. April 2, 2024. ⤶

- Special Enrollment Periods. NY State of Health. Accessed December 2023. ⤶

- Assistors. New York State of Health. Accessed December 2023. ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶ ⤶

- ”Recipients Enrolled in QHP or EP – as of May 5, 2024” New York State of Health. May 5, 2024 ⤶ ⤶

- Recipients Enrolled in QHP or EP as of January 1, 2024 by Issuer. NY State of Health. January 2024. ⤶

- ”Press Release: New York State Department of Health and NY State of Health Announce the Essential Plan Expansion Increasing Access to Affordable Health Insurance Begins Today” NY State of Health. April 1, 2024 ⤶

- Letter asking Biden administration to pause consideration of NY’s pending 1332 waiver. State of New York. September 2023. ⤶

- New York Addendum to 1332 Waiver. New York Department of Health. December 2023. ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2024 ⤶

- ”State Health Department’s NY State of Health Announces Approval of State’s Innovation Waiver Amendment In Time for 2025 Enrollment Period” New York State Department of Health. Oct. 2, 2024 ⤶

- Invitation and Requirements for Insurer Certification and Recertification for Participation in 2024. NY State of Health. Accessed December 2023. ⤶

- Insulin Cost-Sharing Limit Q&A Guidance. New York State Department of Financial Services. Accessed December 2023. ⤶

- NY Senate Bill 504. BillTrack50. Accessed December 2023. ⤶

- ”New York S504” BillTrack50. Accessed March 4, 2024. ⤶

- ”Summary of Requested & Approved 2025 Rate Actions” New York State Department of Financial Services. Aug. 30, 2024. ⤶ ⤶ ⤶

- New York health insurance rates to rise in 2015. Long Island Business News. September 2023. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Department of Financial Services Announces 2017 Health Insurance Rates. New York State Department of Financial Services. August 2016. ⤶

- DFS Announces 2018 Health Insurance Rates in a Continued Robust New York Market. New York State Department of Financial Services. August 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- DFS Announces 2021 Health Insurance Premium Rates, Protecting Consumers During COVID-19 Pandemic. New York Department of Financial Services. August 2020. ⤶

- DFS Announces 2022 Health Insurance Premium Rates, Saving New Yorkers $607 Million. August 2021. ⤶

- “DFS Announces 2023 Health Insurance Premium Rates” NY Dept. of Financial Services, April 17, 2022 ⤶

- 2024 Individual and Small Group Requested and Approved Rate Actions. New York State Department of Financial Services. October 2023. ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- ”Recipients Enrolled in QHP or EP – as of February 1, 2024 by County and Issuer” NY State of Health. May 5, 2024. ⤶

- Medicaid Enrollment and Unwinding Tracker. KFF. Data through June 2024. ⤶

- State-based Marketplace (SBM) Medicaid Unwinding Report, data through April 2024. Centers for Medicare & Medicaid Services. Accessed Aug. 15, 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶