Medicaid eligibility and enrollment in Hawaii

Post-pandemic disenrollments paused through end of 2023, due to Maui fires

Who is eligible for Medicaid in Hawaii?

Hawaii’s Medicaid/CHIP is called Med-QUEST (QUEST stands for Quality care, Universal access, Efficient utilization, Stabilizing costs, and Transforming the way health care is provided to recipients).

Hawaii’s Medicaid eligibility levels for children are much higher than the national average and about average for pregnant women and parents (these eligibility limits include a built-in 5% income disregard that’s used for income-based (MAGI) Medicaid eligibility determinations):

- Children ages 0-18 qualify with family income levels up to 313% of the federal poverty level (FPL)

- Pregnant women qualify with family income up to 196% of FPL, and coverage for the mother continues for a year after the baby is born

- Parents and other adults qualify with family income up to 138% of FPL

Hawaii residents with low incomes and low asset/resource levels can qualify for Medicaid if they’re 65 or older, or if they’re blind or disabled. These enrollees are covered under fee-for-service (FFS) Medicaid, rather than the managed-care Med-QUEST program.

Hawaii also uses Medicaid funds to help cover premium costs for Hawaii residents who aren’t U.S. citizens but who are citizens of nations that have entered into the Compact of Free Association (COFA) with the U.S.

for 2026 coverage

0.0%

of Federal Poverty Level

Apply for Medicaid in Hawaii

You can apply on-line at My Medical Benefits or by phone at 1-877-628-5076. Or, fill out an application.

Eligibility: Children with family income levels up to 308% of FPL. Pregnant women with family income up to 191% of FPL. Adults with family income up to 138% of FPL.

ACA’s Medicaid eligibility expansion in Hawaii

Hawaii adopted Medicaid expansion through the Affordable Care Act, extending eligibility for Medicaid to adults with income up to 138% of the poverty level (133% plus an automatic 5% income disregard). Medicaid expansion took effect in Hawaii in January 2014.

Starting in 2022, Hawaii extended postpartum Medicaid coverage so that it lasts for 12 months instead of 60 days, and the state also added adult dental benefits to Medicaid starting in 2023.

According to U.S. Census data, only 3.5% of Hawaii residents were uninsured as of 2016, down from 6.7% in 2013. Although the state’s uninsured rate was reduced by nearly half from 2013 to 2016, it was already less than half of the national average uninsured rate even in 2013, before the bulk of the ACA’s provisions had taken effect. Hawaii’s Prepaid Health Care Act, which has been in place since the 1970s, had already resulted in nearly all of the state’s population having insurance coverage, even before the ACA took effect.

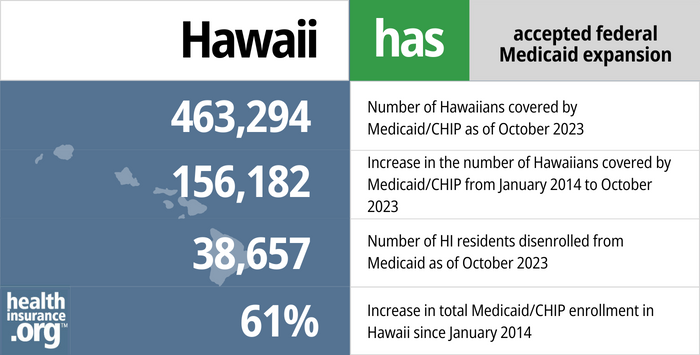

463,294 people were enrolled in Medicaid/CHIP in Hawaii as of September 2023. Hawaii Medicaid/CHIP enrollment has grown by 61% since late 2013. That growth has been mainly due to Medicaid expansion and the COVID-related rule that prevented states from disenrolling anyone from Medicaid between March 2020 and March 2023.

- 463,294 – Number of Hawaiians covered by Medicaid/CHIP as of October 20231

- 156,182 – Increase in the number of Hawaiians covered by Medicaid/CHIP from January 2014 to October 20232

- 38,657 – Number of HI residents disenrolled from Medicaid as of October 20233

- 61% – Increase in total Medicaid/CHIP enrollment in Hawaii since January 20142

Explore our other comprehensive guides to coverage in Hawaii

Hawaii utilizes a federally run health insurance Marketplace, which means residents enroll through HealthCare.gov, where two private insurers offer individual/family health plans for Hawaii residents. But Hawaii still oversees the plans sold in the exchange.

In 2023, three insurers offer stand-alone individual/family dental coverage through the health insurance Marketplace in Hawaii.4 Learn about other dental coverage options in the state.

There are nearly 300,000 Medicare beneficiaries in Hawaii as of 2023.5 Read our overview of Medicare enrollment, including Hawaii’s rules on Medigap plans.

As of 2023, short-term health insurance plans are no longer being sold in Hawaii.6 Find out why in our guide to short-term coverage in Hawaii.

Frequently asked questions about Hawaii Medicaid eligibility and enrollment

How do I enroll in Medicaid in Hawaii?

You can apply for Med-QUEST:

- Online at My Medical Benefits or at Healthcare.gov (only apply through Healthcare.gov if you don’t have Medicare)

- Over the phone at 1-877-628-5076

- By mail. Download an application or call the appropriate eligibility office to have an application mailed to you. Complete the application and return it by mail to the office.

How does Medicaid provide financial help to Medicare beneficiaries in Hawaii?

Many Medicare beneficiaries receive assistance from Medicaid with Medicare premiums, prescription drug costs, and expenses not covered by Medicare – including long-term care.

Our guide to financial assistance for Medicare enrollees in Hawaii includes overviews of these programs, including Medicaid long-term care benefits, Extra Help, and eligibility guidelines for assistance.

Hawaii considered legislation in 2023 to remove the $2,000 asset limit that currently applies to Medicaid eligibility for people who are also enrolled in Medicare. It did not advance during the 2023 session, but bills in odd-numbered years are carried over the next year in Hawaii’s legislature, so this could be reconsidered in 2024.

How is Hawaii handling Medicaid renewals after the pandemic?

Throughout the pandemic, states received additional federal Medicaid funding, but on the condition that nobody be disenrolled from Medicaid. But that rule ended March 31, 2023, and states began a year-long process of “unwinding” the pandemic rules, gradually redetermining eligibility for everyone enrolled in Medicaid.

Hawaii began disenrolling ineligible Med-QUEST members (and those who didn’t respond to renewal packets) at the end of May 2023, and enrollment had dropped by about 1.4% by September. But due to the devastating Maui wildfire, Hawaii opted to pause all Med-QUEST eligibility redeterminations through the end of 2023. And for Maui residents, redeterminations will not resume until at least April 2024 (June 2024 for those in West Maui).

Hawaii Med-QUEST has a useful overview page about the return to normal eligibility operations. It includes a dashboard where data is being posted throughout the unwinding period, press releases, and copies of the letters that enrollees are receiving.

Hawaii had previously indicated that they would process renewals in their regularly scheduled month for enrollees whose renewals are current, and would spread backlogged renewals out over a 12-month unwinding period, prioritizing renewals for people whose coverage had been pended the longest time during the pandemic. But the Maui fires have caused a temporary delay, and have also pushed redeterminations for West Maui enrollees out until at least the summer of 2024.

Hawaii’s unwinding plan already noted that the state would wait until the end of the unwinding period to process renewals for unhoused enrollees. And dual-eligible enrollees (ie, eligible for both Medicare and Medicaid) who become eligible for Medicare between April and September 2023 won’t go through a Medicaid eligibility redetermination until six months after their Medicare begins.

For those who are no longer eligible for Medicaid, a 16-month special enrollment period is available on HealthCare.gov for people who lose Medicaid during the unwinding process. But it’s still important to sign up for a new plan before the date that Medicaid ends, in order to avoid a gap in coverage. Many people who lose Medicaid will find that they’re eligible for an employer’s plan, but that has a limited 60-day enrollment window, so again, it’s important to act quickly in order to secure new coverage.

Legislation impacting Hawaii Medicaid

Medicaid expansion helped cement top-ranking health scores

Hawaii has a long history of supporting initiatives to make health insurance broadly available to residents. Hawaii was among the first six states that implemented a Medicaid program in January 1966, just six months after federal legislation authorizing the program was enacted. In 1974, Hawaii implemented its Prepaid Health Care Act, which mandated that most employers make health insurance available to employees who work at least 20 hours a week.

In conjunction with the Affordable Care Act (ACA), Hawaii initially implemented a state-run health insurance marketplace and adopted Medicaid expansion. The marketplace transitioned to a federally-supported state-run marketplace for 2016, and transitioned again to a fully federally-run exchange for 2017, largely in an effort to take advantage of the economies of scale that the federally-run exchange could bring to a state with low overall enrollment in the individual market (because of Hawaii’s Prepaid Health Care Act, nearly all non-elderly Hawaii residents get coverage from an employer, and relatively few need coverage under individual market plans). Nothing changed about Medicaid with the switch to Healthcare.gov though; the expanded Medicaid eligibility guidelines are still in effect in Hawaii.

Through its efforts, Hawaii consistently has low uninsured rates and high overall health scores. In 2018, Hawaii was ranked the healthiest state in the nation for the 7th year in a row according to the Gallup Healthways Physical Wellbeing Index, and the state consistently scores at or near the top in other ranking systems (number 1 in the America’s Health Rankings 2020 survey, and number 1 in the Commonwealth Fund’s 2020 Scorecard on State Health System Performance).

Hawaii Medicaid history

Hawaii implemented its Medicaid program in January 1966.

In the early 1990s, Hawaii implemented the State Health Insurance Program (SHIP) to cover people who weren’t eligible for Medicaid. Then, in 1994, CMS approved Hawaii’s section 1115 Medicaid waiver (one of the first in the nation) to wrap SHIP in with Medicaid in an effort to achieve universal insurance coverage (in combination with the state’s Prepaid Health Care Act). The result of the waiver was the creation of Hawaii’s MED-QUEST program, which initially covered low-income women and children, but has since expanded (as of 2009) to cover nearly all of Hawaii’s Medicaid beneficiaries. The MED-QUEST waiver is subject to renewal every five years.

Medicaid in Hawaii is separated into two different methods of providing services: the fee-for-service (FFS) program and the managed care program, called Med-QUEST or MQD. Under the FFS program, doctors and other healthcare providers bill Medicaid directly to be reimbursed for services provided to Medicaid beneficiaries. Under Med-QUEST, the state contracts with managed care plans that provide healthcare services to Medicaid beneficiaries.

Virtually all of the people enrolled in Hawaii’s Medicaid program are covered through managed care (Med-QUEST). Hawaii only uses fee-for-service Medicaid (ie, without managed care) for a handful of limited Medicaid programs. Hawaii Medicaid managed care members include people who are covered under Hawaii’s fully-state-funded Medicaid program, in addition to the majority of enrollees who are in regular Medicaid that’s funded partially by the state and partially by the federal government.

In August 2017, Hawaii submitted a waiver amendment to CMS in order to gain federal approval to use Medicaid funding to provide housing services to qualified Medicaid enrollees who are homeless and also have behavioral health and/or substance abuse problems. That waiver request was approved in October 2020.

Footnotes

- “October 2023 Medicaid & CHIP Enrollment Data Highlights” , Medicaid.gov, Accessed February 2024 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2024 ⤶ ⤶

- “Medicaid and CHIP National Summary of Renewal Outcomes” , medicaid.gov, Accessed February 2024 ⤶

- “Hawaii dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Availability of short-term health insurance in Hawaii” healthinsurance.org, March 7, 2023 ⤶