Medicaid eligibility and enrollment in Indiana

76% increase in Indiana’s total Medicaid/CHIP enrollment in since late 2013, driven largely by Medicaid expansion and COVID-era pause on disenrollments

Who is eligible for Medicaid in Indiana?

Indiana’s Medicaid eligibility guidelines are average for children and pregnant women. Low-income adults can obtain Medicaid coverage under the Healthy Indiana Plan (the state’s version of Medicaid expansion), described below.

Indiana’s Medicaid eligibility standards as of 2023 are:

- 208% of the federal poverty level (FPL) for children up to 1-year-old

- 158% of FPL for children 1 to 18 years old; the Children’s Health Insurance Program (CHIP) covers children at higher income levels, up to 250% of FPL

- 208% of FPL for pregnant women (eligibility for the mother continues for 12 months after the baby is born)

- 138% of FPL for other adults under age 65 (Healthy Indiana Plan 2.0)

See the Indiana Medicaid Eligibility Guide for more information on who qualifies for Medicaid in Indiana.

for 2026 coverage

0.0%

of Federal Poverty Level

Apply for Medicaid in Indiana

Apply online at the Indiana Family and Social Services Administration or HealthCare.gov. Print an application or request one by mail. Call 1-800-403-0864 to apply by phone. You may also apply in person at a Division of Family Resources office.

Eligibility: Children up to 1 year with household income up to 208% of FPL. Children ages 1-18 with household income up to 158% of FPL. Pregnant women with household income up to 208% of FPL. Adults with incomes up to 138% of FPL can enroll in HIP 2.0.

Has Indiana implemented Medicaid expansion?

In January 2015 —a year after many other states had expanded Medicaid — Indiana won approval from CMS for its amended Healthy Indiana Plan, known as HIP 2.0. The Healthy Indiana Plan expanded Medicaid eligibility in Indiana to non-elderly, non-disabled adults, but with state-specific variations from the expansion outlined by the ACA. Indiana began accepting applications for Medicaid under HIP 2.0 in late January 2015, with coverage beginning as soon as Feb. 1, 2015.

Although the majority of the states have expanded Medicaid under the ACA, several of them have used 1115 waivers to modify the terms of their expansion. The nature of a Section 1115 waiver means that Medicaid expansion is a bit more complicated in those states, and involves more conditions and requirements than the straight Medicaid expansion called for in the Affordable Care Act (ACA). But Indiana’s waiver was considered even more complicated than those of other states that had obtained previous waivers (see details below).

This was notable on the national stage during the Trump administration, as Trump’s vice president, Mike Pence, was the governor of Indiana during the implementation of the state’s Medicaid expansion program, and Seema Verma, who directed CMS during the Trump administration, was a chief architect of the state’s expansion of Medicaid (this article is a good overview of their roles and the faults that a federal commission found in Indiana’s approach to Medicaid expansion).

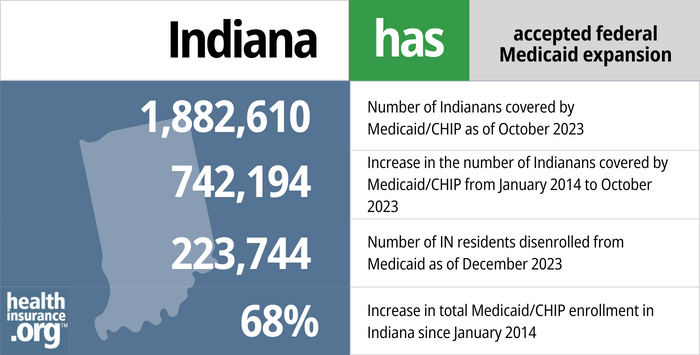

- 1,882,610 – Number of Indianans covered by Medicaid/CHIP as of October 20231

- 742,194 – Increase in the number of Indianans covered by Medicaid/CHIP from January 2014 to October 20232

- 223,744 – Number of IN residents disenrolled from Medicaid as of December 20233

- 68% – Increase in total Medicaid/CHIP enrollment in Indiana since January 20142

Explore our other comprehensive guides to coverage in Indiana

Indiana uses the federally run health insurance exchange/Marketplace, HealthCare.gov, where six private insurance companies offer individual/family coverage for 2024.1 Marketplace plans are designed to serve those without access to employer-sponsored coverage or government-run coverage like Medicare or Medicaid. This includes self-employed individuals, people who work for small businesses that don’t offer health benefits, and early retirees who aren’t yet eligible for Medicare.

Get protection from expensive dental costs. Compare different plan options to find premiums and deductibles that match your budget.

In 2023, more than 1.3 million people in Indiana were enrolled in Medicare.4 If you’re curious about signing up for Medicare in Indiana or want to know about the state’s Medigap rules, our guide has you covered.

As of 2023, there were at least seven insurance companies offering short-term healthcare policies in Indiana.5

Frequently asked questions about Indiana Medicaid eligibility and enrollment

How do I apply for Medicaid in Indiana?

If you believe you or a family member may qualify for Medicaid, you have several options for submitting an application:

- Apply online through the Indiana Family and Social Services Administration or at HealthCare.gov.

- Call 1-800-403-0864 to apply by phone.

- Apply in person at a Division of Family Resources office. Find a nearby office.

How does Medicaid provide financial help to Medicare beneficiaries in Indiana?

Many Medicare beneficiaries receive help through Medicaid with the cost of Medicare premiums, prescription drug expenses, and costs that aren’t covered by Medicare — such as long-term care.

Our guide to financial resources for Medicare enrollees in Indiana includes overviews of those programs, including Medicare Savings Programs, long-term care benefits, and income guidelines for assistance.

How is Indiana handling Medicaid renewals after the COVID pandemic?

Medicaid disenrollments have been paused, nationwide, throughout the COVID pandemic. From March 2020 through March 2023, states have not been allowed to disenroll people from Medicaid, even if their circumstances changed and they were no longer eligible for the program (in trade, states have also been receiving additional federal Medicaid funding throughout the pandemic).

But starting in April 2023, states can once again disenroll people who are no longer eligible for Medicaid. The return to normal rules and the transition away from the pandemic-era continuous coverage requirement is being referred to as “unwinding.” Indiana has published its unwinding plan, and also has a video of a public meeting regarding the return to normal eligibility redeterminations.

In terms of timing, Indiana began sending initial warning letters in late February, to people who are due for renewal in April. The renewal packets will be sent out (for those whose coverage cannot be auto-renewed) in mid-March. And the first round of disenrollments will come at the end of April, for people who are no longer eligible or who don’t respond to their renewal packet. Premiums for CHIP (Hoosier Healthwise) will resume in the summer of 2023, as will POWER account contributions for Healthy Indiana Plan (Medicaid expansion) enrollees.

About a quarter of Indiana Medicaid enrollees are enrolled due to the continuous coverage rules, which means that the state either has information indicating that they are no longer eligible, or the person has not responded to eligibility verification requests during the pandemic. The other 75% of enrollees are currently eligible, but will also need to have their eligibility verified during the 12-month “unwinding” of the continuous coverage requirement. The state plans to conduct renewals on enrollees’ regularly scheduled renewal date, and will disenroll those who are found to be ineligible. But this will be spread out across a 12-month period, so some people will not get a renewal packet until late 2023 or early 2024.

The state has clarified that up to 500,000 people who are currently enrolled due to the continuous coverage requirements will need to take action in order to maintain their coverage (ie, they will need to respond to eligibility verification requests; if they are no longer eligible, they will no longer be able to keep their Medicaid after their renewal date).

Legislation impacting Indiana Medicaid

Does Indiana have a Medicaid work requirement?

No, Indiana does not have a Medicaid work requirement. A work requirement was approved by the Trump administration but never implemented, and the approval was ultimately revoked by the Biden administration.

In 2019, Indiana began phasing in a work requirement for Medicaid expansion enrollees, and people who weren’t exempt or in compliance were slated to begin losing Medicaid coverage after the end of 2019. But a lawsuit was filed to block the work requirement, and Indiana paused implementation of the work requirement altogether in November 2019, pending the outcome of the lawsuit.

The COVID pandemic made Medicaid work requirements essentially unworkable. And in June 2021, the Biden administration notified Indiana that approval for the Medicaid work requirement was being withdrawn, so it will not go into effect after the COVID pandemic ends.

Indiana’s alternative to Medicaid expansion

Under the Affordable Care Act, Medicaid expansion is a vital strategy to make health care accessible to more people and to reduce the nation’s uninsured rate. Through the ACA, the federal government paid 100% of the cost of covering low-income adults, up to 138% of FPL, through the Medicaid program until 2016. The federal portion gradually dropped to 90% by 2020, and it remains at that level going forward.

Although Indiana expressed willingness to consider a modified version of Medicaid expansion, both then-Governor Mike Pence and the head of the Indiana Family and Social Services Administration took the position that Medicaid must be reformed, not just expanded. But there was significant federal money available to states that expand Medicaid. If Indiana had not expanded coverage at all, the state would have missed out on $17.3 billion in federal funding in the decade from 2013 to 2022.

Indiana did not adopt straight Medicaid expansion as structured under the ACA. However, the state did receive a federal waiver to continue (and expand upon) its then seven-year-old Healthy Indiana Plan, a health insurance program for uninsured adults with income at or below the federal poverty level, in which participants helped pay the first $1,100 of care. However, the program didn’t cover as much as Medicaid does, and there was a limit on the number of people that could be covered. As of late August 2014, the Healthy Indiana Plan was closed to new enrollment.

In January 2015, Indiana received approval for another waiver, which the state calls HIP 2.0. The plan removed Healthy Indiana’s enrollment caps, opened the program to those making less than 138% FPL, and requires cost-sharing (premiums and copayments) for many enrollees.

Enrollees in HIP 2.0 can pay premiums in order to receive more generous benefits, called HIP Plus. The premiums are as low as one dollar per month for people with income in the 0% to 5% of FPL range, and are in the form of contributions to a “Personal Wellness and Responsibility” (POWER) health savings account. Premiums were paused during the COVID pandemic, but resume in mid-2023.

Those who don’t pay premiums receive lesser benefit packages. For enrollees with incomes between 101% and 138% of FPL, premiums are required in order to enroll in HIP 2.0, although they’re capped at 2% of income (there is some additional flexibility in terms of how these premiums are determined, under the waiver extension that CMS approved in 2018; premiums are still generally less than 2% of income for most beneficiaries, but they’re based on income brackets, rather than each enrollee’s exact income). For those enrollees, there’s a six-month wait to re-enroll if they’re disenrolled because of failure to pay premiums (there’s a 60-day grace period for overdue premiums – after that, the coverage terminates).

For people who enroll in HIP Plus, coverage is effective as of the first day of the month that the enrollee pays the first premium, rather than the date of the Medicaid application.

For enrollees with incomes at the poverty level or below, HIP Basic offers an alternative that doesn’t require premiums, although it also doesn’t have some of the benefits of HIP Plus (no adult dental and vision, for example), and enrollees have to pay copays for services. If HIP Plus enrollees (with income that doesn’t exceed the poverty level) fail to pay premiums, they’re transferred into the HIP Basic plan instead.

Battles with CMS over Indiana Medicaid lock-outs

HIP 2.0 includes a six-month re-enrollment lock-out for people above the poverty level who fail to pay required premiums. But ever since the original HIP waiver approval in 2007, Indiana had also had a 12-month lock-out for people who fail to complete the eligibility redetermination process.

There was some confusion in terms of this aspect of the program, as Indiana officials assumed it had been approved by CMS, while CMS indicates that they would not have approved such a provision. In April 2016, Indiana asked CMS to make the lock-out (now set at six months, and effectively only three months since there’s an initial 90-day reinstatement period) officially part of HIP 2.0, but in August 2016, CMS denied the request. However, the February 2018 waiver approval from CMS (now under the Trump Administration instead of the Obama Administration) allows Indiana to implement the eligibility lock-out period for Medicaid expansion enrollees who fail to complete their eligibility redeterminations, as long as the state ensures that there are exceptions for certain vulnerable populations and for mitigating circumstances.

In June 2016, Indiana officials expressed concerns about an access to care survey that CMS (under the Obama Administration) was conducting regarding HIP 2.0. The state claimed that the survey was biased and misleading, and also that it was unnecessary, as the state has already had an independent party evaluate beneficiaries access to care under HIP 2.0. CMS had not said directly that they had concerns about access to care under HIP 2.0, but had noted that they were trying to gain a clear understanding of how Indiana’s unique implementation of Medicaid expansion was impacting access to care, since some other states were considering similar proposals.

The interim report on the access to care survey indicated that while 52% of HIP Plus enrollees did not struggle to pay their premiums, 16% always worried about the affordability of HIP Plus premiums, while 29% worried about affordability usually or sometimes. Enrollees prefer HIP Plus (as opposed to HIP Basic), but the inclusion of premiums adds an element of economic uncertainty that doesn’t exist in states where Medicaid was expanded without deviation from the ACA’s original plan. (As noted above, premiums and disenrollments were suspended during the COVID pandemic, from March 2020 through March 2023.)

Background on Indiana’s Medicaid program

After Medicaid was founded in 1965, Indiana was one of the last states to implement a Medicaid program, waiting until Jan. 1, 1970. Legislation authorizing the state-federal partnership was enacted in July 1965. Forty-one-states and the District of Columbia moved ahead with Medicaid implementation before Indiana.

As a result of the ACA Medicaid expansion, Indiana’s Medicaid and CHIP enrollment grew significantly from 2013 through 2022, going from 1,120,674 enrollees to more than 2 million enrollees as of late 2022. This enrollment growth has been driven largely by Medicaid expansion (which began in 2015 in Indiana) and the COVID-era rules that prevented disenrollments for three years, from March 2020 through March 2023.

From 2013 to 2014, the uninsured rate in Indiana declined slightly from 14% to 11.9%, according to U.S. Census data. By 2016, after Medicaid had been expanded, the uninsured rate fell to 8.1% (it stayed at roughly the same level in subsequent years, growing slightly to 8.7% by 2019, which mirrored the nationwide trend of increasing uninsured rates under the Trump administration). Medicaid expansion — despite its complexities in Indiana — is playing a significant role in driving down the uninsured rate.

Footnotes

- “October 2023 Medicaid & CHIP Enrollment Data Highlights” , Medicaid.gov, Accessed February 2024 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2024 ⤶ ⤶

- “Medicaid Renewals and Outcomes Dashboard” , in.gov, Accessed February 2024 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Availability of short-term health insurance in Indiana” healthinsurance.org, Feb. 23, 2023 ⤶