Medicare in Illinois

Since the 1980s, Illinois has required Medigap insurers to cover beneficiaries under 65; New “birthday rule” window provides limited plan change options for some Medigap enrollees as of 2022

Key Takeaways

- More than 2.3 million residents are enrolled in Medicare in Illinois.

- About 38% of Illinois Medicare beneficiaries are enrolled in private plans — most Medicare Advantage plans but also some Medicare Cost plans.

- Since the 1980s, Illinois has required Medigap insurers to sell plans to disabled Medicare beneficiaries under age 65. Illinois also has a year-round guaranteed-issue Medigap plan from BCBSIL for people over the age of 65. And as of 2022, the state has a new “birthday rule” limited annual plan change window for Medigap enrollees aged 65-75 (legislation under consideration in 2023 would slightly expand the birthday rule).

- Illinois residents can select from among 23 stand-alone Part D prescription plans in 2022, with premiums ranging from about $7 to $94 per month.

Medicare enrollment in Illinois

There were 2,327,109 Medicare beneficiaries in Illinois as of October 2022, amounting to about 18% of the state’s population.

Most beneficiaries are eligible for Medicare coverage because they’re at least 65 years old. But Medicare eligibility is also triggered when a person has been receiving disability benefits for two years, or has ALS or end-stage renal disease. Nationwide, about 12% of people enrolled in Medicare are under 65; in Illinois, it’s about 11%; the state has about 256,000 Medicare beneficiaries who are under 65.

Medicare’s annual election period (October 15 to December 7 each year) allows Medicare beneficiaries the opportunity to switch between Medicare Advantage plans and Original Medicare and/or add or drop a Medicare Part D prescription plan.

Medicare Advantage enrollees also have the option to change to a different Medicare Advantage plan or to Original Medicare during the Medicare Advantage open enrollment period, which runs from January 1 to March 31.

Find Medicare plans that fit your needs.

Enroll in a plan today.

Explore our other comprehensive guides to coverage in Illinois

Illinois runs a partnership exchange with the federal government. The state operates Get Covered Illinois, which has a website, in-person help, and a help desk,1 but Illinois residents use the federally-run HealthCare.gov platform to enroll in Affordable Care Act (ACA) Marketplace health plans.

In 2023, ten insurers offer stand-alone individual/family dental coverage through the health insurance marketplace in Illinois.1 Learn about other dental coverage options in the state.

In 2018, Illinois passed a law that restricts short-term health plans to six months and bans any renewals. As of 2023, there were at least nine insurers offering short-term health insurance policies in the state:4

Frequently asked questions about Medicare in Illinois

What is Medicare Advantage?

Although Medicare is funded and run by the federal government, enrollees can choose whether they want to receive their benefits directly from the federal government via Original Medicare or enroll in a Medicare Advantage plan offered by a private insurer, if such plans provide service in their area. There are pros and cons to Medicare Advantage and Original Medicare, and no single solution that works for everyone.

There are Medicare Advantage plans for sale throughout Illinois, with plan availability ranging from 10 plans to 72 plans, depending on the county (most counties in Illinois have at least 30 plans available as of 2023).

Twenty-two percent of Medicare beneficiaries in Illinois were enrolled in Medicare Advantage plans as of 2018, compared with an average Medicare Advantage enrollment of 34% nationwide. But by October 2022, about 38% of the people with Medicare in Illinois — 891,894 people — had private coverage (as opposed to Original Medicare; that figure does not include people who had private plans to supplement Original Medicare).

The vast majority of those people are enrolled in Medicare Advantage plans, but there are also some Medicare beneficiaries with Medicare Cost plans in Illinois, accounting for a very small number of the private plan enrollees. Nationwide, the percentage of private plan Medicare coverage enrollment had increased to about 46% by 2022, so the increase in Illinois is in keeping with the national trend.

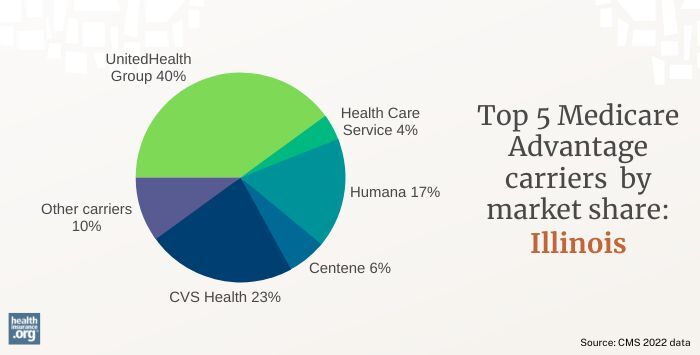

Between late 2019 and early 2022, UnitedHealth Group saw a 34.1% increase in Medicare Advantage enrollment in Illinois. With 270,162 Illinois residents enrolled in its MA plans in February 2022, the carrier had the highest market share – 40% – out of a field of 24 carriers selling MA plans in the state.

In 2022, UnitedHealth Group held the highest market share of Medicare Advantage carriers in Illinois. (Source: CMS 2022 data)

What are Medigap plans?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental coverage. More than half of Original Medicare beneficiaries nationwide receive their supplemental coverage through an employer-sponsored plan or Medicaid. But for those who don’t, Medigap plans (also known as Medicare supplement plans) are designed to pay some or all of the out-of-pocket costs (deductibles and coinsurance) that Medicare beneficiaries would otherwise have to pay themselves.

Medigap plans are sold by private insurers, but the plans are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The benefits offered by a particular plan (Plan C, Plan G, etc.) are the same regardless of which insurer is selling the plan. So plan comparisons are much easier for Medigap policies than for other types of health insurance; consumers can base their decision on premiums and less tangible things like customer service, since the benefits themselves are uniform.

There are 41 insurers that offer Medigap plans in Illinois, with premiums that vary depending on whether the person is in the Chicago area, the north-central area, or the southern area of the state. There are also two insurers (AARP/UnitedHealthcare and Blue Cross Blue Shield of Illinois) that offer Medicare SELECT plans in Illinois.

According to an AHIP analysis, there were 787,968 Illinois Medigap enrollees in 2020, so about half of the state’s Original Medicare population had Medigap coverage. This is higher than the rate in most states; nationwide, about a quarter of Original Medicare beneficiaries have Medigap coverage.

Unlike other private Medicare coverage (Medicare Advantage plans and Medicare Part D plans), there is no annual open enrollment window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed-issue. This window starts when a person is at least 65 and enrolled in Medicare Part B (you must be enrolled in both Part A and Part B to buy a Medigap plan). But Illinois has stronger consumer protections in this area than most other states: Illinois has long protected the right of beneficiaries under age 65 to enroll in Medigap (discussed below) and added a new limited annual enrollment window for some Medigap enrollees, which became available in 2022.

In 2021, Illinois enacted legislation that created a new Medicare Supplement Annual Open Enrollment Period (effective as of 2022). The annual enrollment opportunity is fairly limited, but it does still go beyond federal rules. Under the new Illinois law, Medigap enrollees between the ages of 65 and 75 have an annual window during which they can switch to a different Medigap plan, offered by their current Medigap insurer, as long as the plan offers equal or lesser benefits (so a person could switch from Plan F to Plan G, but not from Plan A to Plan G, for example). The window starts on the beneficiary’s birthday, and lasts for 45 days.

Additional legislation is under consideration in 2023 that would slightly expand the current birthday rule, allowing people to pick a plan with equal or lesser benefits from the same insurer or “any affiliate authorized to transact business” in Illinois. That would still be quite limited, but would allow access to a plan offered by an affiliate the person’s current insurer, rather than just the current insurer.

People who aren’t yet 65 can enroll in Medicare if they’re disabled and have been receiving disability benefits for at least two years, and 13% of Medicare beneficiaries in Illinois — about 300,000 people — are under 65 years old. Federal rules do not guarantee access to Medigap plans for people who are under 65, but the majority of the states, including Illinois, have enacted laws to ensure at least some access to private Medigap plans for disabled enrollees under the age of 65.

Illinois was one of the first to do so (see Illinois Insurance Code, Section 363). Since 1989, Illinois has required all Medigap insurers to sell policies to disabled Medicare beneficiaries. Medigap insurers must sell any of their available plans to beneficiaries under age 65, with a six-month guaranteed-issue window that starts when the person is enrolled in Medicare Part B (or when they are determined eligible for retroactive Medicare Part B coverage).

And while Medigap insurers in Illinois can charge an under-65 beneficiary higher premiums than they would charge a 65-year-old, beneficiaries under age 65 cannot be charged more than the insurer’s highest on-file rate for people over age 65. So a Medigap insurer could, for example, charge a 45-year-old the same premium they would charge an 85-year-old, but they cannot have an entirely separate set of under-65 rates that are higher than any of the age-based premiums for people over 65.

Illinois also goes a step beyond what many other states provide in terms of Medigap access for people under the age of 65: A disabled Medicare beneficiary who did not purchase a Medigap plan during their initial six-month enrollment window can buy a plan from Blue Cross Blue Shield of Illinois between October 15 and December 7 (although this is the same window during which Medicare beneficiaries have open access to Medicare Part D plans and Medicare Advantage plans, this is not a general open enrollment period for Medigap plans).

Blue Cross Blue Shield of Illinois also offers year-round guaranteed-issue coverage, regardless of medical history and at standard premiums, for people who are over the age of 65 and who are no longer in their initial enrollment period for Medigap. This is a fairly rare provision; most states do not have a year-round guaranteed-issue option for Medigap plans after a person’s initial enrollment period has closed.

As of 1999, a decade after Illinois began requiring Medigap insurers to offer plans to disabled beneficiaries under age 65, there were only 14 states with laws requiring Medigap insurers to offer even a single plan to people under age 65. Today, there are at least 33, although there are still several states that have made no provisions to ensure access to Medigap plans for disabled Medicare beneficiaries.

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those regulations don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period of up to six months, if you didn’t have at least six months of continuous coverage prior to your enrollment. And if you apply for a Medigap plan after your initial enrollment window closes (assuming you aren’t eligible for one of the limited guaranteed-issue rights), the insurer can look back at your medical history in determining whether to accept your application, and at what premium.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. More than half of Original Medicare beneficiaries have supplemental coverage via an employer-sponsored plan or Medicaid, and these plans often include prescription coverage. But Medicare enrollees without creditable drug coverage need to obtain Medicare Part D prescription coverage. Medicare Part D plans can be purchased as a stand-alone plan, or as part of a Medicare Advantage plan that includes Part D prescription drug coverage.

Insurers in Illinois are offering 24 stand-alone Medicare Part D plans for sale in 2022, with premiums that range from about $5 to $104/month.

As of late 2022, more than 1.8 million Illinois Medicare beneficiaries had Medicare Part D coverage. About 55% of them had stand-alone Medicare Part D plans, while the rest had Medicare Advantage plans that included Part D coverage (the percentage of enrollees with stand-alone Part D plans has been dropping in recent years, as Medicare Advantage enrollment has grown).

Medicare Part D enrollment follows the same basic schedule as Medicare Advantage enrollment: Beneficiaries can pick a Part D plan when they’re first eligible for Medicare (or when they lose creditable drug coverage they had under another plan), or during the annual open enrollment period in the fall, from October 15 to December 7.

How does Medicaid provide financial assistance to Medicare beneficiaries in Illinois?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Illinois includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Illinois?

Need help with your Medicare application in Illinois, or Medicare eligibility in Illinois?

- You can contact the Illinois Senior Health Insurance Program with questions related to Medicare coverage in Illinois.

- The Illinois Department on Aging has an excellent resource for Illinois residents who are shopping for Medigap plans. Premiums varies by location, so there are three separate guides: Chicago Area, North-Central Area, and Southern Area.

- Illinois has a helpful handbook for state employees who are transitioning to Medicare.

- The Medicare Rights Center website provides helpful information geared to Medicare beneficiaries, caregivers, and professionals.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Illinois dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “Affordable Care Act | HFS” Illinois.gov, Accessed September 2023 ⤶

- ”Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment” KFF.org, April 2023 ⤶

- “Availability of short-term health insurance in Illinois” healthinsurance.org, Feb. 23, 2023 ⤶