According to a 2017 survey, approximately 22 million Americans had chosen to use a health savings account coupled with a high-deductible health plan (HDHP) to pay for healthcare costs. And the number of open health savings accounts has continued to grow every year.

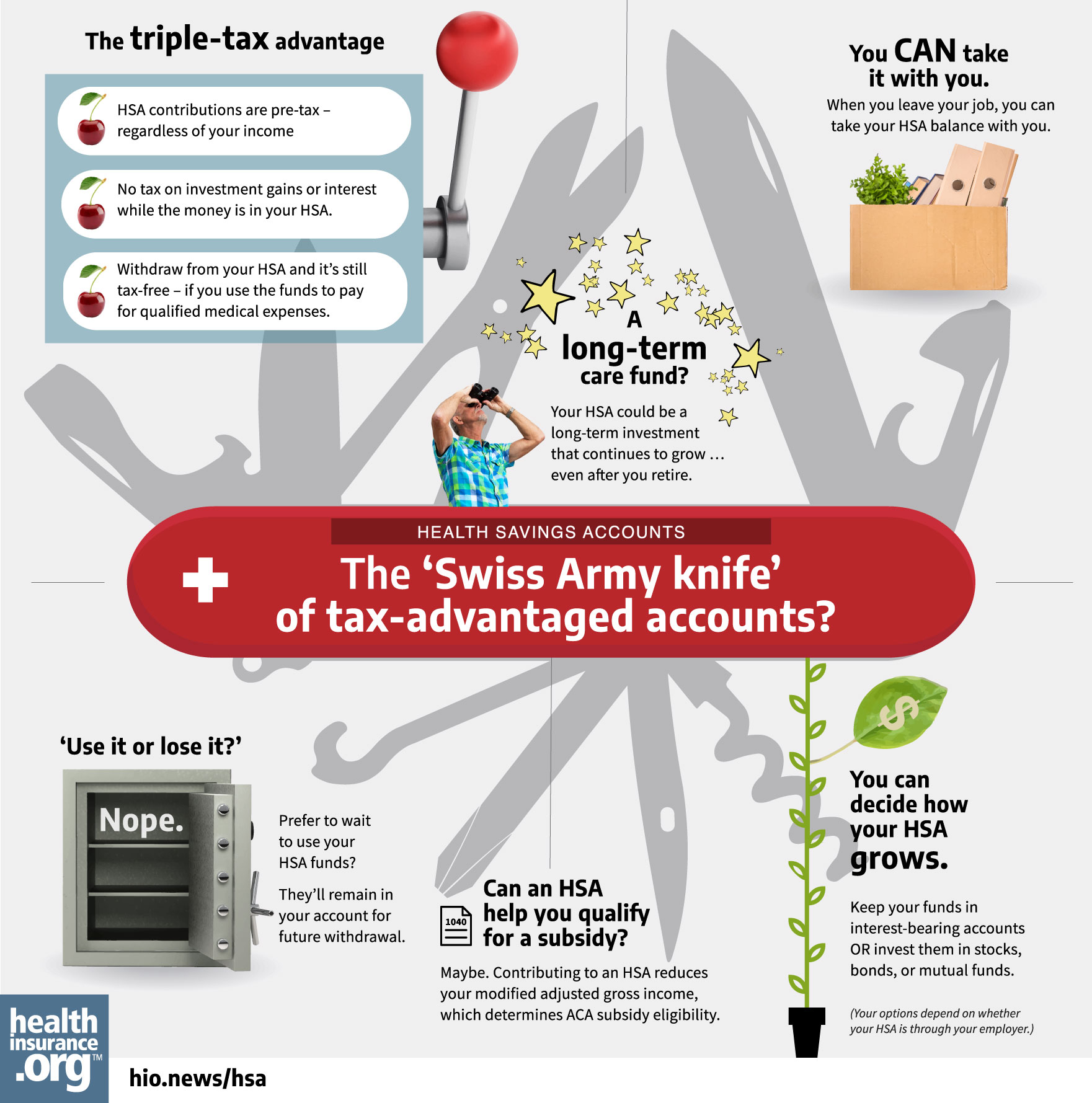

Explaining the increased interest – and enrollment – in HSA-qualified health plans coupled with HSAs isn't difficult when one takes a closer look at this financial tool and an impressive array of benefits that HSAs can offer.

If you're considering a health savings account, but you're on the fence about whether it's the right move for you, here are 10 HSA advantages to keep in mind.

(Click on the image – or this link – for a larger version of this infographic.)