Q. I am 60 and retired. I can get insurance from my former employer but it is very expensive. Do I qualify for health insurance under the exchanges?

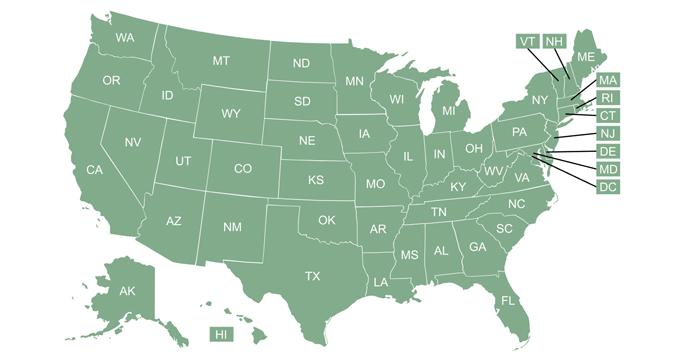

A. You’ll definitely want to talk with a broker or navigator about your specific situation. Depending on your income level, you may qualify for Medicaid. You can check to see whether your state has expanded Medicaid to most low-income adults (note that if your state has expanded Medicaid eligibility under the ACA, your assets are not taken into consideration when your eligibility is determined; it’s all based on your ACA-specific modified adjusted gross income).

Thanks to the American Rescue Plan, premium subsidies are larger and available to more people in 2021 and 2022.

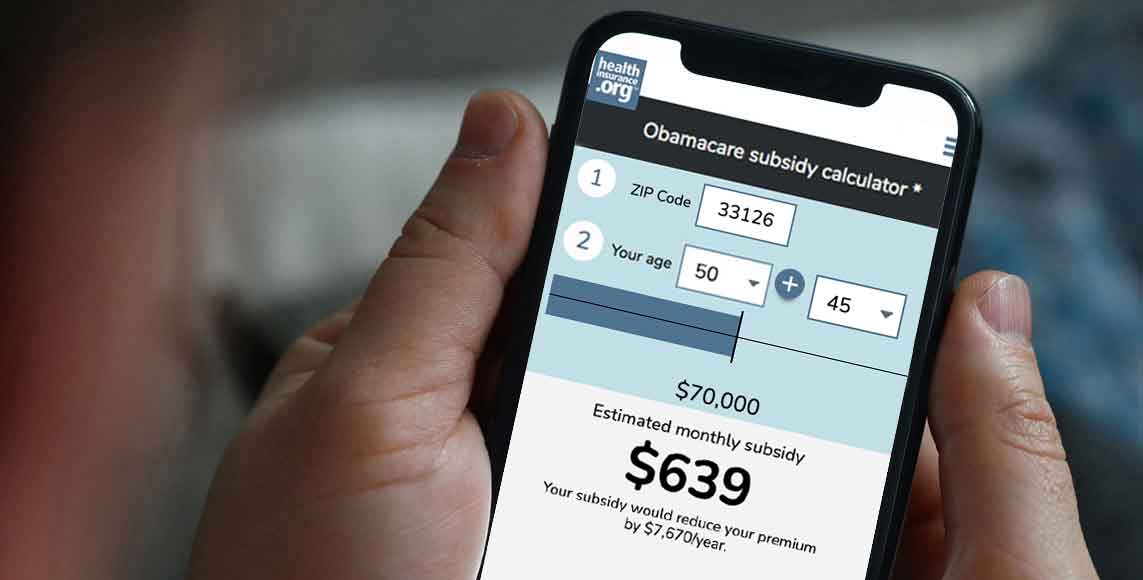

If you don’t qualify for Medicaid, subsidies (premium tax credits) to help purchase private health insurance are available in the exchanges. To be eligible, your income must be at least the poverty level (in states that have expanded Medicaid, income must be above 138% of the poverty level to qualify for premium tax credits, as Medicaid is available below that level).

Normally, premium tax credits are only available to households with income that doesn’t exceed 400% of the poverty level. But the American Rescue Plan has eliminated that upper income limit for 2021 and 2022. People with income above 400% of the poverty level can qualify for a premium tax credit if the cost of the benchmark plan would otherwise exceed 8.5% of their household income.

However, subsidy eligibility requires that you not be enrolled in a retiree health plan from your former employer, and that – if available – you’ve waived your right to any retiree-only health reimbursement arrangement (HRA) offered by your former employer.

It’s important to note that even if you’re not eligible for a premium subsidy, you can still enroll in a plan through the exchange and pay full price for your coverage. The only requirements for exchange enrollment are that you be a lawfully present U.S. resident, not enrolled in Medicare, and not incarcerated.

Subsidies and access to retiree health benefits

For active employees, premium subsidies aren’t available if they have access to an employer-sponsored health plan that offers minimum value and is considered affordable to the employee under the ACA’s guidelines (costs the employee no more than 9.83% of household income for just the employee’s coverage in 2021). It doesn’t matter whether active employees are actually enrolled in the plan; they’re ineligible for premium subsidies in the exchange if the plan is available to them.

But for retirees, the guidelines are more relaxed. Retirees who have access to a plan that provides minimum essential coverage can still enroll in a subsidized exchange plan instead, as long as they don’t enroll in their former employer’s plan. And if the employer offers a retiree-only HRA instead of extending minimum essential coverage to retirees, retirees can still access exchange subsidies instead, as long as they prospectively waive coverage under the HRA.

Exchange enrollment rules

If you’re enrolled in a retiree health plan from your former employer, you’ll generally need to wait until open enrollment to drop that plan and switch to an exchange plan, unless you experience a qualifying event during the year. Voluntarily dropping your retiree health benefit is not a qualifying event, so you wouldn’t be able to drop your plan mid-year and switch to an exchange plan at that point.

If you lose access to your employer’s minimum essential coverage when you retire, you’re eligible for a special enrollment period in the exchange at that point. This is true regardless of whether you’re given the option to switch to a retiree-only health plan offered by your employer (it’s also true even if you’re offered the opportunity to continue your employer-sponsored coverage with COBRA). But if you opt for coverage under the retiree-only plan, you can’t choose to drop it later on and enroll in a plan through the exchange, except during open enrollment or if you experience a qualifying event.

Some employers offer a program that essentially allows the employee to get a discount on the cost of retiree health benefits for a certain amount of time (the actual amount of time can vary considerably, depending on the circumstances). If you’re getting subsidized retiree health benefits and then the subsidy is eliminated, you may qualify for a special enrollment period for individual market coverage at that point. CMS has confirmed that retirees in this situation would qualify for a special enrollment period if an employer subsidy for retiree health benefits were to be eliminated or reduced, causing the retiree’s costs for the coverage to increase to more than 9.83% of the retiree’s income in 2021 (that percentage threshold adjusts each year).

Talk with your former employer’s HR department, as well as a local navigator, broker, or your state’s exchange, and let them know the specifics of your situation to see what your best option is.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.