Home > Dental > Dental insurance in Rhode Island

Find the dental plan in Rhode Island that’s right for you.

Need dental coverage in Rhode Island? Shop and enroll in coverage that can start as early as tomorrow.

Rhode Island dental insurance guide 2023

Rhode Island’s health insurance marketplace has certified individual and family dental plans from two insurers

Rhode Island uses a state-run health insurance marketplace named HealthSourceRI for the sale of certified individual/family dental plans.

Not every insurer that offers medical plans through the Rhode Island exchange include dental coverage with their health plans, but stand-alone dental plans are available for purchase that cover both adults and children.

Frequently asked questions about dental coverage in Rhode Island

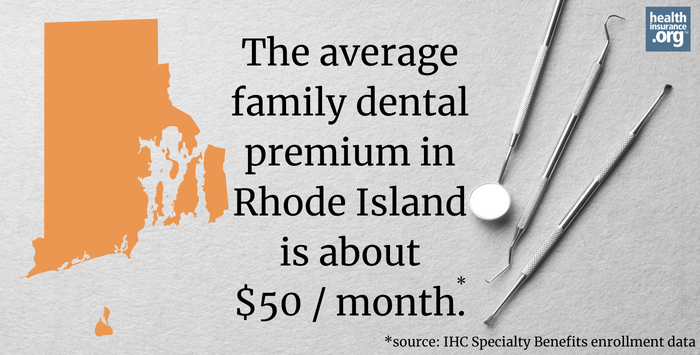

How much does dental insurance cost in Rhode Island?

For adults who purchase their own stand-alone or family dental coverage through the exchange, premiums range from $15 to $67 per month.

IHC Specialty Benefits reports that the average monthly premium for a stand-alone family dental plan sold in Rhode Island in 2022 was $50.25.

If a family is purchasing coverage through the health insurance exchange, the premiums associated with pediatric dental coverage may or may not be offset by premium tax credits (premium subsidies). Here’s more about how that works, depending on whether the health plan has integrated pediatric dental benefits.

Are stand-alone pediatric dental plans on the exchange ACA-compliant?

The stand-alone pediatric dental plans available in HealthSourceRI comply with the ACA’s pediatric dental coverage rules. This means out-of-pocket costs for pediatric dental care will not exceed $375 per child in 2023 (or $750 for all the children on a family’s plan), and there is no cap on medically-necessary pediatric dental benefits.

As is the case for all essential health benefits, the specific coverage requirements for pediatric dental care are guided by the state’s essential health benefits benchmark plan.

You can see details here for the Rhode Island benchmark plan, which does include coverage for both basic and major dental services for children.

Which insurers offer dental coverage through the Rhode Island marketplace?

In 2023, two insurers offers stand-alone individual/family dental coverage through the health insurance marketplace in Rhode Island. These are dental plans that are not included with a medical plan and must be purchased separately:

- Blue Cross Dental

- Delta Dental

This coverage can be purchased through HealthCare.gov during open enrollment (November 1 to January 31) or during a special enrollment period triggered by a qualifying life event. Exchange-certified stand-alone dental plans are compliant with the ACA’s rules for pediatric dental coverage.

Can I buy dental insurance outside of Rhode Island's exchange?

There are also a variety of dental insurers that sell stand-alone dental plans directly to consumers in Rhode Island. These plans are not subject to the ACA’s essential health benefit rules for pediatric dental coverage, but they are regulated by the Rhode Island Division of Insurance. If you would like to purchase a non-ACA qualified dental plan, ask a dentist for recommendations or search online.

There are also various dental discount plans available in every state. Dental discount plans are not insurance, but can offer discounted rates at participating dentists. Learn about the differences between dental insurance and dental discount plans.

To find plans in your area, search online for dental discount plans and the state you are looking to buy a plan in.

How does Rhode Island Medicaid and CHIP provide dental coverage?

Adults and children enrolled in Medicaid in Rhode Island are eligible for extensive dental services. For adults (age 21 and over) that does not include orthodontia or general anesthesia, but does include all other non-cosmetic dental care.

For children (up to age 18) the state’s Medicaid dental services are run through a dental plan named Rite Smiles.

Rite Care is Rhode Island’s CHIP, and it provides coverage to uninsured children and pregnant women with income above the eligibility limits for Medicaid.

What dental resources are available in Rhode Island?

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.