Please provide your zip code to see plans in your area.

Featured

Featured

If you think you may be at risk of losing health benefits due to Medicaid redeterminations, you have options. Learn more about the process and explore health insurance plans below.

We can help you stay covered.

Home > Understanding Medicaid redetermination and eligibility requirements

Reviewed by our health policy panel.

Understanding Medicaid redetermination and eligibility requirements

Medicaid unwinding & redeterminations:

Will I lose coverage?

During the federal public health emergency for COVID-19, people could keep their Medicaid coverage longer than normal. The continuous Medicaid coverage requirement helped millions of people continue to access the healthcare they needed during the pandemic.

That requirement is now ending because of a change in federal policy. If your coverage was continued under Medicaid because of the public health emergency, you may now lose coverage if you no longer qualify. But even if you still qualify for Medicaid, you may need to take steps to verify your eligibility.

What are Medicaid redeterminations and renewals?

Medicaid redetermination — sometimes called Medicaid renewal – is the process states use to confirm people still qualify for Medicaid. Medicaid eligibility is based on financial and other criteria, and redetermination helps ensure people meet the criteria.

Medicaid redeterminations were put on hold for three years during the public health emergency to help ensure ongoing access to healthcare services.

Now states are returning to normal processes to check Medicaid eligibility and update their Medicaid rolls. If you are covered by Medicaid, you may need to go through your state’s renewal process to show you are still Medicaid eligible.

Steps to take if you currently have Medicaid

Update your contact information

Make sure your address and contact information are up to date with the Medicaid department for your state.

Keep an eye on your mailbox

Carefully read any notices, letters or forms you get in the mail about your Medicaid coverage. Take action and reply promptly to any requests for information.

Appeal the decision, if necessary

If you receive a notice saying your coverage has been terminated, you may be able to appeal the decision. You may need to provide an account number or a case number.

Get other coverage

If you no longer qualify for Medicaid, review other coverage options. This may include Marketplace health insurance, an employer plan or Medicare.

(NOTE: The unwinding of continuous Medicaid coverage does not impact the Supplemental Nutrition Assistance Program (SNAP), although the additional pandemic-related SNAP benefits ended in February. And the scheduled end of the federal public health emergency on May 11, 2023, will affect SNAP eligibility for some people. Watch for letters and notices from your state to stay up-to-date on what you need to know about SNAP.)

Get an ACA Marketplace plan

Get coverage through your employer

Can't afford employer coverage?

Medicare

Medicare is a federal health insurance program for Americans aged 65 and older. It also covers people younger than 65 who have permanent disabilities, including those diagnosed with end-stage renal disease (ESRD) and ALS.

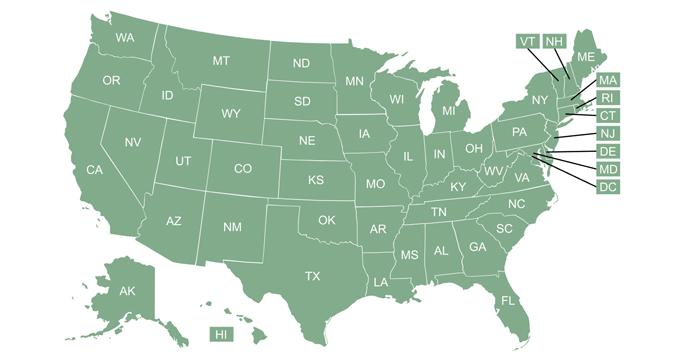

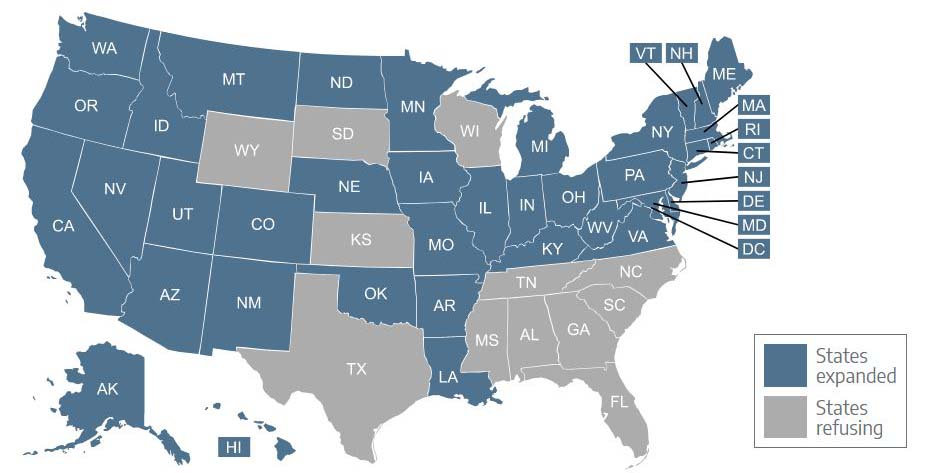

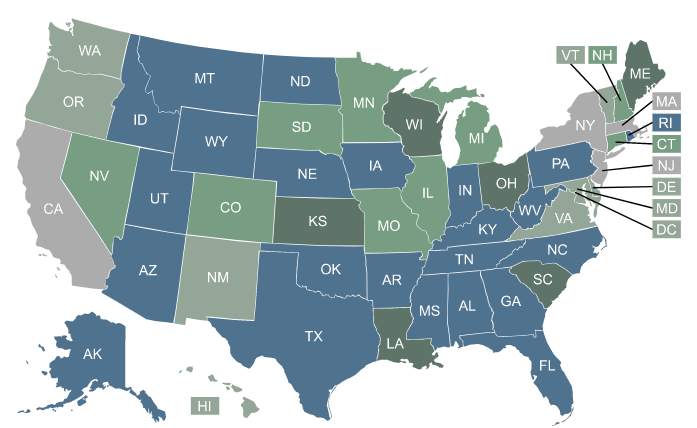

Medicaid coverage in your state

Unwinding of continuous Medicaid coverage will be different in each state. Click your state below to find state-specific information.

When might I lose Medicaid coverage?

If you live in a state that begins disenrollments as soon as allowed, you could lose coverage as soon as April 1, 2023.

The redetermination processes for the entire Medicaid population are being spread out over 12 months. In some states, Medicaid redeterminations may not happen until the anniversary of when you signed up for Medicaid, so the process could take longer. Depending on your state, you may not hear from your state’s Medicaid department until early 2024.

Helpful links

You can learn more about Medicaid redeterminations and renewals by reading this in-depth article.