Frequently-asked questions by tag

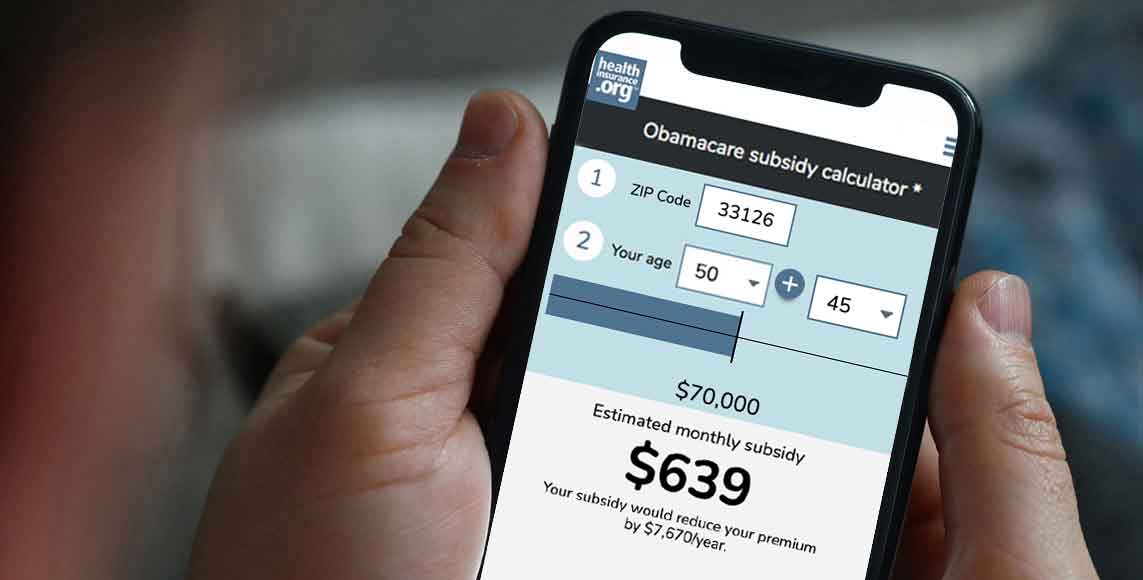

Since a lower income results in a larger subsidy, is there anything I can do to reduce my income under ACA rules?

August 25, 2022 – You can reduce your MAGI — and thus increase your subsidy amount — with contributions to a retirement plan, HSA contributions, and…

My doctor posted a sign saying she ‘doesn’t take Obamacare.’ What should I do?

August 3, 2021 – Q. My doctor posted a sign saying she doesn't take Obamacare. What should I do? A. It depends on your relationship with your doctor. If…

Is Social Security considered income when I’m enrolling in a plan through the exchange?

July 19, 2021 – Social Security income is included in the calculation to determine your subsidy…

How does the IRS calculate premium tax credits for self-employed people when their AGI depends on their health insurance premium amount?

May 19, 2021 – For self-employed Americans, premium amounts affect modified adjusted gross income, which in turn affects premium amounts. But the IRS has…