Frequently-asked questions by tag

We claim our son, but not our daughter, on our taxes. How are premium subsidies calculated for families like ours?

December 5, 2022 – Q. My husband and I have two children. We claim our son on our taxes; he's in high school, lives at home and has a part-time job. Our 23…

What is the Medicaid ‘coverage gap’ and who does it affect?

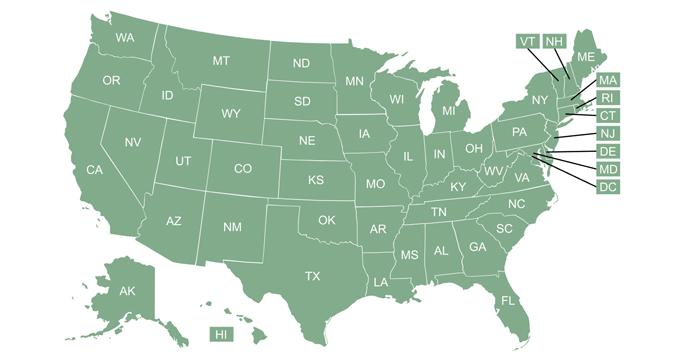

November 18, 2022 – Q. I keep hearing about the "coverage gap" in states that are not expanding Medicaid. Can you explain what that means and who it affects?…

I earn just $22,000 a year. How can I afford the out-of-pocket costs of health insurance?

November 10, 2021 – Q. I'll turn 26 soon, and will lose access to coverage under my parents' health plan. I understand that I am expected to buy insurance,…

If I get an Obamacare subsidy in the exchange, is the subsidy amount considered income?

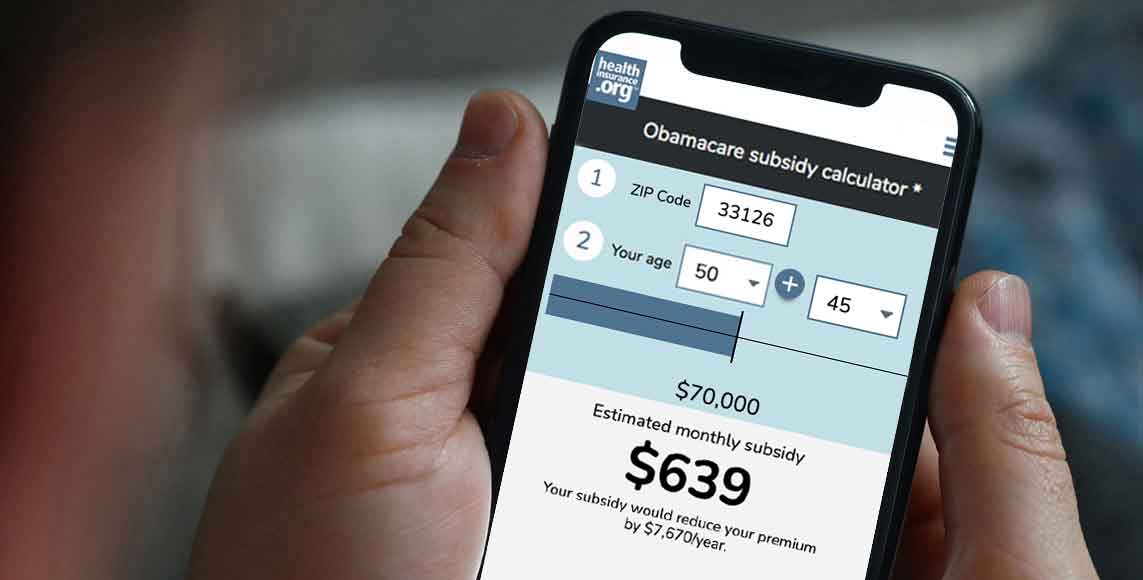

July 26, 2021 – ACA health insurance subsidies (both premium assistance tax credits and cost-sharing reductions) are not considered income and are not…

How does the IRS calculate premium tax credits for self-employed people when their AGI depends on their health insurance premium amount?

May 19, 2021 – For self-employed Americans, premium amounts affect modified adjusted gross income, which in turn affects premium amounts. But the IRS has…