Key takeaways

- Health insurance – coverage, availability and rules – varies dramatically from state to state.

- Under the Families First Coronavirus Response Act, Medicare, Medicaid, and private health insurance plans are required to fully cover the cost of COVID-19 testing.

- But plans that aren’t considered minimum essential coverage aren’t required to cover COVID-19 testing.

- H.R.6201 allows states to use their Medicaid programs to cover COVID-19 testing for uninsured residents.

- All non-grandfathered health plans are required to cover COVID-19 vaccines with no cost-sharing.

- Coverage of the costs of treatment will vary according to the type of health coverage a patient has.

- Some states are requiring state-regulated insurers to cover treatment — telehealth in most cases, but some go beyond that.

- If you’re uninsured, you can sign up for coverage during the COVID-related enrollment window (and if you’re insured, you might want to upgrade your plan during this window).

Will my health insurance cover the costs of coronavirus testing and treatment?

The COVID-19 pandemic has drastically impacted the world over the last year. A common question that people have is “How will my health insurance cover the coronavirus?”

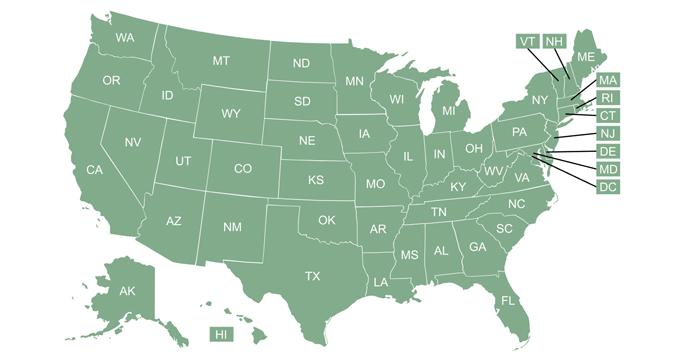

The short answer? It depends. With the exception of Original Medicare, health insurance differs greatly in the U.S., depending on where you live and how you obtain your coverage. Including the District of Columbia, there are 51 different sets of state insurance rules, separate rules that apply to self-insured group plans (which are not regulated by the states), and 51 different Medicaid/CHIP programs.

Nearly half of all Americans – including a large majority of non-elderly Americans – get their health coverage from an employer. Those plans are regulated by a combination of state and federal rules, depending on the size of the group and whether it’s self-insured or fully-insured.

And about 6% of Americans buy their own health insurance in the individual market, where both state and federal rules apply.

Is testing for COVID-19 covered by health plans?

Under the terms of the Families First Coronavirus Response Act (H.R.6201), Medicare, Medicaid, and private health insurance plans – including grandfathered plans – are required to fully cover the cost of COVID-19 testing, without any cost-sharing or prior-authorization requirements, for the duration of the emergency period (which has most recently been extended through mid-April 2021). That includes the cost of the lab services as well as the provider fee at a doctor’s office, urgent care clinic, or emergency room where the test is administered.

Since it’s a federal law, the requirements apply to both self-insured and fully-insured health plans, whereas the testing coverage requirements that numerous states have imposed (see examples here and here) are only applicable to fully insured plans.

What kinds of health plans might not cover testing?

Health plans that aren’t considered minimum essential coverage are not required to cover COVID-19 testing under the federal rules. This includes short-term health plans, fixed indemnity plans, and healthcare sharing ministry plans. It also includes the Farm Bureau plans in Tennessee, Iowa, Indiana, and Kansas – which are not considered health insurance and are specifically exempt from insurance regulations. But some of these plans are voluntarily covering COVID-19 testing and telehealth, so the specifics depend on the plan.

States have the power to regulate short-term health plans, and Washington, for example, extended its testing coverage requirements to include short-term health plans. (Washington already has very strict rules for short-term health plans). But in most states, most plans that aren’t minimum essential coverage are not required to cover COVID-19 testing.

How will my health plan cover a COVID-19 vaccine?

The CARES Act (H.R.748, enacted in March 2020) requires all non-grandfathered health plans, including private insurance, Medicare, and Medicaid, to cover COVID-19 vaccines without any cost-sharing for the member (the same caveats described above apply, however, as plans that aren’t regulated by the ACA are not included in the vaccine coverage requirement unless a state steps up and imposes its own requirement).

The full coverage of COVID-19 vaccines includes both the vaccine itself and any charges from the provider or facility for the administration of the vaccine. The COVID-19 vaccine has been added to the list of recommended vaccines, and the CARES Act required private health plans to begin fully covering it within 15 business days — much faster than the normal timeframe (which can be nearly two years, depending on the circumstances) between when a preventive care recommendation is made and when insurers have to cover it with no cost-sharing. This applies to all COVID vaccines that have received FDA approval, including emergency use authorizations. As of April 2021, that includes vaccines from Pfizer, Moderna, and Johnson & Johnson.

How can the uninsured get COVID-19 testing and vaccines?

H.R.6201 allows states to use their Medicaid programs to cover COVID-19 testing for uninsured residents, and provides federal funding to reimburse providers for COVID-19 testing for uninsured patients. The CARES Act also provides funding to reimburse providers for the cost of administering COVID-19 vaccines to uninsured individuals.

It’s worth noting that people who don’t have minimum essential coverage are considered uninsured, so depending on availability, they would be eligible for covered testing and vaccines under these programs. In the weeks after the first COVID-19 vaccines were granted emergency use authorizations by the FDA, numerous state insurance departments issued statements clarifying that residents will not have to pay for the vaccine, regardless of their insurance status.

How much of COVID-19 treatment costs will health plans cover?

Although the federal and state governments have stepped in decisively to ensure that most people won’t incur out-of-pocket costs for COVID-19 testing and vaccines, the cost of treatment is a different matter altogether.

Although the majority of patients are able to recover without hospitalization, Harvard’s Global Health Institute estimated early in the pandemic that about 20% of COVID-19 patients need to be hospitalized, and about 20% of hospitalized patients will need intensive care, including ventilators. This dynamic changes as more of the older and vulnerable population are vaccinated, and cases become more concentrated among younger and healthier individuals. But hospitalization and intensive medical treatment are still needed in some cases, regardless of how healthy a person was prior to their COVID infection.

Inpatient care, including intensive care, is an essential health benefit for all ACA-compliant individual and small group health plans (but states define exactly what’s covered for each essential health benefit, so the specifics do vary from one state to another). And although large group plans are not required to cover essential health benefits, they are required to provide “substantial” coverage for inpatient care. If they don’t, the employer can be subject to a penalty under the ACA’s employer mandate, but about 5% of large employers still opt to offer scanty plans that don’t comply with this regulation and would offer little in the way of coverage for intensive COVID-19 treatment.

But even when it’s covered by insurance, inpatient care is expensive. And so is outpatient care, depending on the scope of the care that’s needed. This is where patients’ cost-sharing comes into play. Under the ACA, all non-grandfathered, non-grandmothered health plans must have in-network out-of-pocket maximums that don’t exceed $8,550 for a single individual in 2021 (this limit doesn’t apply to plans that aren’t regulated by the ACA, such as short-term health plans).

So for most patients who need COVID treatment in 2021, out-of-pocket costs won’t exceed $8,550. But that’s still a huge amount of money, and most people don’t have it sitting around. The majority of health plans have out-of-pocket limits well below that amount, but most people are still going to be on the hook for a four-figure bill if they end up needing to be hospitalized for COVID-19. Although employer-sponsored plans tend to be more generous than the plans people buy in the individual market, the average employer-sponsored plan still had an out-of-pocket maximum of $4,039 for a single employee in 2020.

With that said, however, many insurers around the country have opted to waive, at least temporarily, members’ out-of-pocket costs related to COVID-19 treatment. It’s important to understand, however, that if an insurer is acting as an administrator for a self-insured employer-sponsored plan, the employer would have to agree to waive the cost-sharing, as it’s the employer’s money (as opposed to the insurance company’s money) that pays the claims.

Some states work to ensure COVID-19 treatment is affordable

Some states (New Mexico and Massachusetts are examples) stepped up early in the pandemic and issued guidance requiring state-regulated insurers to cover treatment (as well as testing) with no cost-sharing, and others (Minnesota is an example) have strongly encouraged insurers to do so (note that the regulation in Massachusetts only applies to doctor’s offices, urgent care centers, and emergency rooms, but not to inpatient care). In addition, several states are requiring telehealth treatment with no cost-sharing. But for the most part, people who need extensive treatment for COVID-19 are going to have to meet their health plan’s deductible and likely the out-of-pocket maximum, unless the insurer has agreed to waive these costs.

Many states are encouraging or requiring state-regulated insurers to treat COVID-19 testing and treatment as in-network, regardless of whether the medical providers are in the plan’s network. And federal rules require this for the vaccine as well, with the cost fully covered regardless of whether the member gets the vaccine from an in-network or out-of-network provider. For vaccine administration, providers are generally not allowed to seek any payment from the patient, including via balance billing. But for COVID-19 testing and treatment provided by out-of-network medical providers, patients could still be subject to balance billing in some circumstances as the out-of-network provider doesn’t have to accept the insurance company’s payment as payment-in-full if it’s less than the billed amount.

And although H.R.6201 prohibits insurance plans from requiring prior authorization for testing, insurers are still allowed to impose their normal prior authorization rules for other services, including COVID-19 treatment, unless a state otherwise prohibits it on state-regulated plans.

How do I make sure I have coverage to protect myself from COVID-19?

So what can you do to protect yourself as much as possible in terms of your health insurance coverage during this pandemic? Here are a few pointers:

- If you’re uninsured (which includes having a health plan that’s not minimum essential coverage), you can enroll in a plan through the health insurance marketplace (exchange) in your state during the COVID-related enrollment window, which continues through August 15, 2021 in most states.

- The COVID-related enrollment window is also an excellent opportunity to take advantage of the enhanced premium subsidies created by the American Rescue Plan. The new subsidies will reduce most enrollees’ monthly premiums, or you can use them to upgrade your coverage to a plan that might not have fit into your budget prior to the ARP’s additional premium subsidies.

- If you’re receiving unemployment compensation at any point in 2021, you’re likely eligible for a $0 premium Silver plan in your state’s marketplace. This plan will come with robust cost-sharing reductions, which means your out-of-pocket exposure will be far lower than it would be on most other health plans. This will be particularly helpful if you end up needing extensive medical treatment during the year, including treatment for COVID.

- If your income is low (even temporarily, due to a layoff), check to see if you might be eligible for Medicaid.

- If you have health insurance, make sure you understand what your plan covers and what your cost-sharing responsibilities are for various outpatient and inpatient care (check to see if your insurer is offering to waive costs associated with COVID-19 treatment).

- Check to see how your health plan handles prior authorizations.

- Pay attention to the details of your health plan’s provider network. Your best chance of avoiding balance billing is to make sure you see in-network providers, and you don’t want to be having to sort that out while you or a family member is very unwell.

- Check with your plan to see how telehealth is covered, and be sure you understand how to use the telehealth services. For non-severe cases, telehealth is recommended as a way to prevent further spread of the disease, and many health plans have temporarily reduced or eliminating cost-sharing for telehealth services in an effort to encourage its use.

- If you had an HSA-qualified health plan last year and didn’t contribute the maximum allowable amount to your HSA, consider doing so now if you have the money available. You can make contributions for 2020 up until May 17, 2021 (this is an extension; the normal deadline is April 15). And if you currently have an HSA-qualified plan, you can contribute pre-tax money to the account for this year as well, at any point during the year. Whatever money you contribute to your HSA will be available to withdraw tax-free if you end up needing it to pay out-of-pocket costs for medical care.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.