Please provide your zip code to see plans in your area.

Featured

Featured

dependent

What is a dependent?

What is a dependent?

A dependent is a person who is eligible for coverage under a policyholder’s health insurance coverage.

The policyholder is the individual who has primary eligibility for coverage – for example, an employee whose employer offers health insurance benefits. A dependent may be a spouse, domestic partner, or child. You can cover your biological, adopted, and step children. In some cases, you may also be able to cover a grandchild, an adult child with a disability, a foster child or someone for whom you are the legal guardian.

Under Medicare, coverage is individual. Even when you meet Medicare’s eligibility requirements for coverage, you can’t extend coverage to a dependent.

If you have been getting group insurance coverage through an employer and experience a life event (like if you change jobs, get married or divorced, retire, become eligible for Medicare, etc.), your previously enrolled dependents are eligible for continuation of health insurance coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA lets your dependents continue to be part of the same group health plan that they previously had through you. However, your previous employer will likely require you to pay the full premium cost (i.e., both your share and whatever your employer was previously paying).

How long can I cover my child?

In general, you can cover your child up to age 26. Note that you can cover your adult child on your health insurance policy up to age 26 even if you don’t claim them as a dependent on your tax return. The U.S. Department of Labor website has a helpful FAQ page related to health coverage for young adult dependents.

If your child is disabled, you may be able to continue covering them after age 26.

Related terms

Related articles

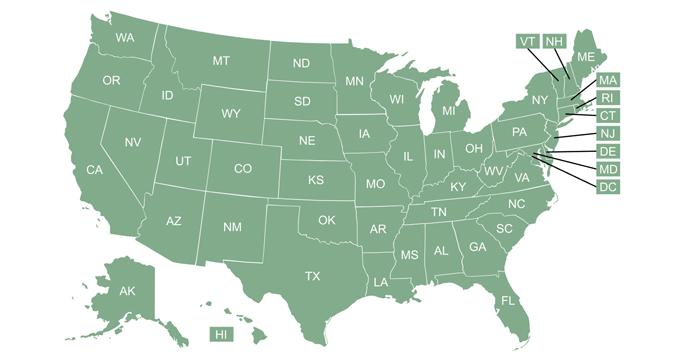

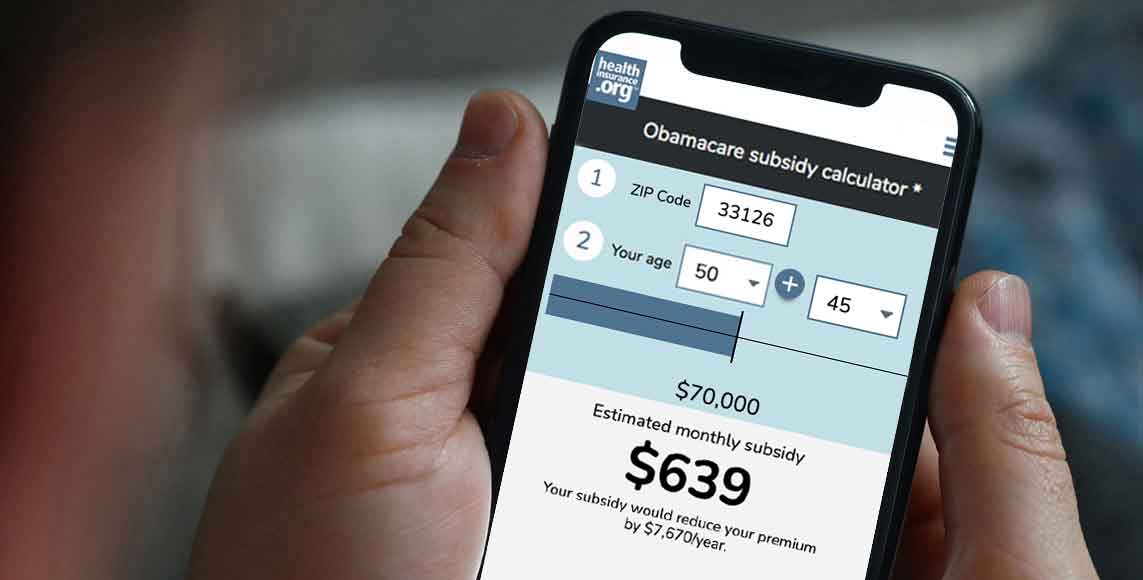

Unless the coverage your employer offers is skimpy, your kids would not be eligible for exchange subsidies, but they might be eligible for Medicaid or CHIP, depending on your income and where you live.