Frequently-asked questions by tag

If an individual pays for an exchange plan, how do they pay for the premium pre-tax as would someone with an employer plan?

January 11, 2023 – Q. If an individual pays for an exchange plan, how do they pay for the premium pre-tax as would someone with an employer plan?…

Do plans sold in the health insurance exchanges cover abortion?

January 10, 2023 – In more than half the states, ACA-compliant health insurance plans are not allowed to cover abortions except for circumstances involving…

Should I let my individual health insurance plan automatically renew?

December 20, 2022 – If you have a health plan in the individual market, on-exchange or off-exchange, you can probably just let it renew for the coming year…

I’m self-employed and am hiring employees. Under Obamacare, am I obligated to provide health insurance for them?

December 16, 2022 – Q. I'm self-employed and am hiring some employees. Under Obamacare, am I obligated to provide health insurance for them? A. No, unless…

We claim our son, but not our daughter, on our taxes. How are premium subsidies calculated for families like ours?

December 5, 2022 – Q. My husband and I have two children. We claim our son on our taxes; he's in high school, lives at home and has a part-time job. Our 23…

My wife and I each make about $40,000 a year. If we file our taxes separately, can we each qualify for an exchange subsidy?

December 1, 2022 – Q. My wife and I each make about $40,000/year. If we file our taxes separately, can we each qualify for an exchange subsidy? A. No. …

Does every business with 50 or more employees pay a penalty if it doesn’t offer ‘affordable, comprehensive’ insurance?

December 1, 2022 – Businesses with 50 or more full-time equivalent (FTE) employees are required to offer comprehensive, affordable health insurance coverage…

Should I buy the health plan my college offers? or buy through an ACA exchange?

December 1, 2022 – Most student health plans offered by colleges and universities are fully compliant with the ACA, with just a few exceptions that don't…

How does my access to employer-sponsored coverage impact my eligibility for subsidized coverage through the exchanges?

November 21, 2022 – A. Fortunately, the IRS has issued new rules, effective in 2023, to allow some families to take advantage of premium subsidies in the…

What is the Medicaid ‘coverage gap’ and who does it affect?

November 18, 2022 – Q. I keep hearing about the "coverage gap" in states that are not expanding Medicaid. Can you explain what that means and who it affects?…

If my income changes and my premium subsidy is too big, will I have to repay it?

October 20, 2022 – If a person receives a premium subsidy in the marketplace and then ends up with a total annual income higher than they projected, they may…

Since a lower income results in a larger subsidy, is there anything I can do to reduce my income under ACA rules?

August 25, 2022 – You can reduce your MAGI — and thus increase your subsidy amount — with contributions to a retirement plan, HSA contributions, and…

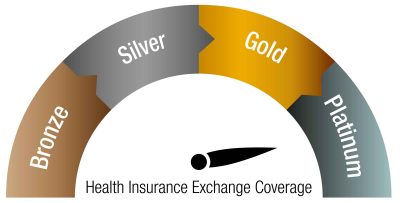

Can I purchase a Platinum policy and also get a premium subsidy?

July 12, 2022 – You can buy a Platinum plan and also get a premium subsidy. The size of the subsidy is based on the cost of a Silver plan, but you can…

Who’s getting zero-premium health insurance plans?

June 10, 2022 – You don't have to be poor to get an ACA-compliant health plan with $0 premiums. See who's getting no-premium coverage and why – and…

I earn too much to qualify for a subsidy. Why should I buy through an exchange?

May 23, 2022 – The American Rescue Plan (ARP), enacted in March 2021, makes health insurance coverage more affordable for millions of people who buy their…

Does the Affordable Care Act make it easier to get individual health insurance?

May 12, 2022 – It's easier to get individual health insurance under the Affordable Care Act, but consumers in the individual market need to be aware that…

Can health insurance policies still have lifetime or annual benefit maximums?

April 18, 2022 – All new individual and small-group plans have covered essential health benefits (EHBs) since 2014, and there cannot be dollar limits on…

My employer offers insurance, but I think it’s too expensive. Can I apply for a subsidy to help me buy my own insurance?

February 8, 2022 – You cannot qualify for a health insurance premium subsidy unless the insurance your employer offers would force you to kick in more than…

If I qualify for Medicaid, should I worry about the deadline for open enrollment?

December 23, 2021 – Q. I've heard that Medicaid enrollment is year-round. So if I qualify for Medicaid, I don't need to worry about the December 15 end of open…

Should I take my ACA premium subsidy during the plan year – or claim it at tax time?

October 11, 2021 – The Affordable Care Act’s premium subsidies are tax credits that can be taken in advance and paid to your health insurer throughout the…

We’re in a same-sex civil union. Should we calculate our subsidy as a household of two, or apply separately?

August 30, 2021 – Q. My partner and I are in a same-sex civil union. For subsidy calculation, does the exchange count our income together as a household of…

Were individual-market health plans less expensive before Obamacare?

July 31, 2021 – A 35-year-old says that before the ACA, his health insurance premiums were $150 a month with a $50 deductible. But did he have a true major…

If I get an Obamacare subsidy in the exchange, is the subsidy amount considered income?

July 26, 2021 – ACA health insurance subsidies (both premium assistance tax credits and cost-sharing reductions) are not considered income and are not…

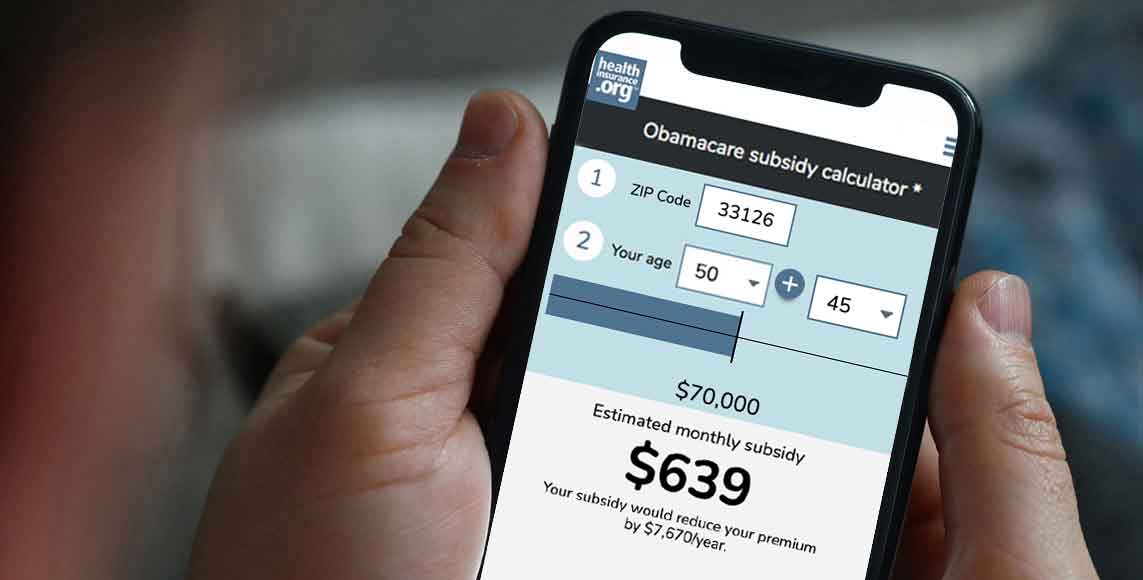

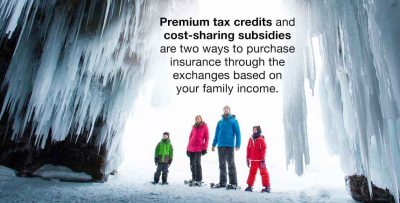

We’re a family of four with an income of $47,000 a year. What kinds of subsidies are available to help us purchase insurance through the exchanges?

July 25, 2021 – Q. We're a family of four with an income of $47,000 a year. What kinds of subsidies are available to help us purchase insurance through the…

I understand that subsidies come in the form of tax credits. But I’m unemployed and probably won’t owe any taxes. How would the subsidy help me?

June 7, 2021 – A: The premium subsidy offered through the exchanges is a tax credit, but it differs from some other tax credits in two important ways.…

I work part-time. Am I eligible for a premium subsidy to help me buy insurance?

May 27, 2021 – Your eligibility for a premium subsidy isn't tied to how many hours you work. As long as you meet the income requirements for the premium…

Who is keeping track of whether I buy health insurance through the exchanges?

May 25, 2021 – Regardless of where you get your health insurance, you (and the IRS) will get a tax form from your employer, insurance company, or exchange…

Who ISN’T eligible for Obamacare’s premium subsidies?

April 16, 2021 – Q. Obamacare advocates frequently talk about how most exchange enrollees qualify for government subsidies. But who is left out? Aren't…