Publication of the first edition of healthinsurance.org’s Guide to Obamacare’s Open Enrollment in 2014 was our response to readers’ frequent requests for information about their enrollment options under the Affordable Care Act.

Our guide has helped thousands of readers successfully navigate the Affordable Care Act’s annual open enrollment period and find affordable, quality health insurance – either through the health marketplaces or off-exchange. We’re proud to have been part of the decrease in the national uninsured rate.

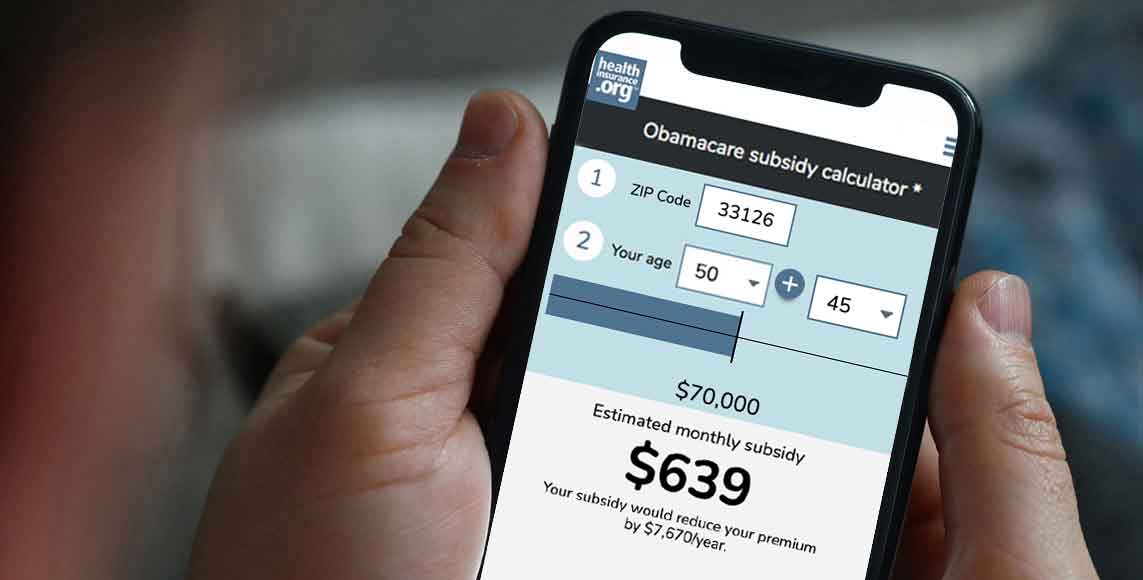

We do know, of course, that not everyone eligible for ACA-compliant health coverage bought coverage during the most recent open enrollment period. Some folks may not have enrolled because they missed the enrollment deadlines. Others may have thought coverage was too expensive, or weren’t aware that they were eligible for the ACA’s premium subsidies (which are substantial enough that 6 million uninsured Americans can qualify for free health insurance, due in part to the American Rescue Plan’s enhancement of the ACA’s subsidies). Others simply didn’t have enough information to make a decision.

But depending on the circumstances, people can still enroll in health coverage even after open enrollment has ended, if they experience a qualifying event. This guide will walk you through all the qualifying events and the specific rules for how they trigger special enrollment periods.

Special enrollment periods are normally required in order to buy coverage outside of open enrollment

In most cases, enrollment outside of the open enrollment window is only available if you experience a qualifying event. It doesn’t matter how healthy you are, or whether you’ve had continuous coverage, or how much you’re able to pay – enrollment is simply not available for most of the year without a qualifying event.

And that’s where our Insider’s Guide to Special Enrollment comes in.

Louise Norris, a highly regarded expert on health insurance and author of our first guide, has put together an authoritative overview of special enrollment periods and the qualifying events that trigger those SEPs. (Note that this guide is specific to special enrollment periods in the individual market; the special enrollment period rules that apply to employer-sponsored plans are similar, but not entirely the same.)

During most SEPs, an individual (and dependents) can enroll in any health plan available in the exchange (as discussed later in this guide, some SEPs have restrictions for plan changes that limit people to a plan at the same metal level they already have). And most of the SEPs also apply to health plans available outside the exchange.

As a licensed agent, the author has seen them all – obvious triggers like loss of coverage due to divorce or legal separation, and not-so-obvious triggers such as an increase in income that makes someone newly eligible or newly ineligible for exchange subsidies.

The qualifying events that trigger special enrollment periods in 2023 are mostly the same as they were in 2022, although there is an extended SEP available through HealthCare.gov for people who lose Medicaid during the “unwinding” of the COVID-related rules that prevented states from disenrolling people from Medicaid during the pandemic.

In most cases, a special enrollment period is only available if you already had minimum essential coverage before the qualifying event, and there are often restrictions that prevent people from using SEPs to upgrade to better coverage during the year. But some of those restrictions have been relaxed or could be relaxed in 2024 and later years.

If you’re reading this guide and feel paralyzed in the “off-season” – the 9.5 months outside of open enrollment – don’t despair. It’s possible you already have a qualifying life event. And if you don’t right now, there may be one just around the next corner. If you’re uncertain about your eligibility for a special enrollment period, call (866) 686-8071 to discuss your situation with a licensed insurance professional.

We hope you find this guide useful – and if you do – we hope you’ll share it with someone else who needs the information.