Key takeaways

For most Americans, choosing a health plan — or at least reviewing existing coverage — is something that has to be done each year. For many people, the Affordable Care Act (ACA, or Obamacare) has made this easier and more affordable.

More than 14.5 million people have enrolled in plans through the exchanges for 2022, and thanks in large part to the ACA’s expansion of Medicaid, enrollment in Medicaid coverage has grown by more than 30 million people since 2013 (there’s been a significant increase in Medicaid enrollment as a result of the COVID pandemic).

There are also more than 64 million Americans enrolled in Medicare (nearly all of whom should be evaluating their coverage options each year). Roughly half of the U.S. population has coverage through an employer. For these people, multiple plan options may be available or the employer might just offer one plan — so the opportunity to “shop” for coverage can be limited, depending on the benefit package the employer offers.

But regardless of where you get your health coverage, it’s wise to be on the lookout for scams. Any major change like the ACA – especially with the subsequent dozen years of additional health care reform debate – comes with scammers who take advantage of the confusion that invariably surrounds a major policy shift. This is true even for people whose coverage was only modestly impacted by the ACA, such as people with Medicare.

Here are some tips to keep in mind:

Scammers tap into confusion over ACA

The ACA was signed into law in 2010, and almost immediately, scammers began looking for ways to make a quick buck. Soon after the law passed, Jim Quiggle, spokesman for the Coalition Against Insurance Fraud, says he wasn’t surprised by the sudden influx of health insurance scams. “Crooks are exploiting the mass confusion over what the health reform means to the average consumer,” Quiggle said. “With each new aspect of reform, another opportunity for fraudulent marketing opens up.”

Quiggle explained that rip-off artists go door to door and use blast emails or pop-up ads to convince unsuspecting customers that they’re selling “ObamaCare.” And, to create a sense of urgency, the scammers tell potential scam victims that the law requires them to buy the insurance they’re selling and do it before an “enrollment period” closes.

It’s true that the ACA created an annual open enrollment period for individual market health insurance (there was already an annual open enrollment period for Medicare beneficiaries; states already set open enrollment windows when Medicaid managed care enrollees could switch plans, and employers already set open enrollment periods when employees could make coverage changes). Outside of open enrollment, coverage can only be obtained if you have a qualifying event (prior to 2014, people could apply for individual health insurance whenever they liked, but the applications were then medically underwritten and could be rejected based on medical history). But again, buyer beware. If in doubt, double-check the facts with a third party to make sure you’re dealing with a legitimate source of coverage.

Marc Young, spokesman for Insurance Commissioner Kim Holland, co-chair of the National Association of Insurance Commissioners’ Anti-Fraud Task Force, explains that criminals sometimes cleverly mask themselves as insurance companies, selling plans that are completely fraudulent. “Unfortunately, the criminals provide all of the materials that legitimate companies provide,” Young says. “They’ll use the industry language to describe levels of coverage. They’ll issue authentic-looking insurance cards.”

Some companies will even set up storefronts in communities, selling policies and sticking around just long enough to file bogus claims – only to completely vanish into thin air overnight. These companies are “very deceptive, very misleading, with very professional looking materials,” Young says.

Again, it’s a good idea to double-check with your state’s department of insurance to make sure that the person and company you’re dealing with are both licensed to do business in your state.

Understand your state’s exchange

In addition to outright scams like identity theft, consumers need to be aware of the possibility that some agents might try to portray their agency as “the exchange” and attract customers who think they’re purchasing coverage through the official exchange. This is further complicated by the fact that licensed agents and brokers who are certified by their state’s exchange are an important resource for consumers who are enrolling in exchange plans.

Individual policies can still be purchased outside of the exchanges. Like exchange plans, they are ACA-qualified which means they are guaranteed issue, cover the essential health benefits, and have the ACA’s limits on out-of-pocket maximums. Some are sold by carriers who also sell policies in the exchange, but some carriers only offer plans outside the exchange.

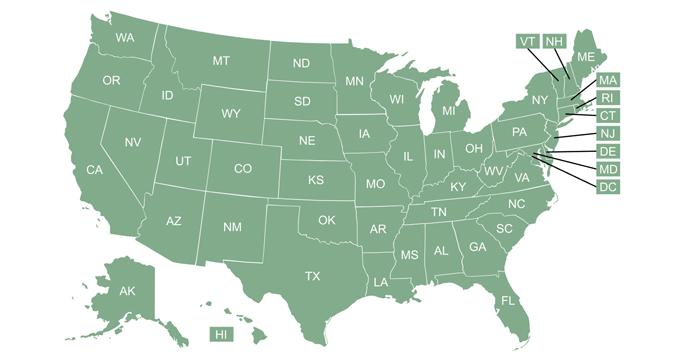

From a consumer perspective, the primary difference between exchange and non-exchange plans is the availability of subsidies. Premium subsidies and cost-sharing subsidies are only available on plans that are purchased through the exchange. Each state has just one official exchange where subsidies are available and in 33 states as of 2022, it’s Healthcare.gov.

If you’re in DC or one of the 17 states that run their own exchanges, you can still use Healthcare.gov to get to the exchange website in your state so that there’s no doubt you’re on the correct site. If a certified broker or agent assists you with your exchange plan application, you will still be submitting your application on the official exchange website (unless the broker uses an enhanced direct enrollment website, discussed in a moment). If you’re submitting an application anywhere else, you’re applying for an off-exchange plan and subsidies will not be available.

It’s important to understand that there are approved enhanced direct enrollmen entities that are authorized to enroll people in on-exchange plans via their own websites, without having to use the actual exchange website. HealthSherpa is an example of this; they only enroll people in on-exchange plans, and enrolled more than 3 million of the 10.3 million people who signed up for plans through the federally-run marketplace (HealthCare.gov) for 2022. CMS has a list of entities that are approved to provide direct enrollment. But if you’re using one of them, you’ll still want to confirm that you’re enrolling in an on-exchange plan, if that’s your preference.

Know how the law affects you, or doesn’t

Another commonly misunderstood aspect of the ACA – and one that scammers have tried to target – is that the majority of Americans do not need to obtain health insurance through the exchanges.

Most Americans haven’t had to make any changes at all under the ACA. If you get your coverage through Medicare, Medicaid, or your employer, you do not need to worry about the exchanges at all. (If you’re enrolling in Medicaid, you may be able to do so through the exchange, depending on why you’re eligible for Medicaid. For MAGI-based Medicaid (most enrollees under the age of 65), some states have switched their entire application system to run through the exchange, so check with your state Medicaid office if you have questions.)

In addition to being a portal for Medicaid enrollment, the exchanges were primarily designed to provide a shopping platform for people who purchase individual health insurance (and for small-business health plans if the employer chooses to obtain coverage through the SHOP exchange, which is still available in some states). This includes people who already had individual health insurance prior to 2014, as well as people who were previously uninsured and didn’t have access to a group plan through an employer.

But nearly two-thirds of the population have either employer-sponsored coverage or Medicare — and can ignore the exchanges — while another 26% have Medicaid and may be able to ignore the exchange, depending on how their states have set up the enrollment and renewal process.

If you have Medicare, you do need to comparison shop for your coverage each year, making sure that you have the Part D or Medicare Advantage plan that best fits your needs. But you won’t do that through the exchange in your state. Instead, you can rely on a trusted Medicare broker in your area, and use Medicare.gov to make sure that any plan you’re considering is legitimate. Be aware that scammers do often prey on elderly people, so it’s wise to ask a trusted friend, family member, or financial advisor before enrolling in any new health plan.

If you’re purchasing individual health insurance, the exchanges are likely the best option if you’re eligible for subsidies. If not, you can shop both in and out of the exchange to find the policy that best fits your needs and budget. Although the exchanges’ online comparison and enrollment features have been heavily publicized, applicants can also enroll by mail or in person. You can contact your state’s department of insurance to verify that the person, agency, or website you’re working with is certified with the state’s exchange.

If you’re shopping for an off-exchange plan, your state’s department of insurance can help you make sure you’re working with a properly licensed agent and buying a legitimate health insurance policy.

Watch out for fakes and frauds

Navigators and brokers will not charge you any sort of fee for their services (in a few states, brokers are allowed to charge fees if they’re not paid a commission by the insurer; but these fee-based brokers are rare and there are extensive rules regarding the disclosures they have to provide to their clients). The only money you need to pay is your first month’s premium, either when you enroll or once you get the invoice. If people are asking you for any additional fee, be wary of a scam.

Seniors who are enrolled in Medicare don’t need to do anything differently. They benefit from Obamacare, but don’t need to make any changes to their coverage and certainly don’t need to “enroll in Obamacare” or do anything with the exchanges.

If you enroll in a health plan, you’ll need to provide relatively extensive personal information, particularly if you’re applying for premium subsidies (and if you get a premium subsidy, you have to reconcile it on your tax return). There’s no legitimate way to enroll in just a minute or two with nothing more than a name and social security number, so be wary of potential scams in which the salesperson is attempting to gather some basic — but personal — information under the pretense of enrolling you in health coverage.

If the plan you’re enrolling in will take effect immediately, chances are it’s not an ACA-compliant plan. The same is true if it excludes pre-existing conditions or doesn’t cover some of the essential health benefits. Here’s more about how you can determine whether the plan you’re considering is compliant with the ACA.

Discount card scams leave consumers holding the bag

Some salespeople offer discount medical cards or “buyers clubs” – some of which legitimately provide discounts on certain expenses such as prescription drug costs and dental services through a network of providers. In some cases, however, unscrupulous marketers are overstating the size of those networks, or offering unbelievable discounts – “sometimes up to 85% off,” Quiggle says.

And, in some cases, consumers are being drawn into those plans on the false promise that the discount card programs will pay for major medical expenses. “We see cases where people are showing up at hospitals presenting their discount card because they think they have health insurance, only to be told they’ll have to pay for services out of pocket,” Quiggle says.

In other cases, consumers incur large medical expenses, then find out that “pre-authorized surgeries” or other large expenses won’t be reimbursed.

Discount plans have existed since long before the ACA was enacted. But since they’re not considered insurance, they’re not regulated under the ACA, which means that unless a state takes steps to limit them, they can still legally be sold. They don’t provide much in the way of benefits though, particularly in the case of a large claim.

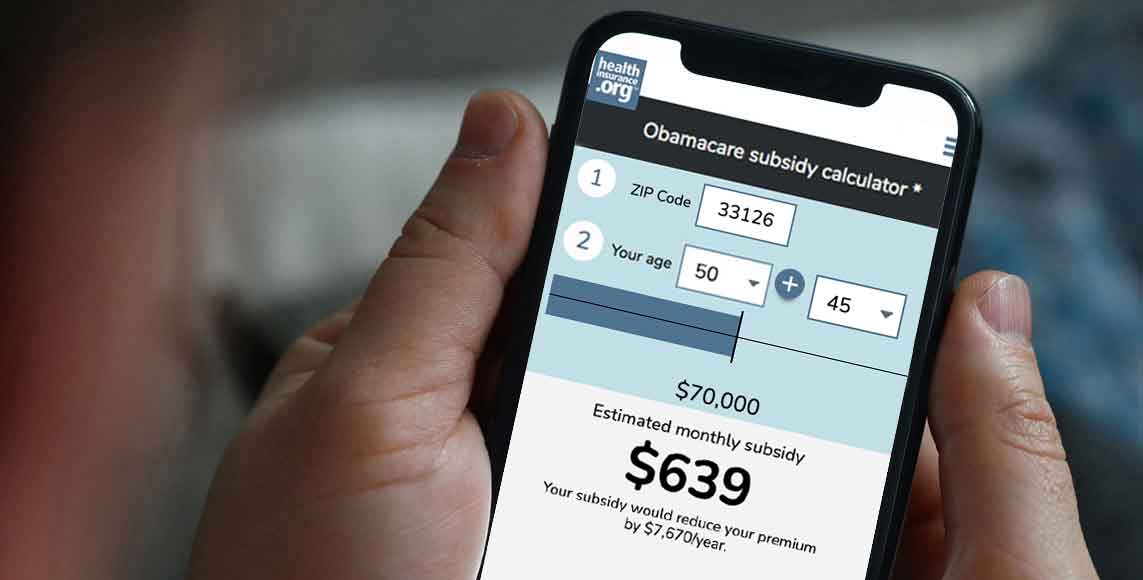

What has changed as a result of Obamacare is the affordability of real health insurance for people with low- and mid-range incomes. Discount plans stood out in the past because of their price, which was far cheaper than real health insurance. But because of the ACA’s premium tax credits (subsidies), the average after-subsidy premium for the 92% of HealthCare.gov enrollees who got a subsidy in 2022 was just $77/month.

Avoiding health coverage scams if you have Medicare

Medicare beneficiaries are, unfortunately, a frequent target for scammers. These scams are often conducted via phone or email, but can also be in-person with door-to-door visits or via the mail. Scammers may attempt to steal a Medicare beneficiary’s identity, including Social Security numbers and Medicare ID numbers (note that Medicare no longer uses Social Security numbers on Medicare ID cards). Here are some tips for avoiding Medicare-related identity theft.

Some other things to keep in mind if you or a loved one are enrolled in Medicare:

- It is illegal for someone to sell you an individual market plan if they know that you have Medicare coverage. So you do not need to use the exchange/marketplace at all.

- Don’t provide your Medicare ID number or policy details to anyone unless you initiated the contact.

- Pay attention to the Medicare Summary Notice you get each quarter or the explanation of benefits you receive from your insurer if you’re enrolled in Medicare Advantage or a Part D plan. These documents will show the medical services you’ve received recently. If the details don’t match your recollection of the care you’ve received, it’s a good idea to contact your medical provider to double-check that your care was correctly billed. If you suspect fraudulent billing, Medicare has information on how you can report it.

- Medicare’s plan comparison tool will allow you to see all of the legitimate Medigap, Part D, and Medicare Advantage plans available in your area. If you have any doubt about the authenticity of a medical plan that’s being offered to you, it’s wise to check that site to be sure that the plan is legitimate.

- Medicare does not allow agents and brokers to complete an over-the-phone enrollment unless the beneficiary initiated the call (ie, it has to be an inbound call to the broker, rather than an outbound call). So if you receive a call from someone claiming to be an agent or broker and attempting to enroll you in a health plan over the phone, do not proceed.

There is no one-size-fits-all when it comes to healthcare. Fortunately, there are a variety of plans available in the individual market, both in and out of the exchanges. Medicare beneficiaries have numerous Part D and Medicare Advantage plans from which to choose (and numerous Medigap plans from which to choose, although there is no annual open enrollment period for those in most states). And Medicaid enrollees often have a choice of multiple Medicaid managed care plans.

If in doubt, there are state and federal government resources to help ensure that you’re dealing with a legitimate representative and health plan. Your state insurance commissioner, state Medicaid agency, Medicare.gov, and the Medicare Rights Center are all good places to start. Take your time, compare all of the available plans, seek help from a reputable source, and be sure that you read the fine print on the plans you’re considering before you enroll.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.